Miners represent the foundation of the Bitcoin market. Their behavior is one of the best indicators of market health and can be used as a gauge for market sentiment.

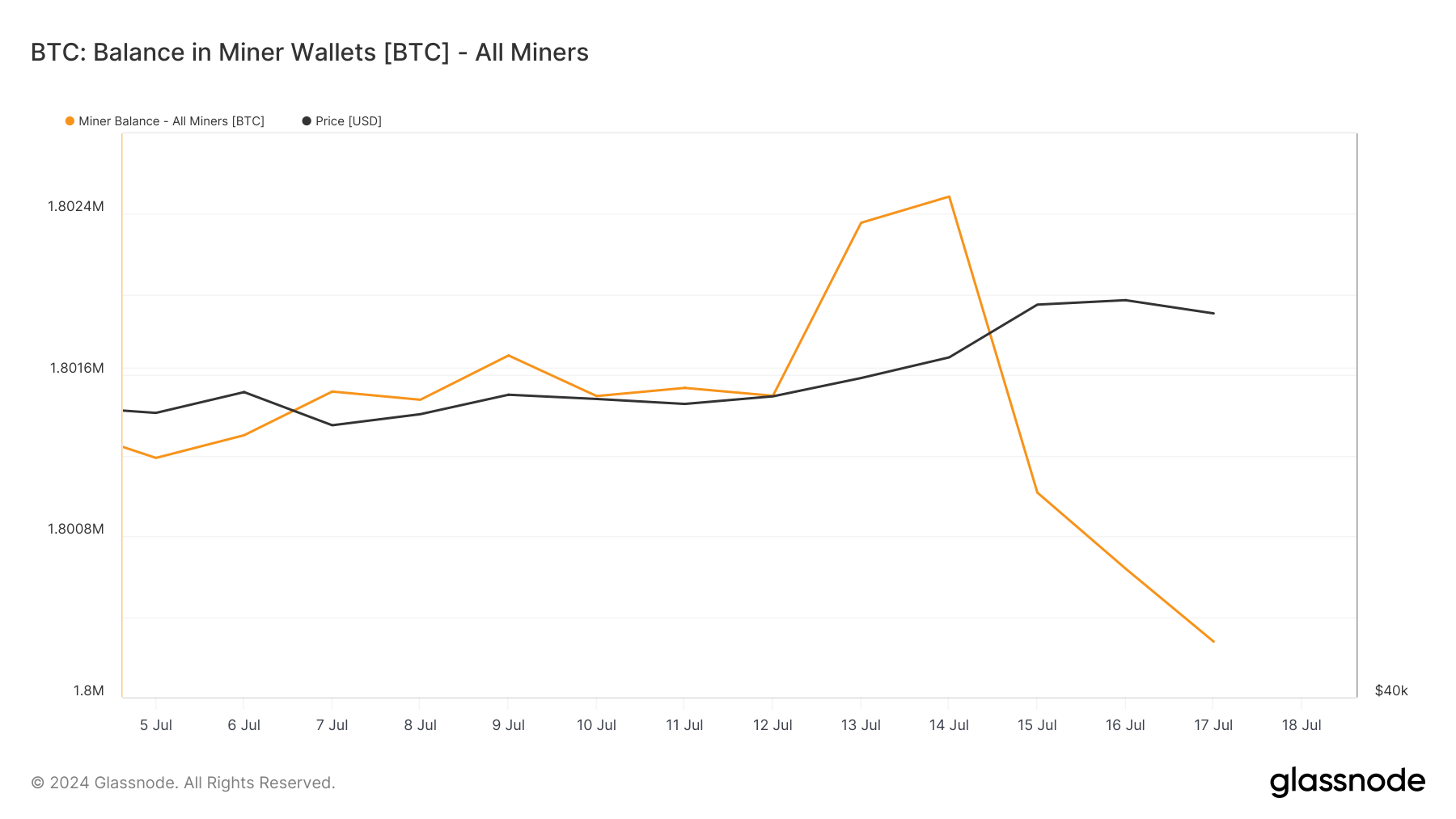

Miner balances reflect the total amount of BTC held by miners. They serve as one of the leading indicators of selling pressure since they are frequent sellers due to the need to cover operational costs.

However, miners are also in a race to stay as profitable as possible, so they usually do not sell or distribute their holdings if Bitcoin’s price is too low. When miners hold onto their BTC, it can be a sign of confidence in future price increases. Conversely, when miners sell, it indicates they’re taking profits while prices are high enough or that they might expect a price decline.

