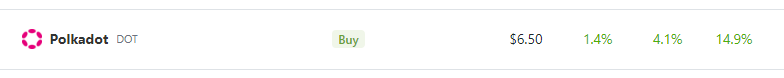

Polkadot (DOT) is in the green (see image below) and going steady. Could this hint at price recovery? Even though Polkadot’s funding rate plunged for a while, it is showing some improvement at the time of writing.

Here’s a quick look at DOT price movement:

- Polkadot price is up by 14.9% in the weekly

- DOT low in market cap dominance

- DOT shows a spike in development activity

According to Coingecko, DOT price has skyrocketed by 4% in the last 24 hours, and trading at $6.50 as of press time.

Polkadot Eco-Friendliness To Drive Positive Momentum

January was phenomenal for most cryptocurrencies that are enjoying a price rally, but DOT was seen struggling and was unable to reach its pre-FTX levels.

On a positive note, DOT was the only asset that consumed the least electricity when pitted against other cryptocurrencies. This eco-friendly quality of DOT can drive positive momentum for the coin.

POLKADOT – THE ECO-FRIENDLY BLOCKCHAIN

Thanks to CCRI Report 2022, we found @Polkadot was ranked #2, only followed by US Household in terms of the total yearly electricity consumption

Let’s see more details below

#Polkadot $DOT #AVAX #ALGO #BTC #ETH #SOL #ADA pic.twitter.com/S5WxxvJSA0

— Polkadot Insider (@PolkadotInsider) January 25, 2023

Even though the weighted sentiment on Polkadot remained to be negative last December, its low electricity consumption can drive a change in public sentiment, switching it to positive which is great news for Polkadot.

The low trading volumes suggest that the bears may have the upper hand. This action has the potential to push DOT prices below the $6.154 support level, putting the brakes on the recent uptrend in DOT.

DOT is predicted to spike in terms of development activity which could tick developer interest this year. In addition, DOT is said to potentially tip its pre-FTX levels in the next couple of days or weeks.

In the event that this positive pattern persists, DOT’s pace of rebound is estimated to climb, which would enable bulls to charge beyond the resistance located at $6.845 and $7.235, which is the range that existed before the crypto turmoil broke out around late November.

Social Metrics Up For DOT

The number of people staking DOT has also increased by over 6.2% as seen in the past month which also hints at a positive streak for the asset. More so, social metrics have also increased for DOT.

Social mentions spiked by 7.6% with engagements shooting over 26K. Interestingly, DOT has been increasingly popular as more people are interested in and talking about it.

Additionally, there are upcoming referendums in line with runtime and governance upgrades that could increase the attractiveness of the coin to investors.

Meanwhile, the market sentiment enveloping DOT still has that air of uncertainty considering its shrinking market cap and high volatility.

Featured image from Freepik