Quick Take

MicroStrategy’s recent acquisition of an additional 16,130 Bitcoin has boosted its total Bitcoin ownership to 174,530 BTC.

This latest Bitcoin acquisition ranks as MicroStrategy’s third-largest purchase since the implementation of its Bitcoin standard strategy.

| Purchase Date | Bitcoins Purchased | Amount (USD) |

|---|---|---|

| 2021-02-24 | 19,452 | $1,026,000,000 |

| 2020-12-21 | 29,646 | $650,000,000 |

| 2023-11-30 | 16,130 | $593,300,000 |

| 2021-09-13 | 8,957 | $419,000,000 |

| 2021-11-28 | 7,002 | $414,000,000 |

Table showing MicroStrategy’s five largest Bitcoin purchases (Source: Companiesmarketcap.com)

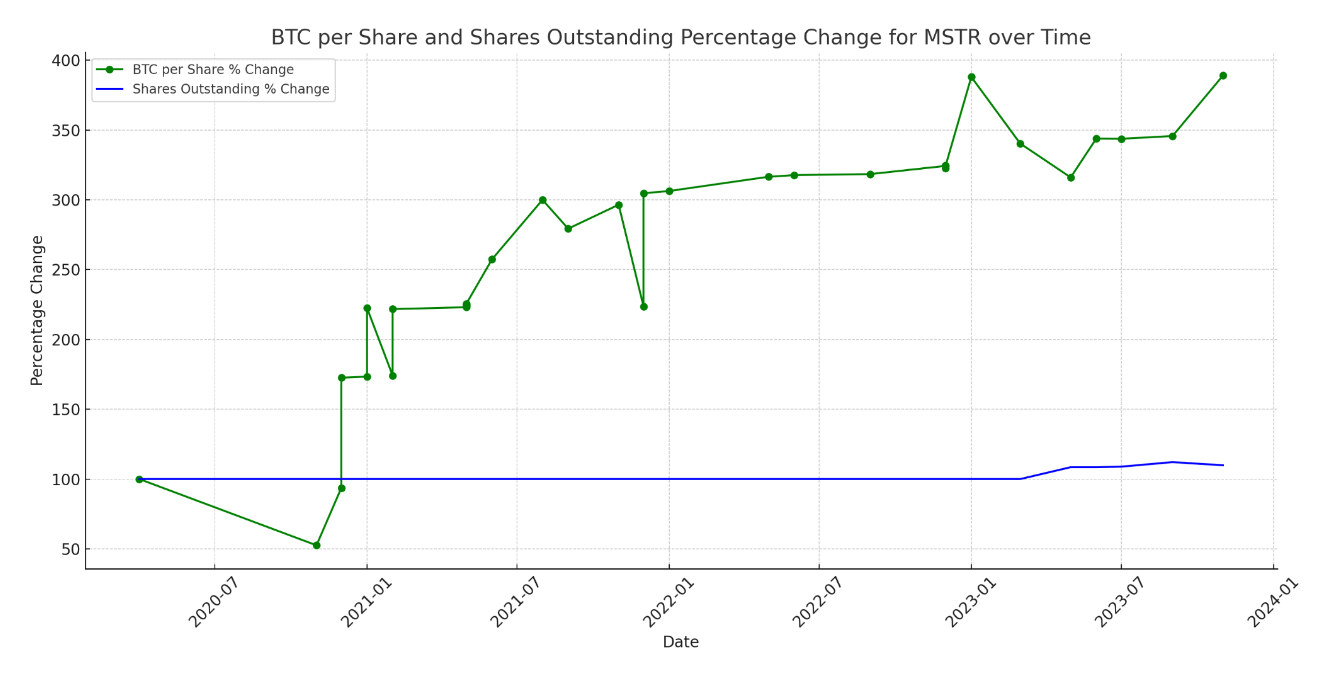

MicroStrategy’s decision to raise up to $750 million through selling stock is a strategic one that works well with its Bitcoin investments. This is shown in a line chart that clearly tracks how their Bitcoin holdings per share have increased over time.

Despite issuing more shares – a process that usually reduces the value of each share – the chart reveals that the company’s Bitcoin per share value has continued to rise. This means that the amount of Bitcoin value represented by each share has grown, bringing more benefits to shareholders.

The chart also shows the change in value starting from a base of 100%. It highlights that the value of Bitcoin per share has increased at a faster rate than the number of new shares issued. In simple terms, the growth in Bitcoin value per share has been strong enough to outweigh the effect of issuing more shares, indicating a positive trend for the company’s Bitcoin strategy.

The post MicroStrategy’s latest Bitcoin purchase boosts shareholder value appeared first on CryptoSlate.