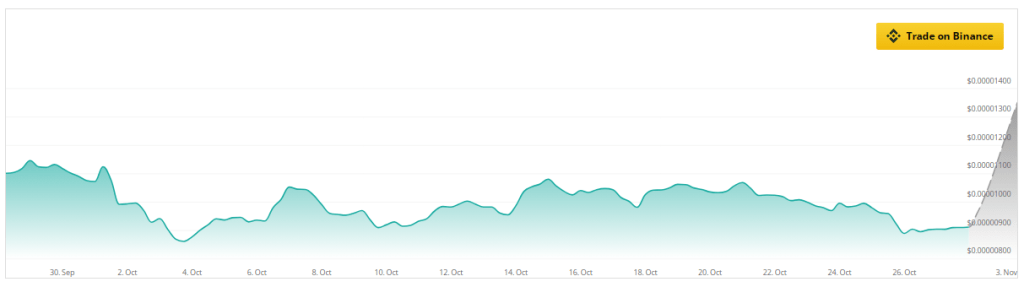

Pepe [PEPE] is currently trading at approximately $0.000000900 and is undergoing a challenging period. The Relative Strength Index (RSI) is currently at 43.80, which is just below the neutral line. This implies that sellers currently possess a minor advantage.

Memecoin Price On The Downtrend

Some investors are apprehensive due to the downward trend of the price. Although PEPE has experienced significant price increases in the past, recent metrics suggest that momentum is diminishing.

It is interesting that the number of holders is consistently increasing, despite the obstacles. This expanding base, which is now approaching 296,000, indicates that a devoted community continues to support the token.

Even if participation has dropped, it is clear that many investors are still committed to the popular meme coin and have future hope. The declining trade activity has raised some questions, though.

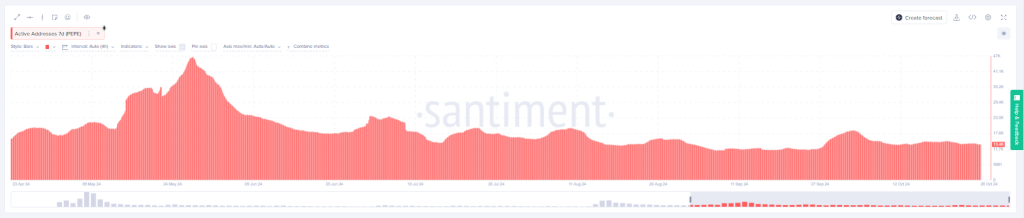

Active Addresses On The Retreat

Active addresses that the PEPE network has seen have dropped significantly, data from Santiment shows; today they count roughly 13.5k. From peak levels recorded earlier this year, this translates to a decline.

Lower active numbers of users would typically denote reduced trading volumes and hence decreased liquidity levels. Perhaps, this might indicate that euphoria regarding the memecoin market in the earlier stages is fading away slowly.

The niche seekers probably are on a lookout for something new within such a developing memecoin territory. If the same continues then PEPE could struggle to regain its vibrancy.

The more cautious sentiment among traders is evident in the subdued price action. Perhaps as a result of the general market’s uncertainty, certain investors appear to be waiting on the periphery. If the price remains under pressure, it is possible that the coin will experience additional declines before it establishes a strong foundation.

Glimmer Of Hope For PEPE

Despite the challenges in engagement and the weakness in price, there are rays of hope for PEPE. In the coming three months, analysts expect more than a 200% increase which is a positive indicator of upside potential.

CoinCheckup forecasts that in the next month PEPE could be trading 220% lower than its current price. This can be an appropriate time to invest in the asset. The experts are of the opinion that the upcoming months will accrue the investor a total of 165% profits.

Nonetheless, in the face of these difficulties, the future developments seem promising and PEPE will soar to $0.00044 by 2026, which may cause renewed interest in the sector as a whole.

Featured image from Vanity Fair, chart from TradingView