Data shows the cryptocurrency derivatives sector has seen a mass liquidation event in the past day as Bitcoin and other assets have crashed.

Crypto Market Has Seen A Long Squeeze In The Last 24 Hours

According to data from CoinGlass, a large amount of contracts have been liquidated during the past day. A position is said to be “liquidated” when its platform decides to forcibly shut it down. The exchange does this when the holder has amassed losses exceeding a certain threshold.

There are two factors that can raise the chances of liquidation. The first one is volatility. A highly volatile asset can end up fluctuating both ways so much that it can be hard to bet on a direction.

Volatility isn’t in the user’s hand, but the second factor, leverage, is. “Leverage” refers to a loan amount that any investor can opt to take up against their initial collateral. Leverage can mean that the profits earned by the holder become multitudes more, but the same also applies to the losses, so the risk of liquidation naturally rises.

In the cryptocurrency market, both of these factors are generally always present, as coins often display wild swings inside short windows and there is an abundance of speculators willing to bet high.

The result of these conditions is that mass liquidation events, popularly called squeezes, occur on the regular. One such event has taken place in the last 24 hours, as the below table shows.

As is visible, cryptocurrency-related liquidations have totaled up to a whopping $904 million during the past day. Out of these, $811 million of the flush, representing almost 90% of the total, involved the long contract holders alone.

The reason behind the liquidations leaning so heavily towards the traders betting on a bullish outcome naturally lies in the fact that Bitcoin and other assets have witnessed a crash in this window.

Here is a heatmap that shows how the liquidations have looked when divided by symbol:

As displayed above, Bitcoin has contributed to the largest share of the liquidations at $261 million. Ethereum (ETH) has come second at $113 million and Solana (SOL) third at $39 million.

XRP (XRP) is larger in market cap than SOL, but has still performed worse in this metric, potentially because of the fact that the latter has seen a larger price drawdown.

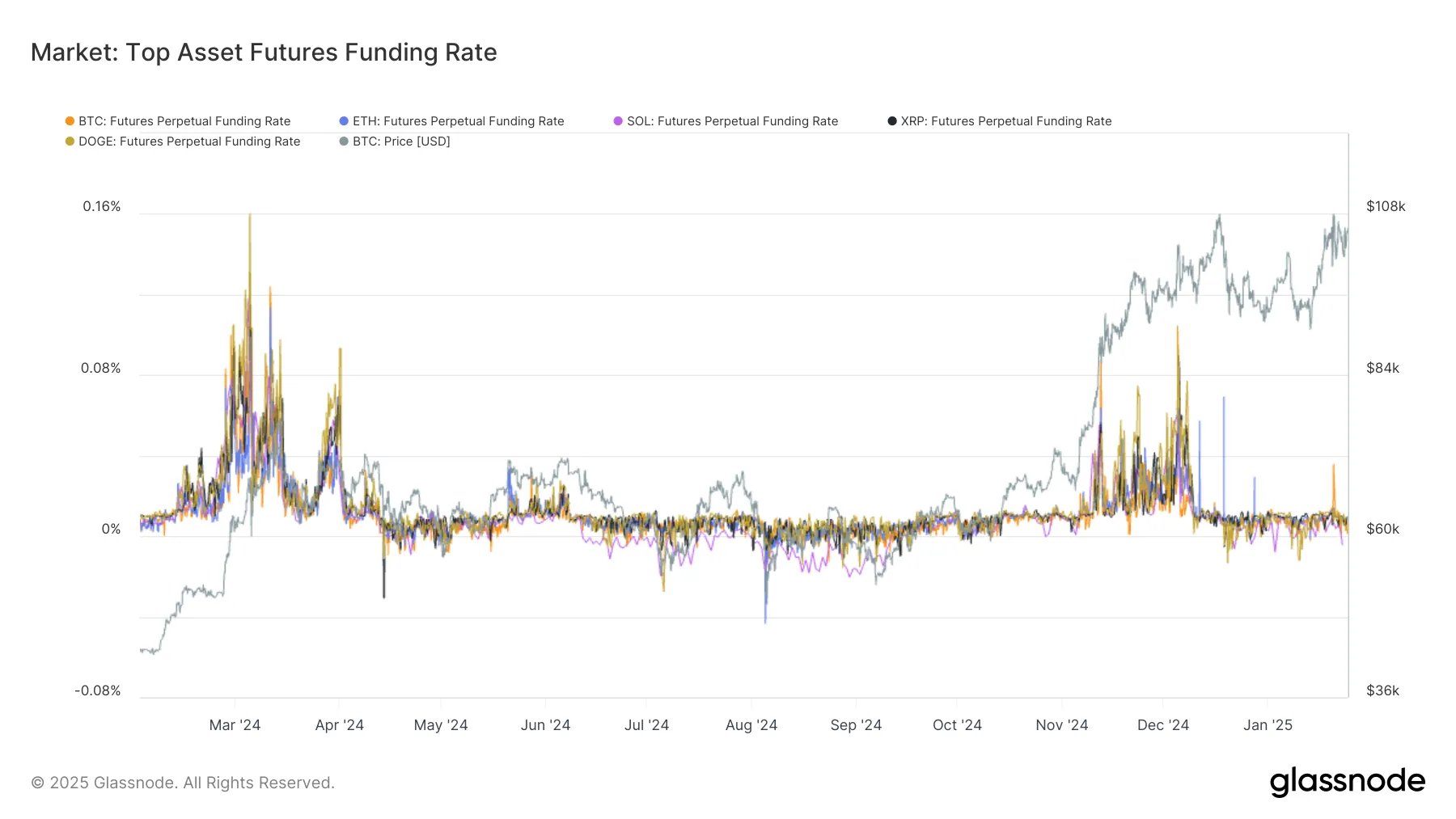

Interestingly, while a long squeeze has occurred in the sector, the exchanges have actually not been too long-heavy in terms of positions recently, as the analytics firm Glassnode has pointed out in an X post.

“The hourly funding rates for the top 5 assets in the market ( $BTC, $ETH, $SOL, $XRP, $DOGE) show the appetite for long positions has not returned to the levels seen in the November to early December rally,” notes Glassnode.

BTC Price

At the time of writing, Bitcoin is trading at around $100,400, down over 4% in the last seven days.