Onchain Highlights

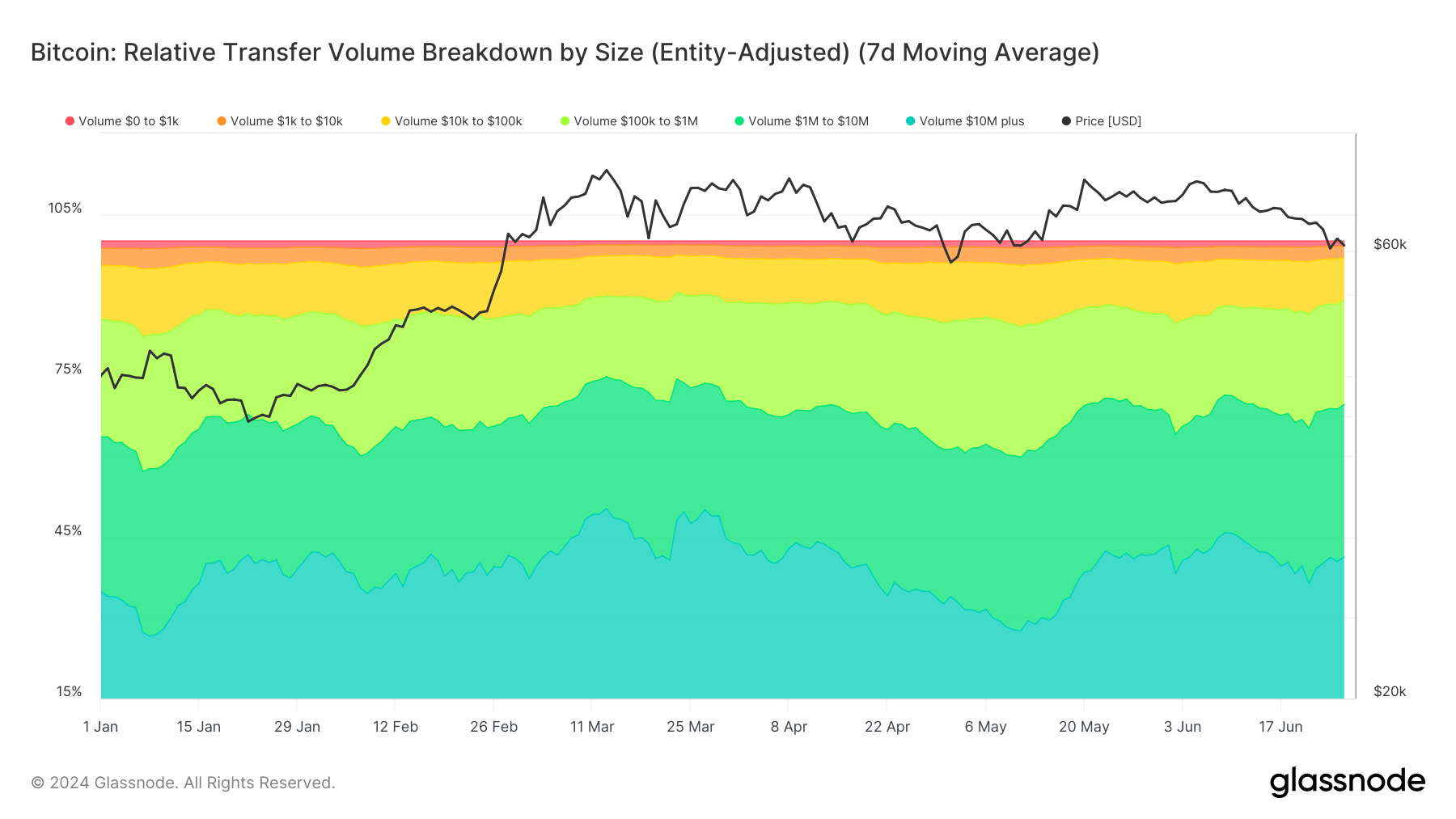

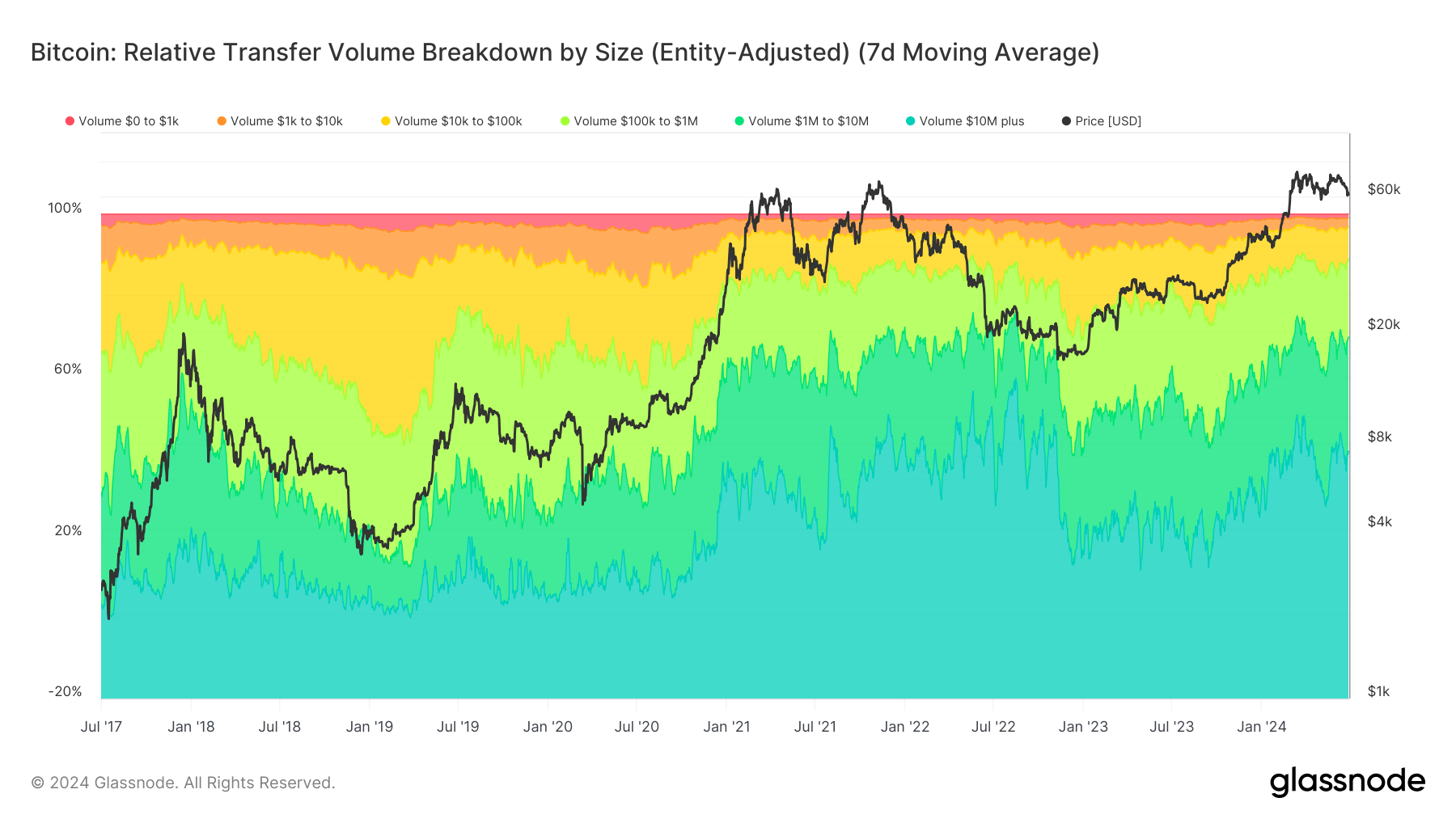

DEFINITION: Entity-adjusted relative on-chain volume breakdown by the USD value of the transfers.

Bitcoin’s relative transfer volume, when adjusted by entity and categorized by transfer size, exhibits nuanced trends across varying transaction bands. In January 2024, transfers under $1,000 constituted a minor portion of overall activity. Notably, transactions between $1,000 and $10,000 experienced a slight increase, reflecting incremental retail participation.

Larger transfers, ranging from $10,000 to $100,000 and $100,000 to $1 million, demonstrated an increase, maintaining around 20-30 % of the total volume. This suggests an increase in institutional activity. Meanwhile, the $1 million to $10 million bracket also showed growth, while transfers over $10 million declined.

Between mid-January and April, volume over $10 million saw a resurgence before a decline, bottoming in May.

Levels for the largest transfers grew again in late May and have stabilized since. Other brackets moved relatively, with the exception of transfers under $100,000, which retained stability.

Compared with historical data since 2017, the past year has seen a reduction in the dominance of the smallest transactions, replaced by mid-sized volumes, especially those over $100,000. This shift highlights a maturation in Bitcoin’s user base, with a growing reliance on significant transactions, potentially aligning with the post-halving market conditions and a matured institutional footprint.

The post Mid-sized Bitcoin transactions rise, reflecting market maturation and retail growth appeared first on CryptoSlate.