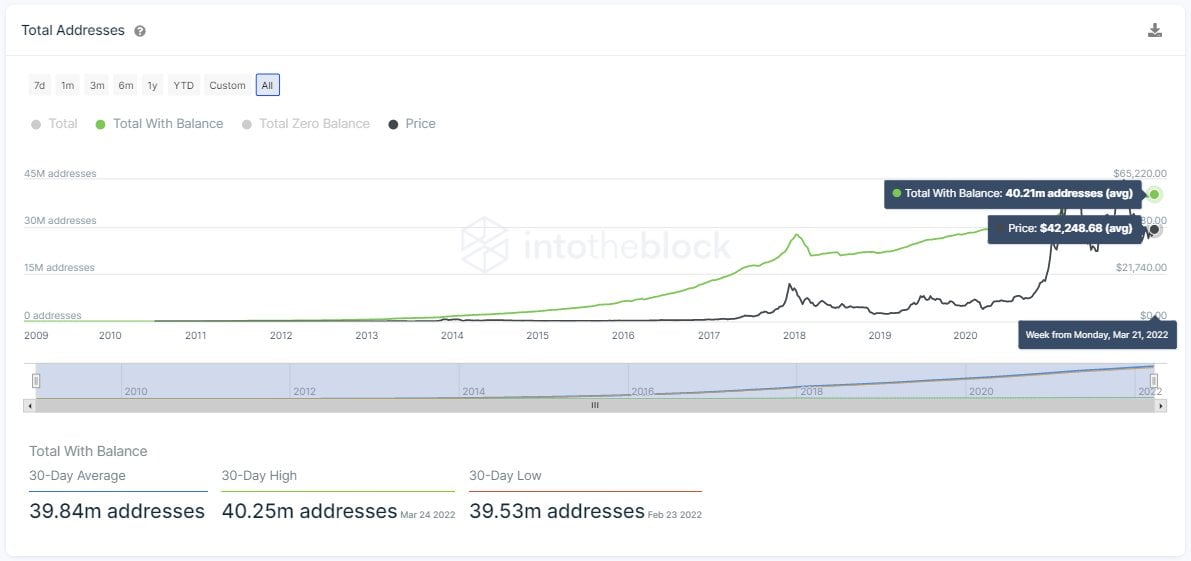

While bitcoin has risen in value in recent times, jumping 8% during the last seven days, statistics show that the number of addresses holding bitcoin has surpassed 40 million addresses. Metrics from the analytics web portal intotheblock.com show addresses that hold any fraction of bitcoin tapped a 30-day high on March 24, reaching 40.25 million addresses.

Addresses That Hold a Small Fraction of Bitcoin or More Swelled Past 40 Million

Non-zero bitcoin (BTC) addresses or accounts that hold at least a single satoshi of BTC has grown at a parabolic rate since 2018. The news was revealed on March 25, when intotheblock.com’s official Twitter account tweeted about the milestone.

“40M+ Holders – For the first time the number of addresses holding bitcoin has surpassed 40 million,” Intotheblock said. “After dropping in February, the number of addresses holding Bitcoin has continued to grow and set new highs.”

The crypto analytics firm Intotheblock added:

This points to growing interest and adoption for bitcoin.

Back on March 12, 2018, or four years ago, the number of non-zero bitcoin addresses was around 20.86 million. Statistics show that the number of bitcoin addresses grew by 92.95% since that day four years ago. Presently, the number of daily active bitcoin addresses is 955,380 and the number of new addresses is 429,120. In terms of profit, 30.64 million addresses holding BTC have profited at the current price.

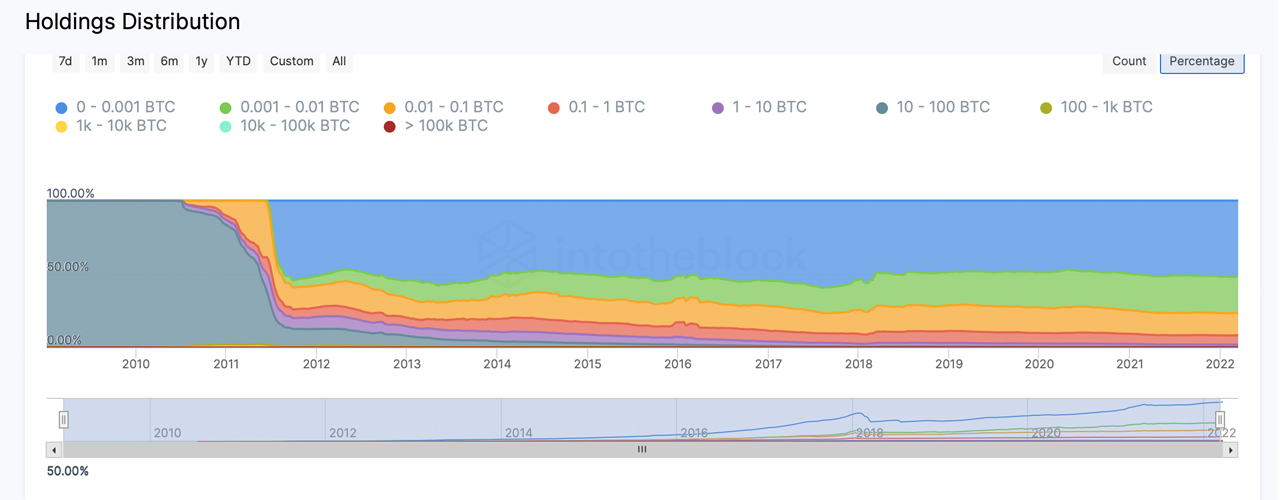

100 Addresses Command More Than 14% of the Crypto Asset’s Supply, 3.3 Million Addresses Hold a Small Fraction up to 0.00001 Bitcoin

Intotheblock.com metrics indicate that the concentration of large bitcoin holders today is 10%, while coincarp.com data indicates the top ten BTC holders own 5.58% of the entire bitcoin supply. 20 wallets command 7.78% of the supply, the top 50 addresses capture 11.36% of BTC’s supply, and the 100 richest addresses hold 14.11% of the leading crypto asset’s supply. As far as any address with at least 0 to 0.00001 bitcoin, today there are 3,315,204 addresses holding that amount.

Bitcoin addresses with at least 1 to 10 BTC held, account for 680,261 addresses on March 25, 2022. In terms of whale addresses with at least 1,000 to 10,000 BTC, there are currently 2,200 addresses today that fall into the whale criteria. As far as mega-whales are concerned, or bitcoin addresses with at least 10,000 to 100,000 BTC, there are only 82 addresses that meet the requirement. Furthermore, in terms of the biggest bitcoin whales of them all, or addresses with at least 100,000 to 1,000,000 bitcoin, there’s presently four BTC addresses that hold that amount.

What do you think about the fact that non-zero bitcoin addresses have crossed the 40 million mark this week? Let us know what you think about this subject in the comments section below.