In a market breakdown shared on X, independent trader and Zero Complexity Trading founder Koroush Khaneghah points to a handful of critical crypto charts that he believes could dictate the next major market move. Khaneghah, who has invested in over 50 startups, emphasizes that the charts for BTC/USD, BTC Dominance (BTC.D), TOTAL2, ETH/BTC, and SOL/BTC provide invaluable insights into the crypto market’s current condition and possible future shifts.

BTC/USD: Defining The Crypto Market

Khaneghah identifies BTC/USD as the yardstick for gauging what stage of the bull run the market might be in. According to his view:

“This decides what stage of the bull run we’re in.

– Breaks above ATH resume the bull run

– Consolidation below ATH -> Altcoins enter accumulation zones

– Major structural breaks -> Time to turn bearish”

He suggests traders begin by determining which of three market environments Bitcoin is in: a raging bull market, a consolidation phase, or a structural downturn. Currently, Khaneghah sees BTC/USD “ranging below all-time highs, coming off some major uptrends,” which often presents either a catch-up scenario for altcoins or a prolonged accumulation phase ahead of Bitcoin’s next attempt to break all-time highs.

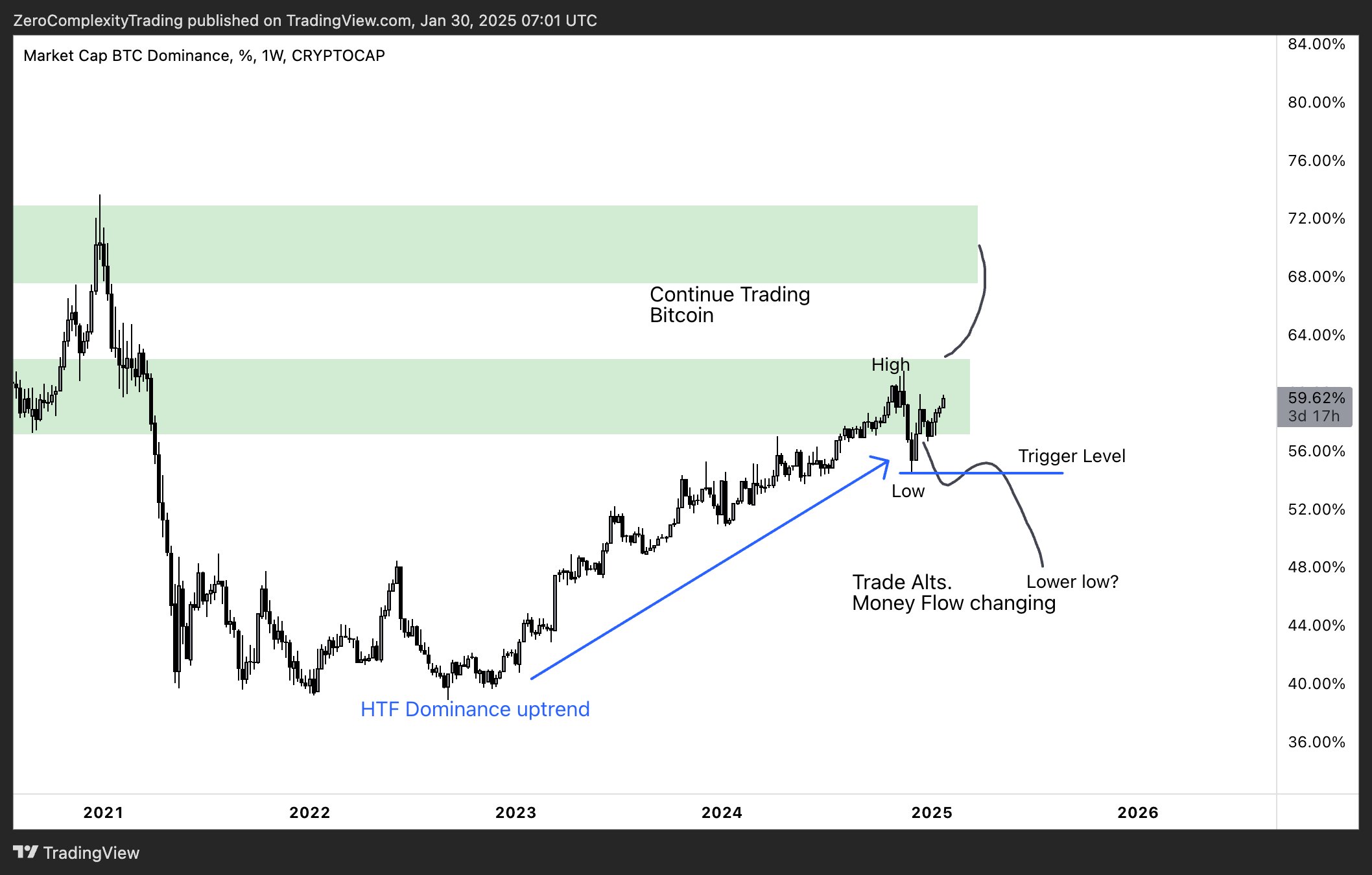

BTC Dominance (BTC.D)

To clarify whether altcoins are poised for a significant move, Khaneghah turns to BTC Dominance. As he explains: “BTC.D (bitcoin dominance) tracks Bitcoin’s share of the total crypto market cap. “Increasing Dominance = BTC outperforms and altcoins lag (same for upside and downside). Decreasing Dominance = BTC cools off and money flows into Altcoins.”

Dominance rising typically means Bitcoin is absorbing the bulk of market liquidity. Meanwhile, a drop in BTC.D often suggests altcoins are about to see greater inflows of capital.

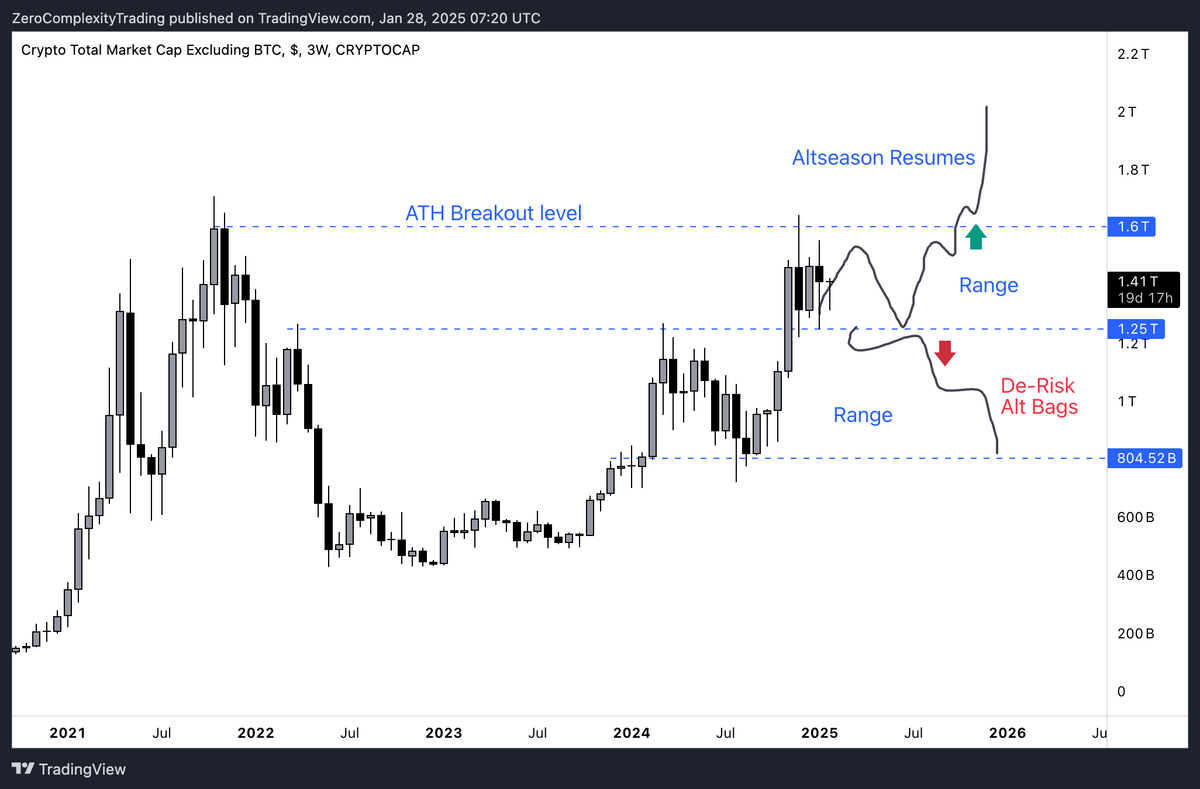

Crypto Market Cap Excluding Bitcoin (TOTAL2)