In the past week, miner balances decreased by around 1,260 BTC. This reduction continues the long-term trend of reducing miner balances, which have been dropping since October 2023. Current miner balances have reached levels not seen since April 2019. And while the decrease we’ve seen over the past week isn’t alarming, it reflects a broader pattern of miners gradually reducing their holdings.

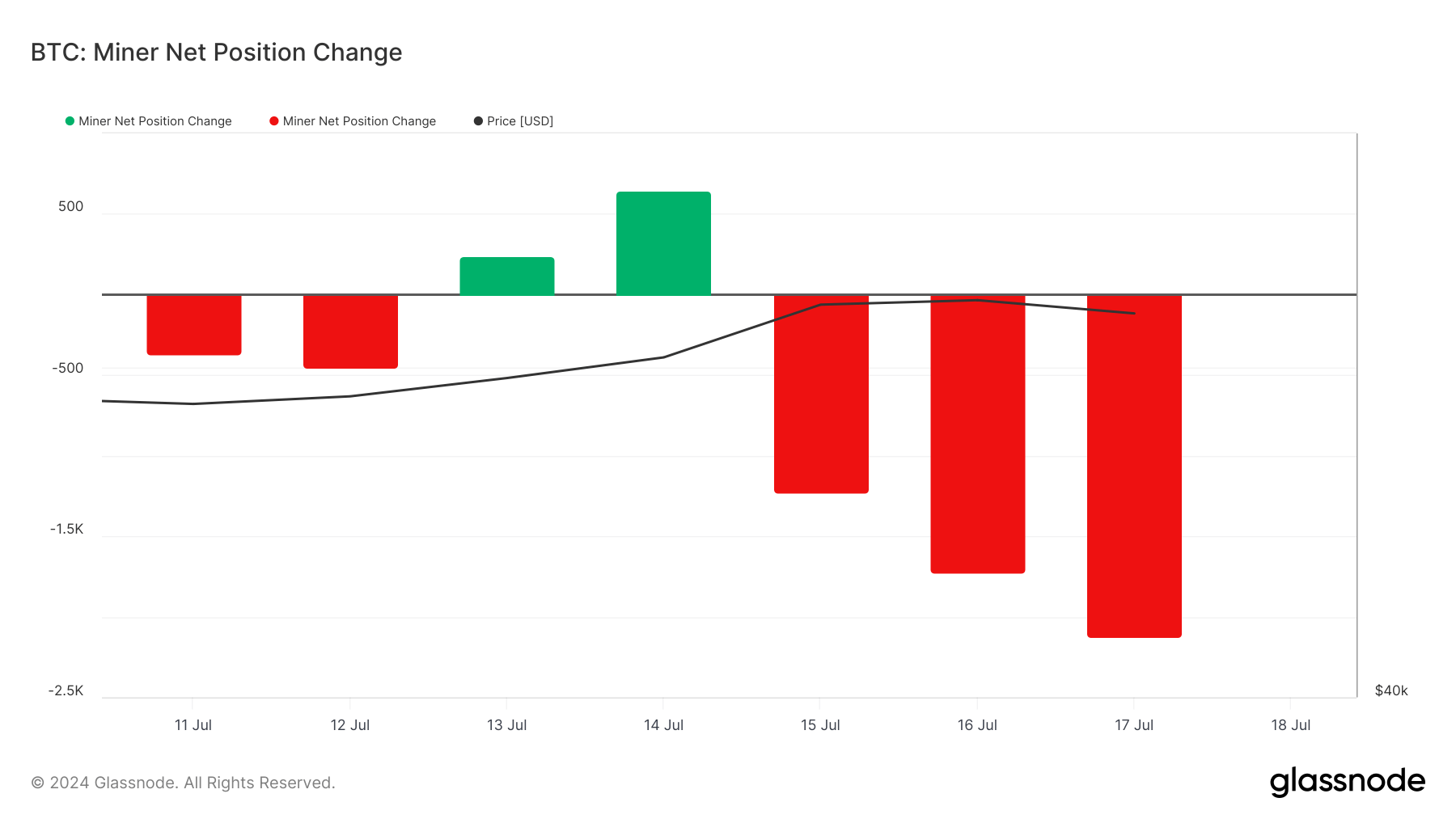

Looking at the miner net position change, we see fluctuations over the past week. Breaking the three-month-long trend of net outflows, July 13 and July 14 saw net inflows of 241 BTC and 645 BTC, respectively, showing temporary accumulation.

