Mt. Gox, the defunct Bitcoin (BTC) exchange that suffered a major collapse in 2014 has recently initiated payout distribution to creditors waiting for it.

The release of a substantial amount of BTC, equivalent to $9.4 billion, on May 27th has raised concerns about potential market liquidity and price stability. In response, the on-chain market intelligence platform CryptoQuant has provided an analysis of the potential impacts of this development.

Potential Market Effects

According to the firm’s analysis, 138,000 Bitcoin moved significantly from Mt. Gox in seven transactions, each worth 4,000 to 32,000 Bitcoin.

Initially, these funds were transferred to a single address and distributed to three separate addresses, each holding 47,400 Bitcoin.

It is important to note that these addresses remain under the control of Mt. Gox’s Rehabilitation Trustee, and no repayments to creditors have been made as of yet. The consolidation of these funds suggests that the Trustee is actively preparing for future repayments by the Rehabilitation Plan.

At present, transfers within the Trustee-controlled addresses have not impacted the market immediately. However, the firm notes that eventual repayment to creditors, targeted for completion by October 31, 2024, could influence Bitcoin’s market dynamics.

For CryptoQuant, the market impact will depend on various factors, including the timing, size, and manner of the repayments. If and when the Trustee begins repaying creditors, it could introduce a substantial amount of Bitcoin into the market, influencing liquidity and price stability. The firm concluded by stating:

There is no immediate selling pressure for Bitcoin from these movements as the transfers have occurred within the addresses of the same entity (Mt. Gox Rehabilitation Trustee) and are not still available to the open market.

Bitcoin Price Gravitates Towards ‘Level 3’ At $91,000

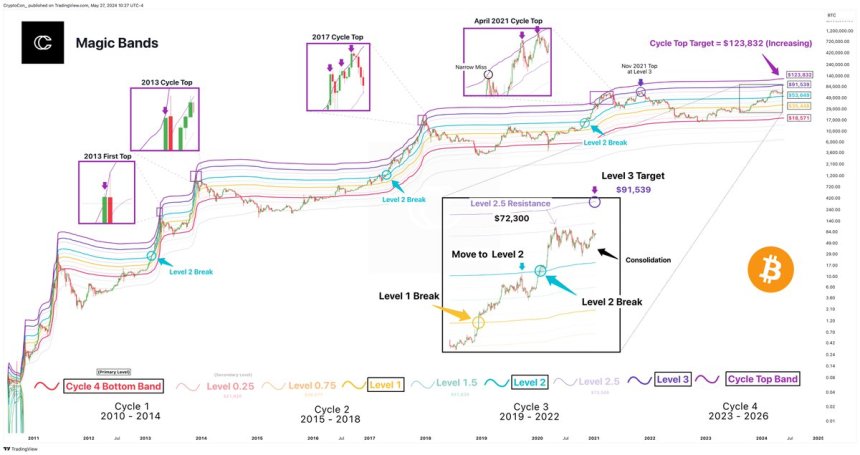

As concerns grow over the potential downside impact on Bitcoin’s price due to Mt. Gox’s repayment plan, analyst Crypto Con offers insights into the current state of Bitcoin price bands.

Bitcoin price bands refer to specific price ranges that analysts closely monitor to gauge potential market movements. These bands act as magnets, attracting the price to specific levels.

In particular, as seen in the chart above, “Level 3” at $91,539 has emerged as a significant price target. Despite the ongoing consolidation at Level 2.5, the analyst believes the market is showing signs of gravitating towards Level 3.

Additionally, Crypto Con notes that historical data suggests that the cycle top band, priced at $123,000, will likely be reached with precision during the final “Bitcoin parabola.”

At the time of writing, the largest cryptocurrency in the market was trading at $67,400, slowly losing ground after continued failed attempts to consolidate above the ley $70,000 level, which is seen as the last hurdle before a potential retest of its current all-time high of $73,700 reached on March 14.

Featured image from Shutterstock, chart from TradingView.com