During this bull cycle, the crypto market has been surfing off Bitcoin’s crest and enjoying the bullish momentum. However, investors hope for a seismic explosion to impulse Altcoins to new highs.

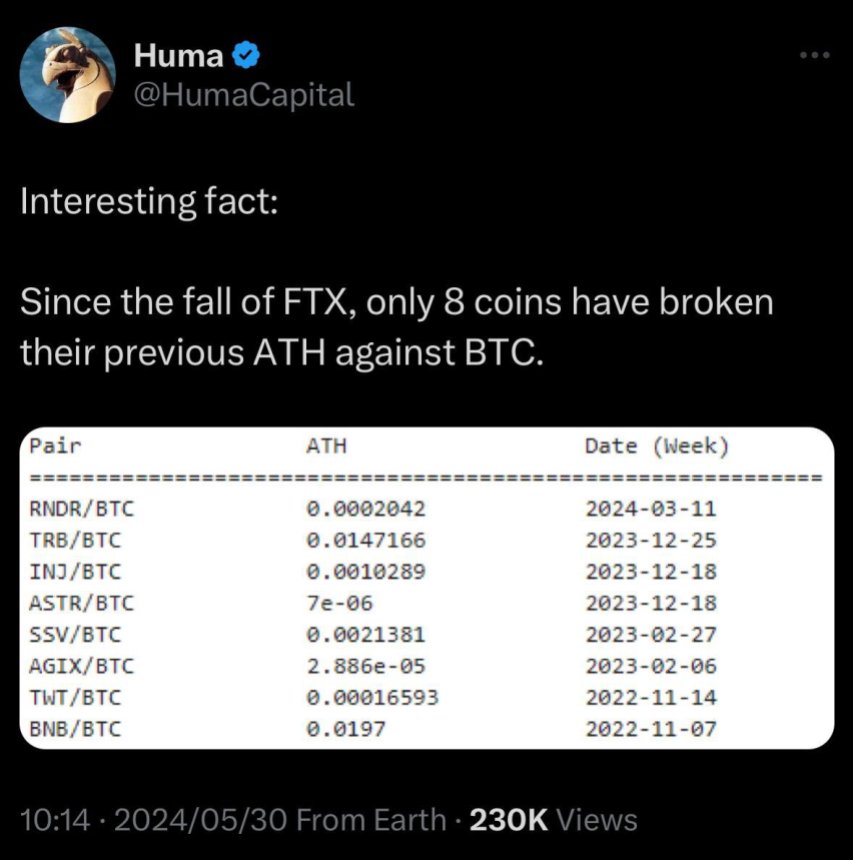

As the crypto industry awaits, online reports revealed that, since FTX’s fall, only eight altcoins have hit a new all-time high (ATH) against Bitcoin. A crypto analyst shared his thoughts on the matter.

Altcoins Underperforming Against Bitcoin This Cycle

On Friday, Crypto analyst Miles Deutscher shared an interesting fact about the crypto market. Since November 2022, just eight altcoins have broken their previous ATH against the flagship cryptocurrency.

To achieve this feat, tokens include Render (RNDR), Tellor (TRB), Injective (INJ), Astar (ASTR), SSV Network (SSV), SingularityNET (AGIX), True Wallet Token (TWT), and Binance Coin (BNB).

It’s worth noting that RNDR was the latest one to accomplish this on March 11 and that the list only contains altcoins launched before FTX’s collapse.

Deutscher explained that despite his initial shock, the news made sense to him and highlighted some takeaways based on the singularities of this run.

First, the analyst considers that asset selection dynamics changed from previous cycles. Investors have been “punished” for being overexposed to certain sectors like L2 and gaming and “rewarded” for participating in others like Memecoins and AI.

In contrast, in the last cycle, “you could basically bet on anything and beat $BTC.” According to the analyst, the market will likely continue experiencing specific sector outperformance despite the retail liquidity injection.

He also explained that “crypto is an attention economy,” and money will flow where attention is. As a result, even the projects with the best technology won’t perform if there isn’t an exciting reason to buy.

Deutscher’s second takeaway highlights the market’s current ATH dilution. As he points out, thousands of new products are being launched daily, and “low float/high FDV VC coins are launching in the billions.” These launches are seemingly outpacing the new liquidity, resulting in Altcoins struggling with performance.

More Room To Catch Up

The analyst’s third point explains that the bull run has been led by Bitcoin and spot BTC exchange-traded funds (ETH). Based on this, he considers it unsurprising that altcoins have “hardly pumped” so far.

Various crypto analysts and experts share this opinion. Alex Krüger previously stated that the cycle has been “almost entirely” driven by the Bitcoin ETFs’ momentum.

Deutscher sees Altcoins’ underperformance as a bullish signal since Bitcoin’s dominance has been instrumental in previous cycles. To him, this performance allows “more room to play catch up” and could drive altcoins to unseen highs.

The analyst believes the market needs another catalyst for a true Altcoins season. Despite this, he highlights that many investors have had a record Q1 “even in mildly bullish conditions for most alts.”

Ultimately, Deutscher considers there is still room to make big profits this cycle “even without the face-melting altseason we all crave.”