Bitcoin, the world’s most popular cryptocurrency, appears poised for a major move, but the direction remains shrouded in mystery. Analysts are divided on whether a bullish breakout or an extended consolidation period lies ahead.

Reaching New Highs: Euphoric Bulls On The Horizon?

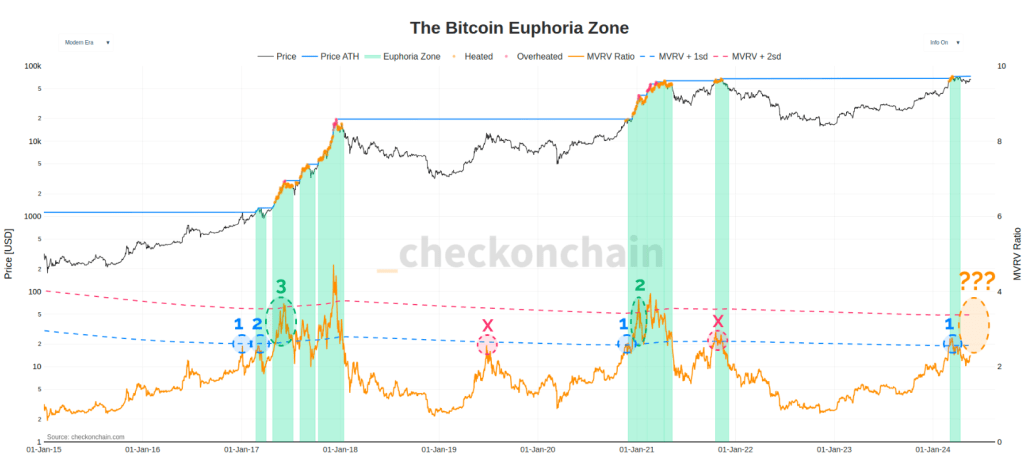

Renowned crypto analyst Checkmate has ignited a spark of optimism with his “Euphoric Bull” theory. According to Checkmate, a surge to a new all-time high could signal a critical shift in market sentiment. This type of bull phase would represent a significant acceleration in bullish momentum, potentially leading to a steeper price increase.

Checkmate’s theory hinges on the Market Value to Realized Value (MVRV) ratio, a metric that compares the current market value of Bitcoin to the total value paid to acquire all Bitcoins in circulation. Historically, when the MVRV ratio climbs above one standard deviation of its average, it has often preceded a shift to a “Euphoric Bull” phase.

#Bitcoin breaking to a new ATH has historically represented a transition point from the Enthusiastic Bull, into the Euphoric Bull.

It also coincides with the MVRV ratio getting above 1 standard deviation, but we rarely clear it on the first attempt.

Bull…Crab…Bull…

A… pic.twitter.com/4YyD179LRS— _Checkmate

(@_Checkmatey_) May 21, 2024

However, Checkmate warns that Bitcoin doesn’t always follow the script on the first try. The market often exhibits cautious behavior, with Bitcoin potentially attempting to breach this key MVRV level multiple times before a decisive breakout.

Bitcoin’s recent consolidation period comes after a surge that saw the alpha crypto reach a six-week high of $71,950. While a slight pullback has occurred, Bitcoin is still trading comfortably near the $70,000 level, with a healthy daily trading volume. This price movement suggests a potential pause before the next significant move, making the current moment a tense waiting game for both traders and investors.

Breakout Or Consolidation? A Bullish Dilemma

Crypto analyst Rekt Capital has emerged as a key voice in the ongoing debate. Rekt Capital believes a weekly candle closing above $71,500 could be the catalyst for a significant breakout. This milestone, if achieved, could trigger a surge in bullish momentum, propelling Bitcoin towards a notable uptrend.

However, Rekt Capital also acknowledges the possibility of an extended consolidation phase. Historically, Bitcoin has exhibited a tendency to consolidate within its re-accumulation range for several weeks before experiencing a breakout. This extended consolidation, Rekt Capital argues, would bring Bitcoin closer to aligning with historical halving cycles, events that have historically preceded major bull runs.

Bitcoin Price Prediction

Meanwhile, other analysts are predicting a potential banner year for the world’s leading cryptocurrency in 2025. The high-end prediction of $168,459 represents a staggering potential increase, fueled by factors like historical price trends and the upcoming Bitcoin halving cycle. Buoying this optimism are technical indicators pointing towards a “Bullish” market sentiment with a hefty dose of “Extreme Greed.”

However, a dose of reality is necessary. The wide range between the predicted high and low ($69,971) underscores the inherent uncertainty in these forecasts. Bitcoin’s notorious volatility, evident in the recent 4.47% price swings within just 30 days, further complicates things. While this level of greed suggests investor confidence, it can also be a warning sign of a potential market correction on the horizon.

Featured image from Vecteezy, chart from TradingView