This was followed by significant net outflows that lasted until July 17, when miners sold 2,126 BTC. The sharp increase in selling these days correlates with a notable rise in Bitcoin’s price, peaking at $65,172 on July 16 before slightly dropping to $64,120 the next day.

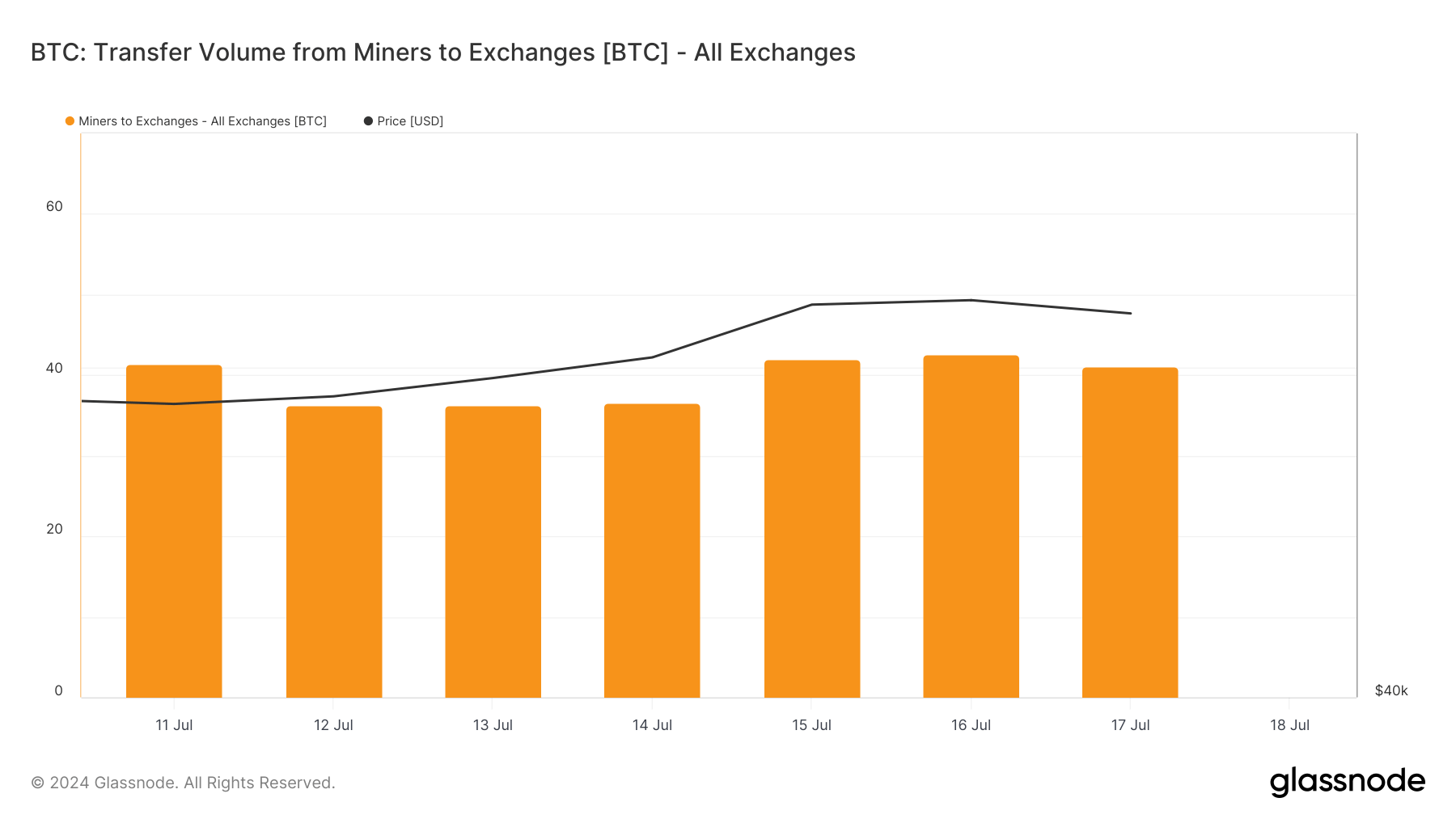

The transfer volume from miners to exchanges remained relatively stable, ranging from 36 BTC to 42 BTC daily. This stability suggests that miners are not significantly increasing their direct sales to exchanges, even as their overall outflows increase.

The highest transfer volume to exchanges in the past three months was 262 BTC on June 13, indicating that recent volumes are within normal ranges. A decrease in miner balances alongside relatively low transfers to exchanges suggests miners might be selling their Bitcoin through over-the-counter (OTC) transactions rather than on public exchanges.

