Nasdaq-listed medical technology firm Semler Scientific has expanded its Bitcoin holdings by purchasing an additional 83 BTC for $5.0 million, according to an Aug. 26 statement.

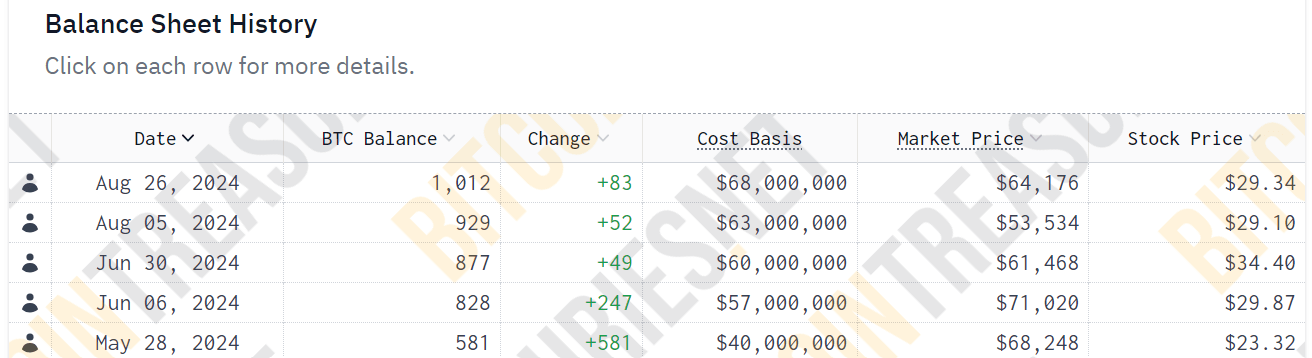

This acquisition brings the company’s total Bitcoin holdings to 1,012 BTC, acquired at a cumulative cost of $68 million, including fees and expenses.

The company’s chairman, Eric Semler, explained that the acquisition was primarily funded through cash generated from the firm’s operations and supplemented by funds from its at-the-market equity program.

He added:

“We are encouraged by the growing institutional adoption of Bitcoin. It was recently reported that institutions now own more than 20% of Bitcoin ETF assets under management. We believe this increasing institutionalization will drive value for both Bitcoin prices and our shareholders.”

Semler Bitcoin purchases

Semler Scientific began investing in Bitcoin in May when it acquired 581 BTC for $40 million.

Since then, the company has continued its buying spree, purchasing 247 BTC for $17 million on June 6 and 49 BTC for $3 million on June 28. By Aug. 5, the firm had purchased an additional 52 BTC for another $3 million.

With the latest purchase, Semler Scientific now ranks among the top 20 corporate Bitcoin holders, based on Bitcoin Treasuries data.

In the second quarter report, CEO Doug Murphy-Chutorian reaffirmed the company’s commitment to Bitcoin, emphasizing that it complements its healthcare business strategy.

Institutional adoption

Semler’s growing Bitcoin stash highlights the increasing confidence among companies in using the flagship digital asset as a treasury reserve.

This trend, which was kicked off by MicroStrategy in 2020, has gained considerable momentum this year, with other firms, like Japan-based investment company Metaplanet and publicly listed DeFi Technologies, making significant Bitcoin acquisitions.

In addition, the introduction of Bitcoin exchange-traded fund (ETF) products has resulted in a notable increase in institutional exposure to the emerging industry. Bitwise CIO Matt Hougan predicted that this trend would further increase in the coming years as the industry continues to mature.

The post Nasdaq-listed Semler Scientific boosts Bitcoin holdings above 1000 BTC to become top 20 holder appeared first on CryptoSlate.