The post Next Crypto to Explode? Meme Index (MEMEX) Raises $450K in Presale for First Decentralized Meme Coin Index appeared first on Coinpedia Fintech News

The festive season did wonders for Meme Index ($MEMEX), as it smashed through the $450K milestone in its presale just after Christmas.

Meme Index is a unique platform that offers the first-ever decentralized index for meme coins.

Rather than just investing in a single token, Meme Index bundles numerous tokens into four baskets, each with a different risk and upside profile.

Instead of betting on a single token, investors can choose an index—or multiple indexes—to determine how aggressive or conservative they’d like to be.

The whole platform is built around its native $MEMEX governance token, which is currently live in presale.

Currently, $MEMEX is priced at just $0.0146285, but it will increase within 48 hours when the next presale phase starts.

A Strong Year for Meme Coins

One of the biggest crypto trends of the year has been the rise of meme coins, with the sector collectively reaching a value of $137 billion at one point.

Some of the hottest meme coins, like Pepe ($PEPE) and Mog Coin ($MOG), saw an over 1,200% upside in 2024 alone.

There are also lesser-known projects like Peanut the Squirrel ($PNUT), which blew the market away with a 2,000% gain since November.

While these successes are hard to ignore, they also reveal how volatile meme coins can be.

That’s where the Meme Index comes in. It helps investors hedge their bets by diversifying risk into various coins rather than concentrating their investment on a single bet.

One Governance Token for Four Indexes

As we saw above, Meme Index has four indexes.

$MEMEX holders govern all four indexes and any future updates. If a new meme coin takes off and the community wants to add it to an index, $MEMEX token holders can propose and vote on it.

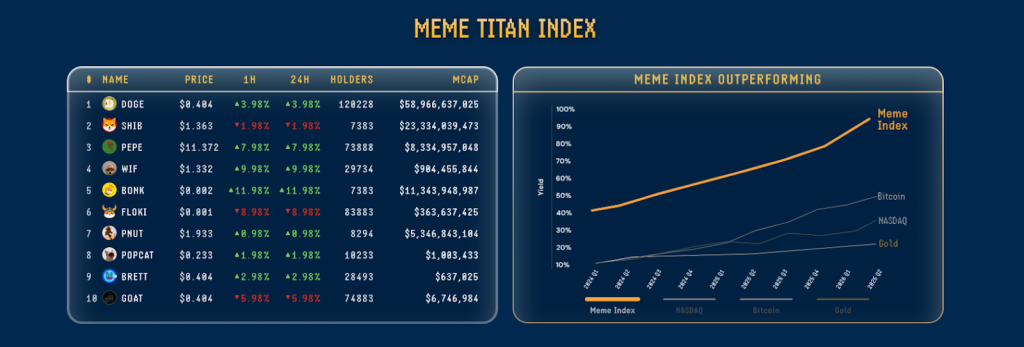

Each index has a different level of risk and upside. Investors can choose a level of risk that aligns with their objectives. For instance, the Titan Index concentrates on the top 10 meme coins with a market cap exceeding $1 billion (such as DOGE, SHIB, and PEPE).

While it provides exposure to established meme coins, it still carries more volatility than standard large-cap cryptos. It could be the right choice if you want to avoid more obscure meme tokens.

Conversely, the Moonshot Index features coins that are either listed or about to be listed on top exchanges but have yet to attain a $1 billion market cap. This is ideal for those who want to gain exposure to growing coins without investing too heavily in speculative projects.

Next on the list is the Midcap Index. It includes meme coins with a market cap between $50 and $250 million. This tier can bring high reward potential if a token moves up to the next tier, though it comes with added volatility.

The last one is the Meme Frenzy Index, a high-stakes basket of brand-new meme coins that may soar to the moon or crash to the ground in days. This option is suitable for high-risk-taking investors chasing exponential gains and certainly not for those playing safe.

How to Buy $MEMEX

With over $450,000 raised in the presale in just a few days, many early supporters are confident that the project can stand out in the meme coin space.

Per the Meme Index whitepaper, the total supply of $MEMEX tokens is limited to 15 billion. The platform has allocated 15% of these tokens to early buyers for the ongoing presale.

You can visit the official Meme Index presale page to buy $MEMEX. You can connect a compatible crypto wallet by clicking ‘Connect Wallet’ and pay with $USDT, $ETH, $BNB, or a credit card.

Buyers can then directly stake these tokens via the Meme Index staking protocol.

The APY is currently over 3,900%. Although this rate will decrease once more participants start staking, it offers an attractive option for $MEMEX holders who want to earn high passive rewards.

It’s worth noting that security has been a top priority for Meme Index. It has audited its smart contracts by Coinsult and SolidProof, where both firms flagged no critical vulnerabilities.

You can join the Meme Index community on Telegram and follow its X account to keep up with the latest news and project updates.