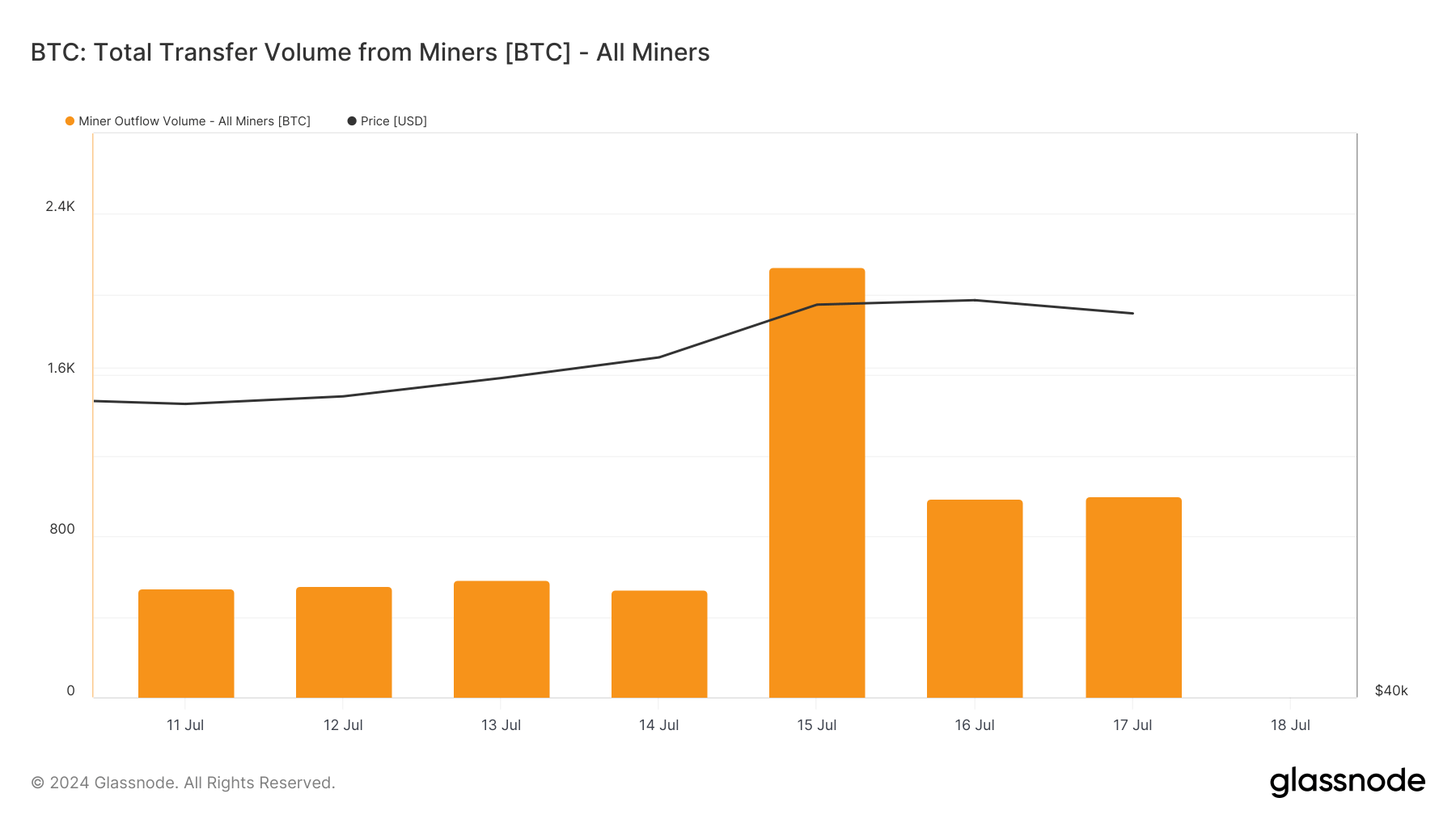

Transfer volumes from miners show more variability, with a significant spike on July 15 at 2,136.10 BTC, the second highest in the past 30 days. This spike aligns with a sharp price increase, showing miners took advantage of higher prices to move substantial amounts of BTC. The outflows of 985.60 BTC on July 16 and 1,001.63 BTC on July 17 further confirm this trend.

The data suggests that miners are reducing their overall holdings to maximize their returns during price increases. This strategic selling contributes to market liquidity and can influence short-term price fluctuations.

The post Miners reduce holdings amid rising prices appeared first on CryptoSlate.