The TOTAL2 chart, which excludes Bitcoin from the total crypto market capitalization, is key to analyzing altcoin behavior. Khaneghah advises: “When BTC.D Falls, TOTAL2 increases because capital is rotating into altcoins. When TOTAL2 breaks out, look for longs on the strongest altcoins, rotate out of Bitcoin, and shift capital into alts again.”

He stresses that the highest probability trades come from identifying moments when the market rotates away from Bitcoin. In these instances, traders might see stronger returns by entering altcoin positions rather than remaining primarily in BTC.

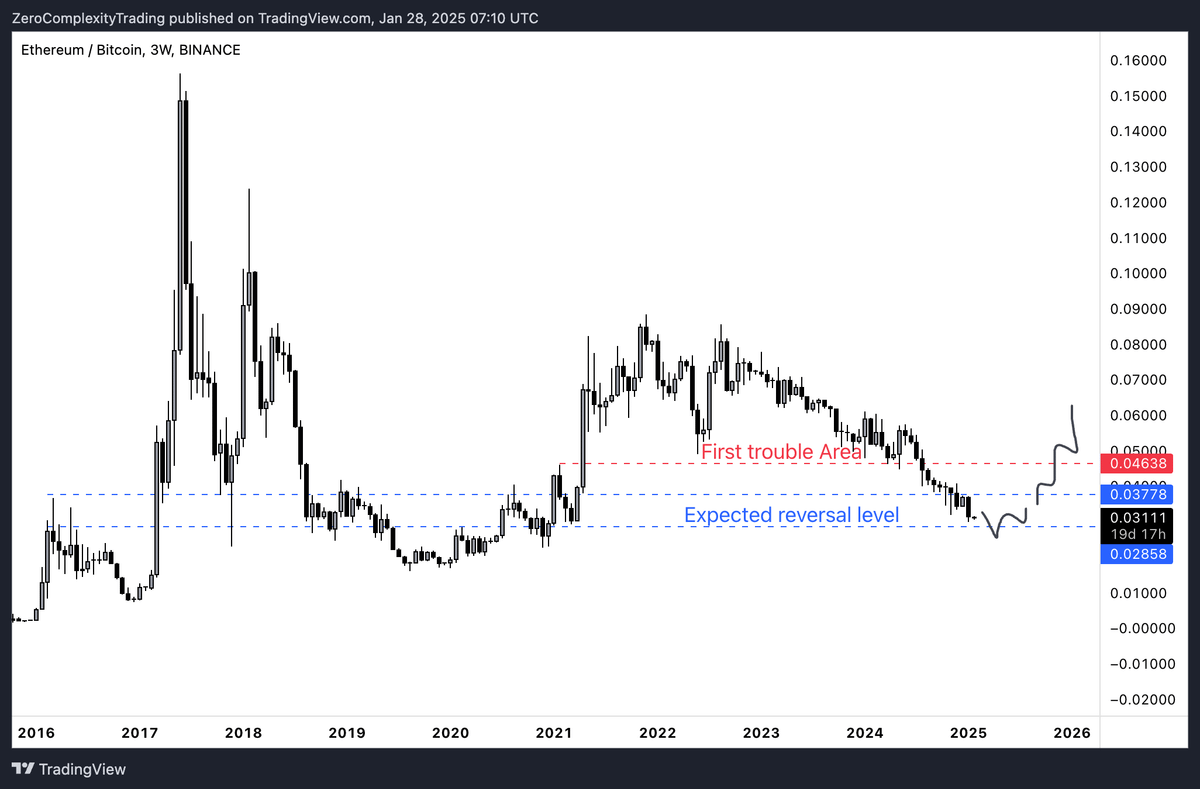

ETH/BTC

Khaneghah underscores that ETH/BTC is a helpful barometer for broader altcoin sentiment: “The best altcoin plays happen when ETH/BTC stops trending downwards because the market confidence in alts returns here.”

