A former executive of a now-defunct cryptocurrency firm, Celsius Network, will have to continue to face his legal battle as a US federal court denied his motion to dismiss the charges against him.

It might seem only like a legal battle of a former crypto CEO but in the greater scheme of things, it’s a reflection of the saga of the government’s scrutiny on the digital currency industry.

Motion Denied

The ex-CEO of Celsius Network, Alex Mashinsky, failed to convince a US federal judge to drop two counts of criminal charges against him relating to the manipulation of crypto prices and fraud.

Judge Rejects Ex-Celsius CEO’s Attempt to Drop Fraud Charges

The latest twist in the Celsius saga: Alex Mashinsky, former CEO of Celsius, just had his motion to dismiss key charges thrown out by a federal judge.

Mashinsky, who faces seven charges, tried to argue that two of… pic.twitter.com/oEa3SkFdHe

— IBC Group Official (@ibcgroupio) November 11, 2024

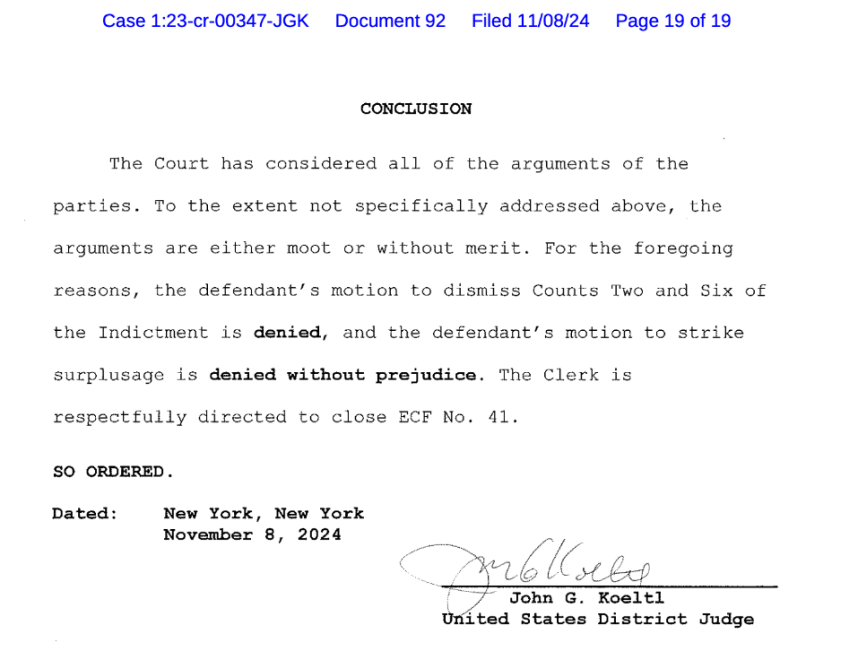

Judge John Koeltl of the US District Court for the Southern District of New York rejected Mashinsky’s motion asking the court to dismiss the two raps against him. Thus, Mashinsky will continue to face the seven complaints in relation to his role in Celsius in January 2025 — a setback that made it inevitable for Mashinsky to defend himself in court when the trial started.

Koeltl ruled that the crypto exec’s arguments to drop the cases were “either moot or without merit.”

Mashinsky’s Argument

Mashinsky’s lawyers argued that their client cannot be charged with violations of the Commodity Exchange Act and the Securities Exchange Act of 1934, saying the court is charging the former CEO with two charges for the same conduct.

However, Koeltl disagreed with their argument, saying a conviction on violating the Securities Exchange Act would not mean that Mahinsky would be acquitted of violating the Commodity Exchange Act.

Mahinsky also claimed that the commodities charge is “legally insufficient”, explaining that the state prosecutors failed to sufficiently allege that the platform’s investors were depositing Bitcoin into a program that offered a weekly reward scheme. The federal judge argued that this argument is a factual question that “cannot be resolved” at this point in the case.

Koeltl also denied Mashinsky’s motion to dismiss market manipulation charges, saying it is “meritless”. The judge added that the US Court of Appeals for the Second Circuit has already ruled before that “open-market transactions that are not inherently manipulative may constitute manipulative activity when accompanied by manipulative intent.”

Celsius: Legal Woes

Celsius used to be a prominent crypto platform in the industry. Unfortunately, the firm collapsed in 2022 following the freezing of customer withdrawals. The company also filed for bankruptcy amidst the huge balance sheet deficit.

As a result, the SEC charged Mashinsky with fraud and manipulating the market which caused the collapse of the crypto firm.

State authorities said that the crypto CEO deceived the investors and claimed that CEL, the firm’s coin, was safer than it was.

If convicted of all the seven charges, Mashinsky could spend 115 years in state prison. The former CEO has not yet pleaded not guilty to these charges.

Featured image from Public Policy Institute of California, chart from TradingView