Onchain Highlights

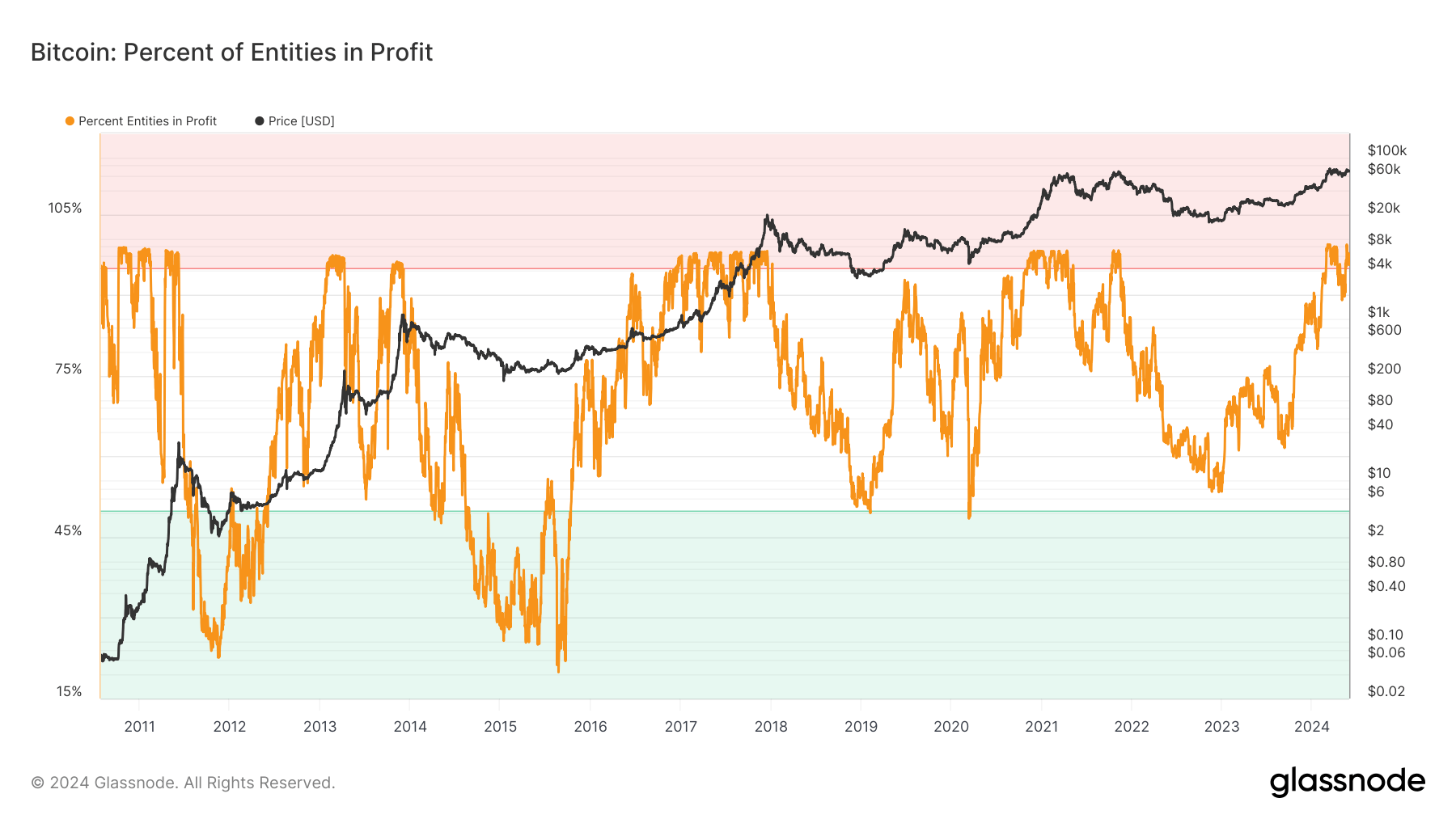

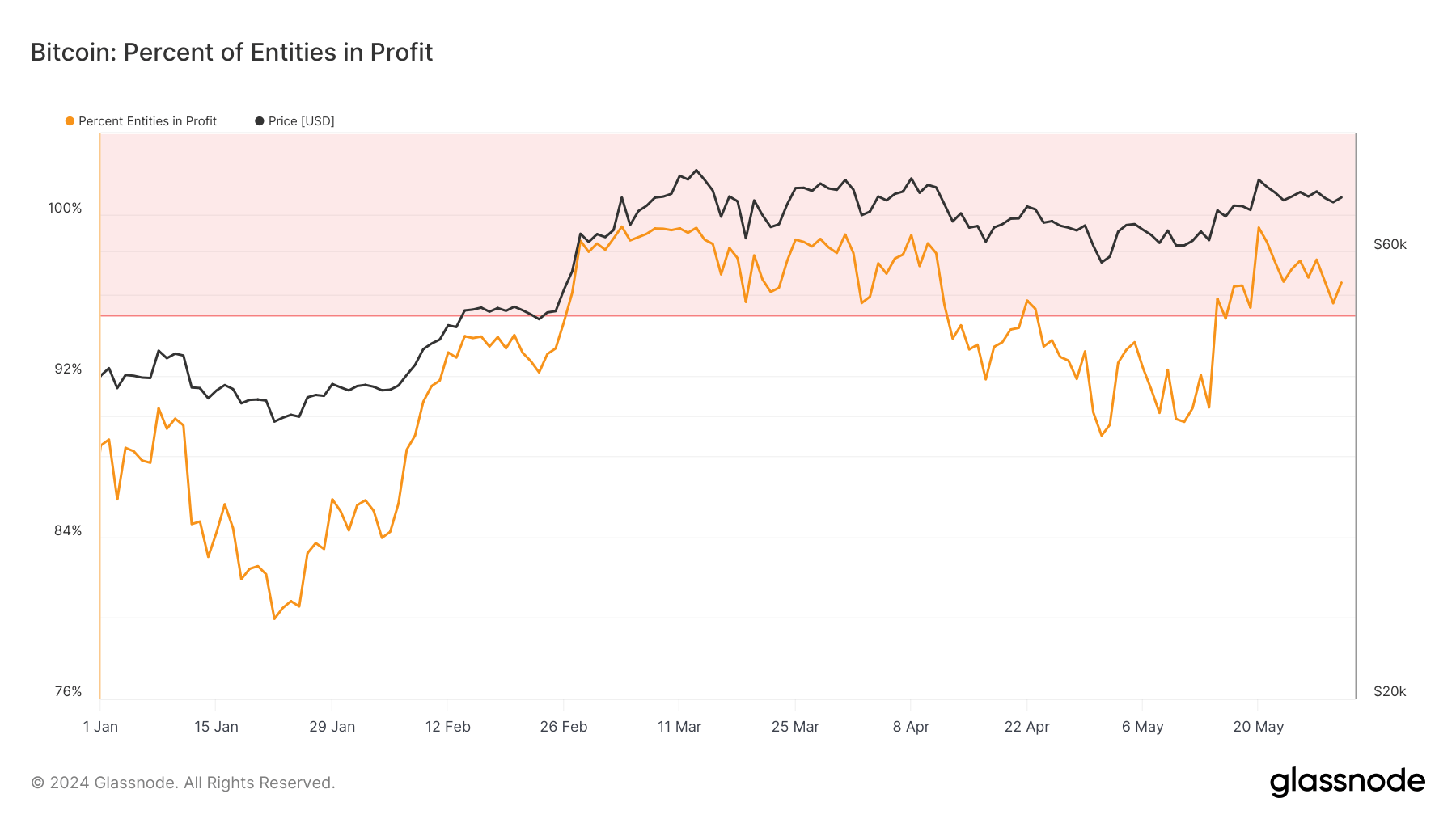

DEFINITION: The percentage of entities in the network that are currently in profit is based on the amount of Bitcoin bought cheaper than the current price. The “Buy price” is defined as the price at which coins were transferred to addresses controlled by the entity.

Bitcoin’s current market trends show a nuanced interaction between price fluctuations and the profitability of entities holding the asset.

Recent data from Glassnode reveals a substantial portion of Bitcoin holders remain in profit despite recent volatility — with over 90% of the supply being profitable as of May.

This trend indicates that holders are maintaining their positions amid market swings, reflecting a resilient support level for the flagship digital asset.

Furthermore, Bitcoin’s price movements in 2024 have been reminiscent of its volatile periods seen in previous years, particularly in 2017. The asset has experienced multiple significant declines and surges, contributing to an overall rollercoaster pattern of market behavior.

This volatility highlights the speculative nature of the market and highlights the impact of external factors, such as regulatory developments and macroeconomic conditions, on Bitcoin’s valuation.

Glassnode data also indicates that the Bitcoin market is experiencing support levels that bolster the confidence of holders, even as the asset undergoes typical cyclical corrections.

The consolidation of Bitcoin’s price around key support levels and the sustained profitability of a majority of holders suggest a strong underlying market structure that could mitigate extreme downturns and provide stability moving forward.

The post Over 90% of Bitcoin supply remains profitable despite market volatility appeared first on CryptoSlate.