Quick Take

Bitcoin recently experienced a significant decline, with its value dropping below $42,000 and even hitting a day’s low near $40,000. Interestingly, despite this 5% slump, the funding rates remained positive, illustrating resilience in the face of the downturn.

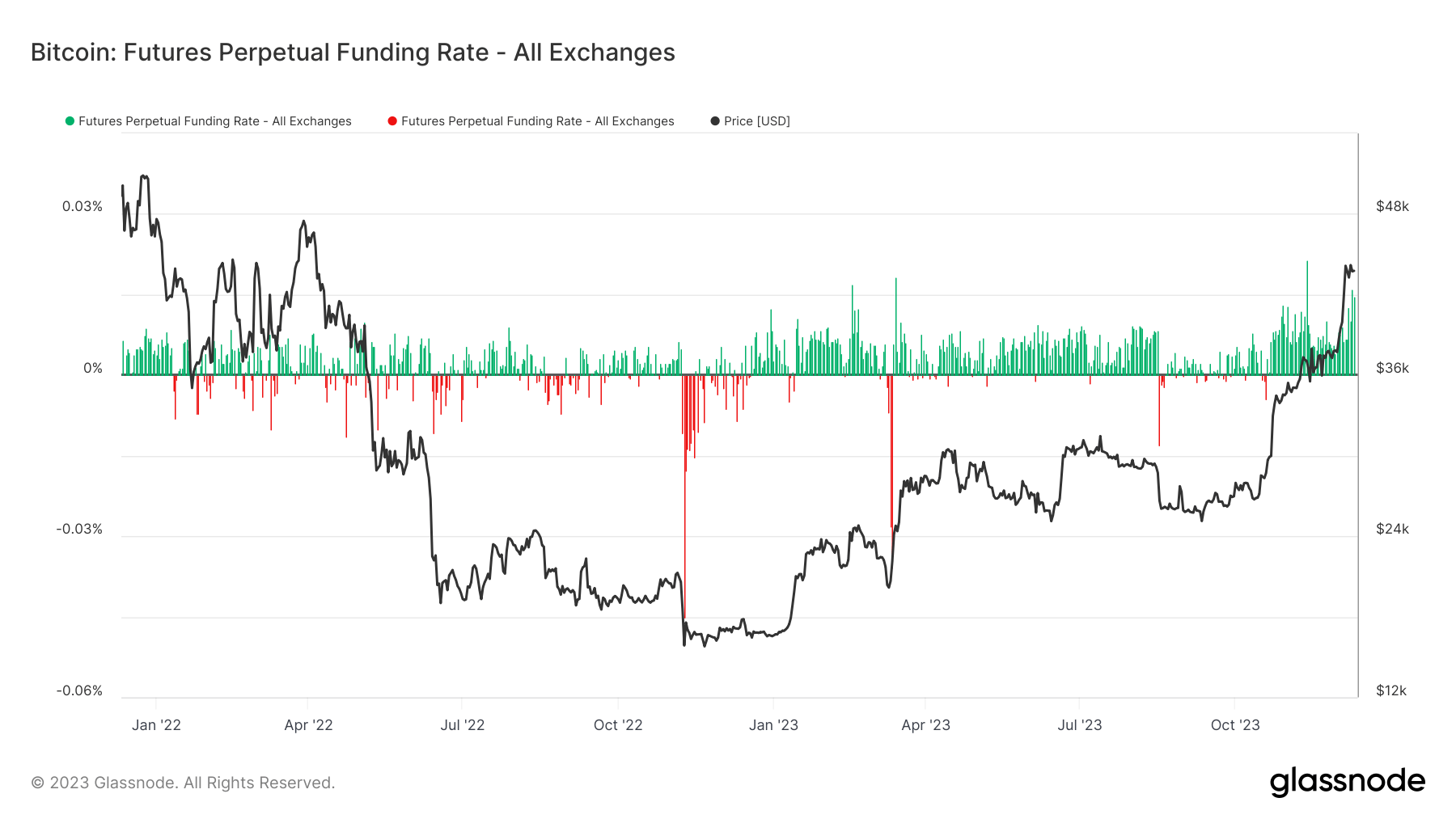

The average funding rate, expressed in percentage, established by exchanges for perpetual futures contracts operates in a particular manner. If it’s positive, long positions are required to pay short positions periodically. In contrast, if the rate tilts towards the negative, the tables turn, and short positions periodically compensate long positions.

Prior to the crash, the positive and stable funding rate hinted at a bullish market sentiment. This, coupled with a stable or slightly increasing BTC price, signaled a robust market.

As the crash unfolded, the drastic decrease in the BTC price was evident. Despite this, the funding rate experienced a drop yet remained positive, implying that traders continued to maintain their long positions, suggesting the persistence of some bullish sentiment.

Post-crash, the BTC price stabilized at a lower level, and while the funding rate dropped somewhat, it stayed above zero. This continued positivity in funding rates signifies that traders, on the whole, are still leaning towards a bullish outlook, albeit with less intensity. Interestingly, despite the unpredictable market turbulence, the funding rate regime remains in one of its most positive stances of the year, exceeding 0.017%.

The enduring positive funding rate post-crash might suggest that the market perceives this drop as a temporary correction rather than a trend reversal. However, a future decline of the funding rate towards zero or into the negatives could hint at a rising bearish sentiment.

A negative funding rate typically signifies the local bottoms in the Bitcoin cycle. This pattern is observable in past instances, such as the global upheaval caused by the COVID-19 pandemic, the FTX low point in November 2022, and the Silicon Valley Bank collapse in March.

The post Positive funding rates challenge Bitcoin’s 5% market slump narrative appeared first on CryptoSlate.