Equities, crypto markets, and precious metals did well during the early morning trading sessions on Wednesday, just before the U.S. central bank wrapped up its Federal Open Market Committee (FOMC) meeting. While the Fed said in a statement that the benchmark interest rate would rise soon, the central bank’s lead Jerome Powell said the committee “is of a mind to raise the federal funds rate at the March meeting.” Powell’s statements following the meeting, alongside discussions of reducing the balance sheet, were viewed as hawkish among investors and global markets dipped in value.

FOMC Says It Plans to Raise the Federal Funds Rate ‘Soon,’ Fed Chair Jerome Powell Insists Rates Will Change in March

Following a week of dismal markets, the highly anticipated Federal Open Market Committee (FOMC) meeting took place, and members of the committee unanimously approved the decision to keep rates at near-zero levels.

“With inflation well above 2 percent and a strong labor market, the Committee expects it will soon be appropriate to raise the target range for the federal funds rate,” the FOMC said in a statement on Wednesday. While the financial institution’s statement highlighted “soon,” it meant that the U.S. central bank plans to keep the baseline interest rate range untouched, at least for now.

Fed chairman Jerome Powell spoke after the meeting and explained that the benchmark rate may rise in March. Powell also noted that getting the Fed’s balance sheet down will take some time.

“The balance sheet is substantially larger than it needs to be,” Powell told the press. “There’s a substantial amount of shrinkage in the balance sheet to be done. That’s going to take some time. We want that process to be orderly and predictable.” As everyone was still clinging to the FOMC’s “soon” statement, Powell stressed:

The committee is of a mind to raise the federal funds rate at the March meeting assuming that the conditions are appropriate for doing so.

Stocks, Crypto Markets, Precious Metals Sink Lower Following Fed Statements

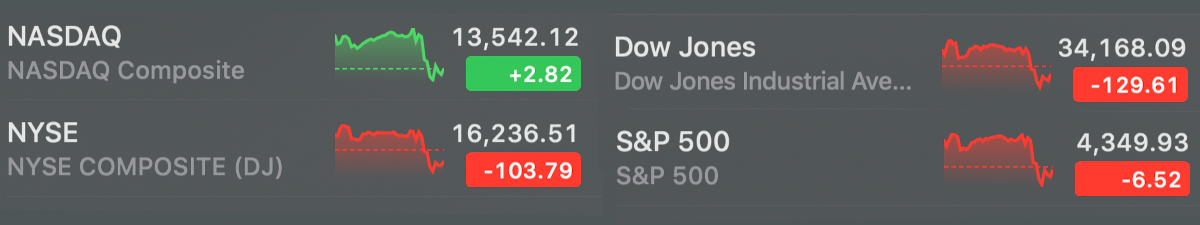

When stock markets closed, NYSE dipped 103 points, and the Dow Jones Industrial Average was down about 129 points. Nasdaq’s index managed to stay above a few percentages and S&P 500 shed a few percentages.

The price of one ounce of .999 fine gold slipped 1.77%, and the value of one ounce of .999 fine silver lost 2.48%. Of course, gold bug and economist Peter Schiff threw in his two cents about the Fed’s meeting and Powell’s statements.

“Powell said the Fed will begin shrinking its balance sheet at the appropriate time,” Schiff tweeted. “He then said he really has no idea when that may be as the FOMC hasn’t even discussed that yet. Really? What exactly do they talk about when they meet, sports? We’re screwed and they know it.” A few people trolled Schiff because the price of gold slipped after Powell’s statements.

The global cryptocurrency market capitalization didn’t do too well either, as it dropped more than 2% to 1.71 trillion. The leading crypto asset bitcoin (BTC) was quite volatile and within two five-minute candles before the Fed’s statements were published, BTC jumped from $37,400 to $38,946 on Bitstamp.

Metrics show bitcoin (BTC) had a 24-hour price range between $35,300 and $39,310 per unit during the course of the day. Many other top ten crypto assets lost between 2% to 7% a few hours following Powell’s statements.

What do you think about the FOMC meeting and Jerome Powell’s statements? What do you think about the market reaction that followed? Let us know what you think about this subject in the comments section below.