The post Only 8.97 Million Ethereum (ETH) Left on Exchanges, Bullish Signal? appeared first on Coinpedia Fintech News

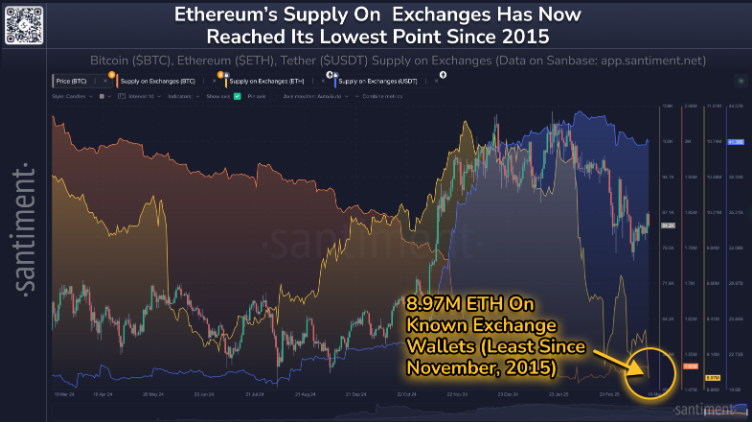

Amid Ethereum’s (ETH) continuous price drop, whales and long-term holders have seized the opportunity to buy the dip. On March 21, 2025, the on-chain analytics firm Santiment reported that during the ongoing price decline, crypto enthusiasts have significantly accumulated ETH tokens, leaving only 8.97 million ETH on exchanges, which indicates a bullish trend.

Ethereum Reserves Fall to 8.97 Million

This massive drop in exchange reserves has occurred for the first time in the past 10 years, with the last instance reported in November 2015. However, the current reserve is 16.4% lower than it was seven weeks ago, indicating potential accumulation by whales and long-term holders.

Experts see these metrics as bullish signs as prices continue to fall, along with ETH exchange reserves. Besides this significant 16.4% drop in reserves, asset prices have also declined during the same period, which investors have taken as a buying opportunity.

Current Price Momentum

Ether is currently trading near $1,960, registering a 0.50% price drop in the past 24 hours. During the same period, its trading volume declined by 40%, indicating lower participation from traders and investors, possibly due to market uncertainty.

Ethereum (ETH) Price Action and Upcoming Levels

Despite the bearish market sentiment and reduced participation from investors and traders, ETH’s current level appears bullish. Its lack of a rally is not solely due to negative sentiment.

According to expert technical analysis, ETH remains bullish, having recently broken out of a prolonged consolidation phase that lasted over a week. Following the recent price drop, the asset seems to have successfully retested that zone, and its price now appears to be moving upward.

Based on recent price action and historical patterns, if Ether holds above the $1,950 level, there is a strong possibility it could surge by 12% to reach $2,200 in the coming days.

At press time, the asset is trading well below the 200 Exponential Moving Average (EMA) on the daily timeframe, hinting at a potential price rebound.