Solana has been struggling since late January, experiencing a sharp decline alongside the broader crypto market. SOL has lost over 60% of its value, with bulls now fighting to hold onto current price levels. Analysts remain skeptical, calling for a continuation of the downtrend as Solana struggles to reclaim higher levels.

Despite the negative sentiment, some investors remain optimistic about a quick and strong recovery in the coming months. They argue that market conditions could shift rapidly, especially if broader economic factors and liquidity conditions improve.

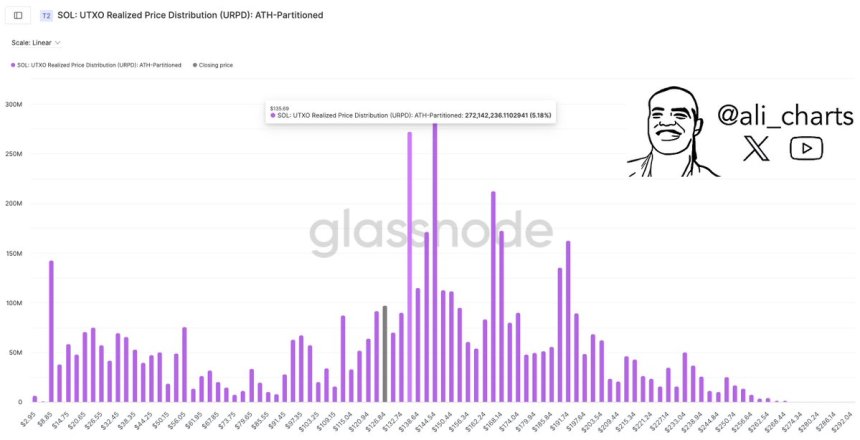

On-chain data from Glassnode reveals that Solana faces a major test, as $135 is the most important resistance level according to the UTXO Realized Price Distribution (URPD) indicator. This metric identifies key price levels where large amounts of SOL have previously changed hands, making $135 a critical level for price action.

If SOL can break and hold above $135, it could signal a trend reversal and open the door for a potential recovery. However, failure to reclaim this level could result in further downside, reinforcing the bearish outlook. The coming weeks will be crucial for determining Solana’s next major move.

Solana Struggles Below Key Resistance as Bears Take Control

Solana has been trading under heavy selling pressure, struggling to reclaim key levels after weeks of market uncertainty. Bulls lost control once SOL dropped below the $180 mark, and now speculation about a prolonged bear market is rising. The price remains stuck below key resistance, making a recovery challenging.

Top analyst Ali Martinez shared insights on X, revealing that Solana faces a major test at the $135 level, which has been identified as the most important resistance based on the UTXO Realized Price Distribution (URPD) indicator.

The URPD indicator is an on-chain metric that tracks the price levels at which coins were last moved. It highlights significant areas of accumulation, showing where investors have previously bought and sold. When many tokens have changed hands at a specific price, that level becomes a critical support or resistance zone.

In Solana’s case, $135 represents a level where a large amount of SOL was last transacted. This means that if bulls reclaim $135, it could act as strong support and signal a trend reversal. However, if SOL fails to break above it, bears could reinforce selling pressure, leading to further downside.

Solana Faces Key Support Test at $126

Solana (SOL) is trading at $126 after experiencing massive selling pressure in recent weeks. The price has been in a strong downtrend, failing to reclaim key levels as market-wide uncertainty and volatility continue to drive sentiment.

Currently, SOL is sitting at a crucial weekly demand level, which bulls must defend if they want to initiate a recovery or at least establish a consolidation phase around current prices. Holding this support could provide the foundation for a relief rally, but the market remains fragile.

If SOL loses the $120 level, selling pressure could intensify, potentially sending the price toward the $100 mark or even lower. A break below this demand zone would indicate further weakness and could trigger panic selling, leading to deeper losses across the altcoin market.

For any meaningful recovery, bulls need to push SOL above $135 and reclaim $150 to shift momentum in their favor. Until then, downside risks remain high, and traders will closely watch how Solana reacts at this critical support level in the coming days.

Featured image from Dall-E, chart from TradingView