The post Polkadot (DOT) Breakout Alert, Traders Eye 75% Rally appeared first on Coinpedia Fintech News

After a significant price decline of over 50% since May 2024, Polkadot (DOT) is now poised for a notable upside rally. The potential reasons for this bullish speculation include recent price action, increased investor interest, and the current bullish market sentiment.

Polkadot (DOT) Technical Analysis and Upcoming Levels

According to expert technical analysis, since May 2024, DOT has followed a lower high and lower low price action pattern while facing resistance from a descending trendline. However, with the recent price rally, DOT has broken out of this trendline, shifting the sentiment from a downtrend to an uptrend.

Based on recent price action and historical momentum, there is a strong possibility that DOT could surge by 75% to reach $7.65 in the coming days. However, DOT may encounter several resistance levels along the way: Resistance (R1) at $5.1, R2 at $5.6, R3 at $6.5, and R4 at $7.6.

However, considering the current market sentiment, it appears that DOT could easily surpass this level in the coming days.

Despite this bullish outlook, DOT is currently trading below the 200-day Exponential Moving Average (EMA) on the daily timeframe, indicating a downtrend.

Bullish On-Chain Metrics and Current Price Momentum

DOT is currently trading near $4.35 and has experienced a price jump of over 1.5% in the past 24 hours. During the same period, its trading volume dropped by 10%, indicating lower participation from traders and investors compared to the previous day.

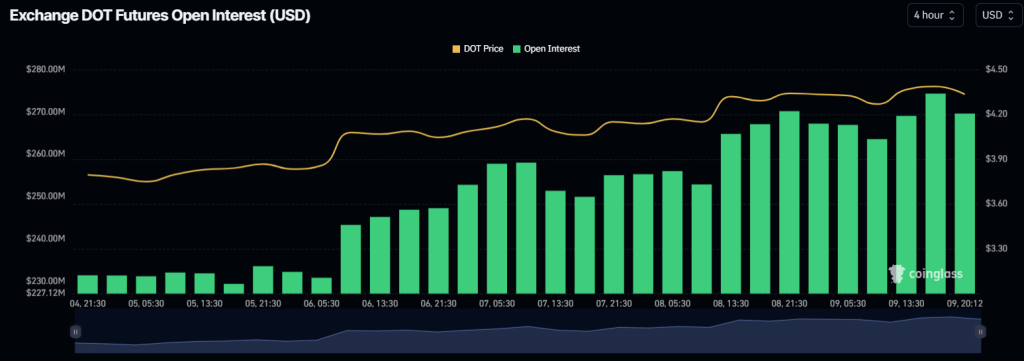

Besides small price changes, on-chain metrics further support DOT’s positive outlook. According to on-chain analytics firm Coinglass, DOT’s long/short ratio currently stands at 1.07, indicating strong bullish sentiment among traders. Additionally, its open interest appears to be steadily rising, reflecting growing interest from community members.

Based on the data, DOT’s open interest has increased by 2.9% over the past 24 hours and 1.67% in the past four hours.

A combination of these on-chain metrics and technical analysis suggests that bulls are currently dominating the asset, which could support DOT in achieving a 75% rally in the coming days.