A new dog-themed meme coin has taken the crypto market by storm. Inspired by Kabosu owner’s new dog, Neiro, a new wave of Shiba Inu-themed tokens surged on Solana. However, Its Ethereum-based competitor has stolen the show with its stellar performance in the last four days.

Kabosu’s Sister Sparks New Memecoin Wave

Kabosu, the dog that inspired the legendary Doge meme, passed away in May. The beloved dog also inspired the flagship memecoin Dogecoin (DOGE), and a plethora of Shiba Inu-themed tokens. Its owner recently announced she had adopted Neiro, a 10-year-old rescued Shiba Inu dog.

Related Reading: Ethereum Seeing High Exchange Outflows, But Watch Out For This Bearish Signal

Following the announcement, the crypto community saw the launch of several tokens inspired by the dog. Most of these tokens were deployed on Solana, initially pumping to millions in market capitalization.

On its first day, the largest Solana-based Neiro meme coin reached a $100 million market cap. However, it has since plummeted over 80% to a market capitalization below $20 million, possibly due to the overabundance of Neiro tokens on the chain.

The token was also heavily criticized after online reports called out alleged insider activity from the developers. Blockchain data firm Bubblemaps revealed that the developers of the largest Neiro token deployed on Solana had control of 6% of the token’s supply and eventually sold it for $5.7 million.

Since then, the meme coin has seen a massive 84% price drop, going from its all-time high (ATH) of $0.12 to trading at $0.019.

Are The Dog Days Back?

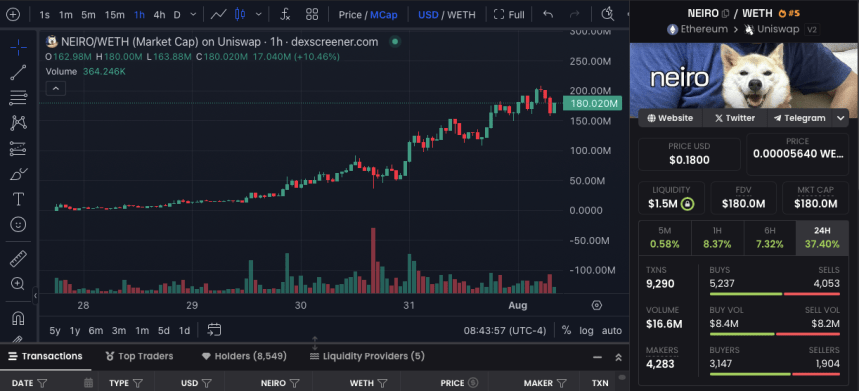

The Ethereum-based Neiro stole the show from its Solana counterparts. The token has seen remarkable growth in the last four days, hitting a $200 million market cap on August 1.

Since its creation on July 27, Neiro has registered a 4,400% surge, shredding two zeros as a result. Additionally, the token reached a new ATH price of $0.20 after soaring 81% from the day before.

Nonetheless, the developers of Ethereum’s Neiro have also been accused of insider trading. Following the massive surge, Bubblemaps alerted investors that the token allegedly “is heavily controlled.” According to the report, 78% of the memecoin’s supply was sniped at launch and quickly spread among 400 wallets. The firm revealed that the wallets had sold 12% of their holdings, around $4.5 million, by July 30.

Investors seemed unfazed by the reports, with many calling the report “bullish news.” Others expressed excitement by the firm’s “fudding,” stating, “A lot of the most successful memes require supply control.”

Moreover, many investors consider “the dog days are back” and the “Doge legacy continues” with the Ethereum-based memecoin. To an X user, there are a few reasons why Neiro’s has become an overnight sensation, including its “SHIB-like narrative,” “concentrated attention,” and the “return of dog meta that always dominates Ethereum bull cycles.”

As of this writing, Neiro is trading at $0.18, a 63% surge in the last 24 hours.