The post POPCAT Aims for 30% Rally, 1:4 Risk-Reward Opportunity appeared first on Coinpedia Fintech News

Amid this price correction, Popcat (POPCAT), a popular Solana-based meme coin appears bullish and has formed a perfect buying opportunity with an excellent risk-reward ratio. The potential reason for this bullish outlook is the meme coin’s daily chart pattern and bullish price action.

POPCAT Technical Analysis and Upcoming Levels

According to the expert technical analysis, POPCAT appears bullish and is currently heading towards the lower boundary of the bullish channel pattern which has acted as a strong support for the meme coin since the beginning of October 2024.

Based on the recent price action, whenever the POPCAT price approaches this support level, it tends to experience buying pressure and an upside rally. This time, traders and investors are expecting a similar upside rally.

If POPCAT holds itself above the lower boundary of the bullish channel pattern, there is a strong possibility that the meme coin could soar by 30% to reach the $1.84 level in the coming days. In addition, the current level presents a potential buying opportunity with a 1:4 risk-reward ratio.

Bullish On-Chain Metrics

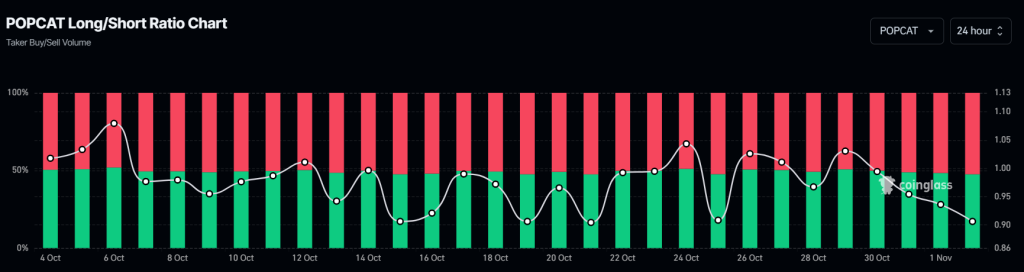

Despite this positive outlook, POPCAT’s on-chain metrics hint at mixed sentiment. According to the on-chain analytics firm Coinglass, its Long/Short ratio currently stands at 0.90, indicating bearish sentiment among traders. Additionally, POPCAT’s open interest has dropped by 12% over the past 24 hours, reflecting the liquidation of traders’ positions, which is comparatively higher than the previous day.

The combination of falling open interest and a long/short ratio below one indicates weak bearish sentiment among traders, as new positions are not being built up.

Current Price Momentum

As of now, POPCAT is trading near $1.44 and has registered a price decline of over 11% in the past 24 hours. During the same period, its trading volume dropped by 30%, indicating lower participation from traders and investors amid the ongoing price decline.