The cryptocurrency exchange landscape is a battlefield of trust. With centralized platforms still reeling from high-profile scandals like FTX and Celsius, any misstep can send user loyalty plummeting. Nexo, a platform that had recently emerged relatively unscathed, now finds itself in hot water after a surprise fee increase sparked outrage amongst its customer base.

From Hero To Zero: Trust Eroded By Unannounced Fees

Nexo had managed to carve out a niche as a customer-centric exchange. Their ability to dodge legal troubles and a swift reversal of a disliked fee policy in April had painted a picture of a platform that listened. However, this carefully crafted image shattered on May 21st when users woke up to emails announcing a significant hike in bank transfer fees.

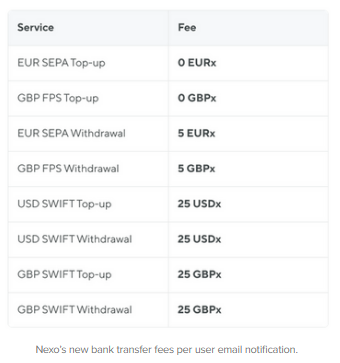

The new structure imposed a £5/€5 charge for FPS/SEPA withdrawals and a hefty $25/£25 fee for SWIFT transactions. This abrupt change ignited a firestorm on social media platforms like Reddit, with users expressing a mix of betrayal and frustration.

“They practically sent out the email after or at the exact moment they implemented it,” commented one disgruntled user, echoing a common sentiment. Many worried that this was just the tip of the iceberg, fearing a slippery slope of additional charges down the line.

The backlash extended beyond mere grumbling. One user on X, a popular social media platform, took a direct jab at Nexo’s aspirations, stating, “You won’t replace banks if you’re worse than them.” This highlights the core issue – Nexo’s attempt to position itself as a disruptive force in finance now appears undermined by its own fee practices.

@Nexo new fees structure completely F’s me in the A, eating all of my interest payments up, making using Nexo totally pointless for me.

Please allow free fiat withdrawals for Platinum customers, I don’t want to leave Nexo.

You won’t replace the banks if you’re worse than them.

— Toddy (@GeordieToddy) May 21, 2024

Communication Gap: Nexo’s Defense Rings Hollow

In response to the growing discontent, Nexo attempted to quell the flames by claiming the new fees were simply passing on costs incurred with third-party payment processors. A company moderator further asserted Nexo’s commitment to “keep transactions accessible and affordable.” These justifications, however, fell flat with many users.

Related Reading: Massive XRP Rally Expected With Federal Reserve’s $6 Trillion Inflation Shift

The lack of transparency and the absence of any prior warning were major sticking points. The timing, coming just weeks after the community lauded Nexo for reversing the loan repayment fee, added another layer of sting.

Featured image from Brookings Institution, chart from TradingView