The post NEIRO Price Growth Is Surging: Could It Break $0.002160? appeared first on Coinpedia Fintech News

NEIRO’s price surge isn’t happening out of nowhere—investor sentiment has been surprisingly solid, which is critical for any crypto to keep its momentum. According to recent data, NEIRO’s daily on-chain transactions in profit are around 12.32 billion. Sure, that’s not as high as what we saw in September or early October, but it’s still a good sign that people are holding onto their gains. This steady optimism is helping NEIRO stay strong, and if it continues, we might see even more gains on the way.

Of course, the real test will come if some investors decide it’s time to take profits. If most of them hold steady, NEIRO price could push right past $0.0023 and maybe hit a new peak. But if a chunk of them start cashing out, we might see the price dip down to $0.0015.

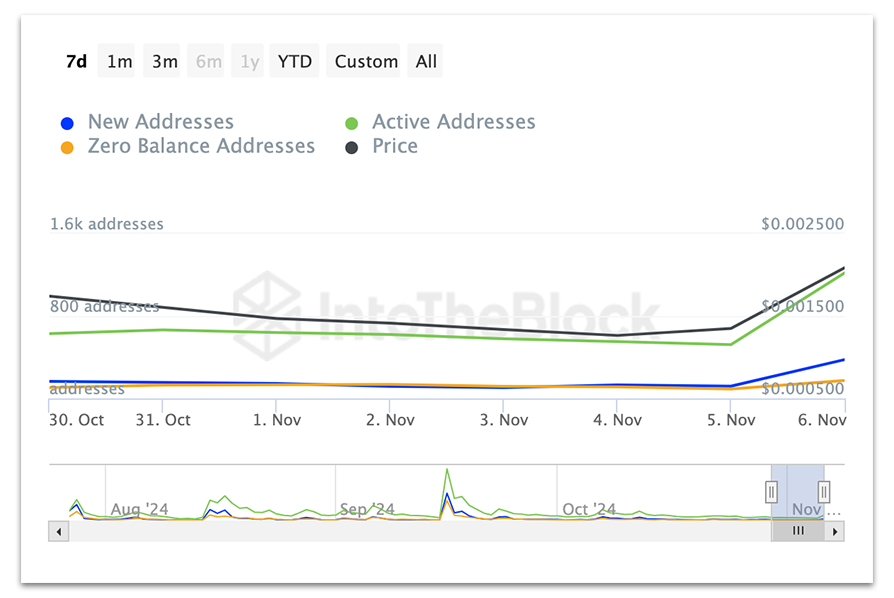

Rise in NEIRO Network Activity

Another key factor boosting NEIRO’s recent performance has been a big jump in network activity. IntoTheBlock data shows there is a huge spike of 130% in the active Neiro addresses over the past week. This shows more investors are engaging with the network and hints at rising interest. Also, the number of new and zero balance addresses is also increasing. This shows new users are entering the ecosystem. This is a good sign for the network. If the users keep pushing the momentum NEIRO might have a solid foundation to keep growing.

Key Resistance and Price Scenarios

NEIRO price movement hasn’t been without its bumps. Starting at a low of $0.0013 on October 30, NEIRO managed to bounce back, breaking out of a downward trend by November 5. Right now, it’s holding above a support level at $0.013, but it’s got resistance to face up at $0.00215989. This level has held strong since early October, so breaking through won’t be easy. On the plus side, the Average Directional Index (ADX) is showing a solid trend at 43.82, which suggests there’s enough strength behind this rally to test that resistance.

- Also Read :

- Will Solana Hit $210 Before Year-End?

- ,

What to Expect

Like any crypto, the future of NEIRO is in the hands of investors. If their sentiment stays high and they keep pushing the momentum, the token could break through and move to $0.0023. If investors lose the interest and start booking profit we could witness a pull back towards a safer zone at $0.0015.