When Ethereum is outperforming Bitcoin or stabilizing against it, it generally sparks confidence that altcoins could experience rallies, often referred to as “altseason.”

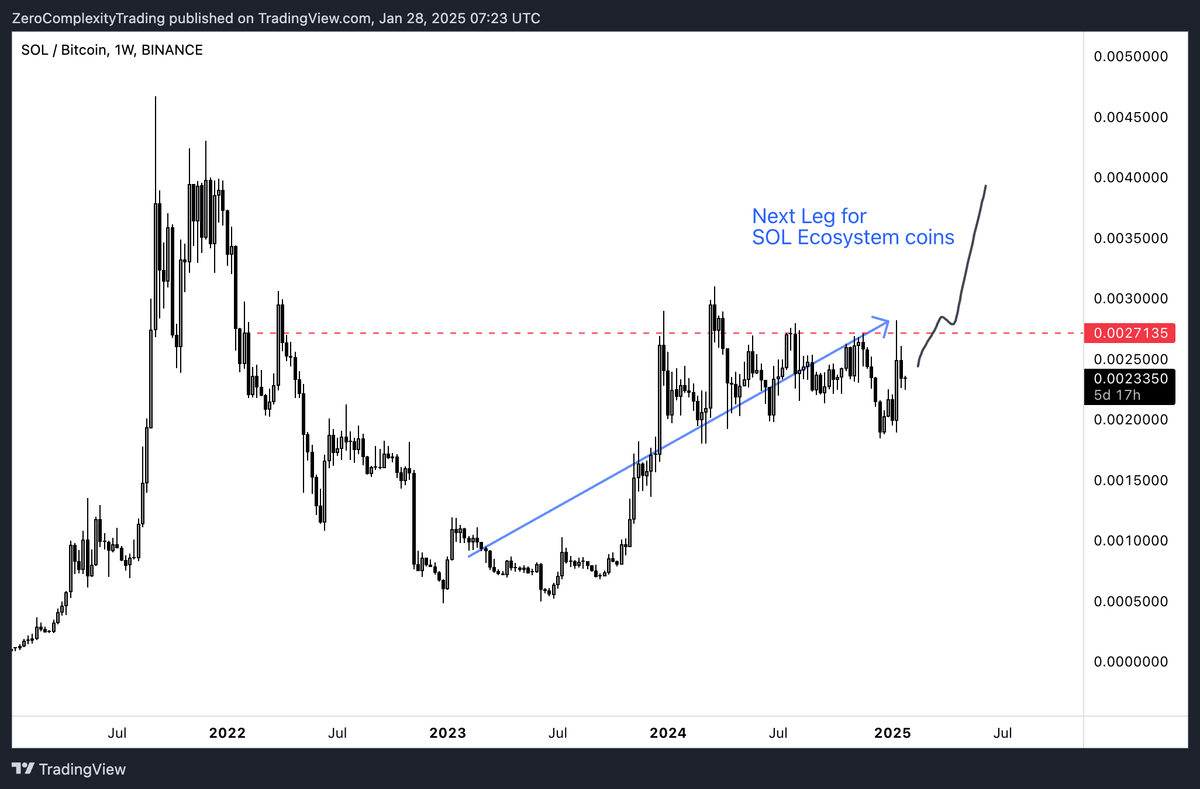

SOL/BTC

Khaneghah also shines a spotlight on SOL/BTC, suggesting that Solana’s performance relative to Bitcoin could reshape altcoin capital rotation: “I don’t normally look at this but a comparison helps decide if the money rotation has a better reward within the SOL ecosystem or ETH. People will think SOL has ‘pumped already’ but I like buying coins with strength, rather than buying coins that might catch a bid.”

While Solana has posted significant gains, Khaneghah believes its strong performance could continue. He notes that if Solana keeps outperforming Bitcoin, some capital might shift away from ETH, potentially amplifying activity across the SOL ecosystem.

At press time, BTC traded at $105,026.