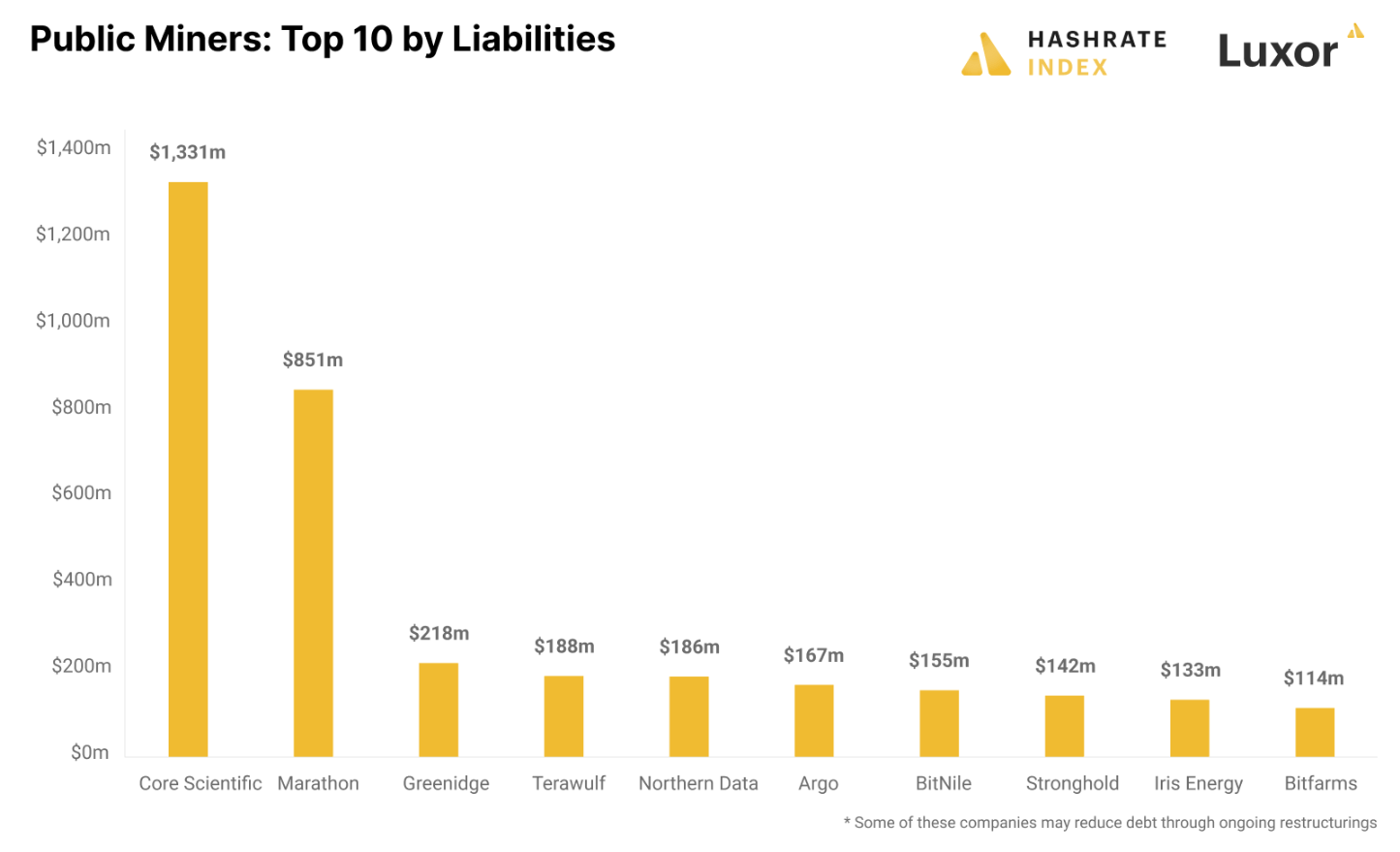

Public Bitcoin (BTC) mining companies collectively have liabilities that amass to over $4 billion, according to Hashrate Index.

Owing the most in liabilities, Core Scientific debt sat at approximately $1.3 billion on Sept. 30, according to a company statement.

The BTC mining industry has seen significant fluctuations during this bear market — the recent bankruptcy of Core Scientific stands as a testament to volatility of the sector.

Though it is the largest public BTC miner by hashrate, Core Scientific has struggled under debt for many months — unable to pay off monthly debt service payments, according to Hashrate Index.

Warning: Hard Hats must be worn

Core Scientific is not the only public miner struggling with debt. Marathon, the second-largest debtor, owes $851 million, mostly in the form of convertible notes that give holders the option to convert them to stock.

Greenidge, the third-biggest debtor, owes $218 million and is undergoing a restructuring process to reduce its debt.

Deep in Debt

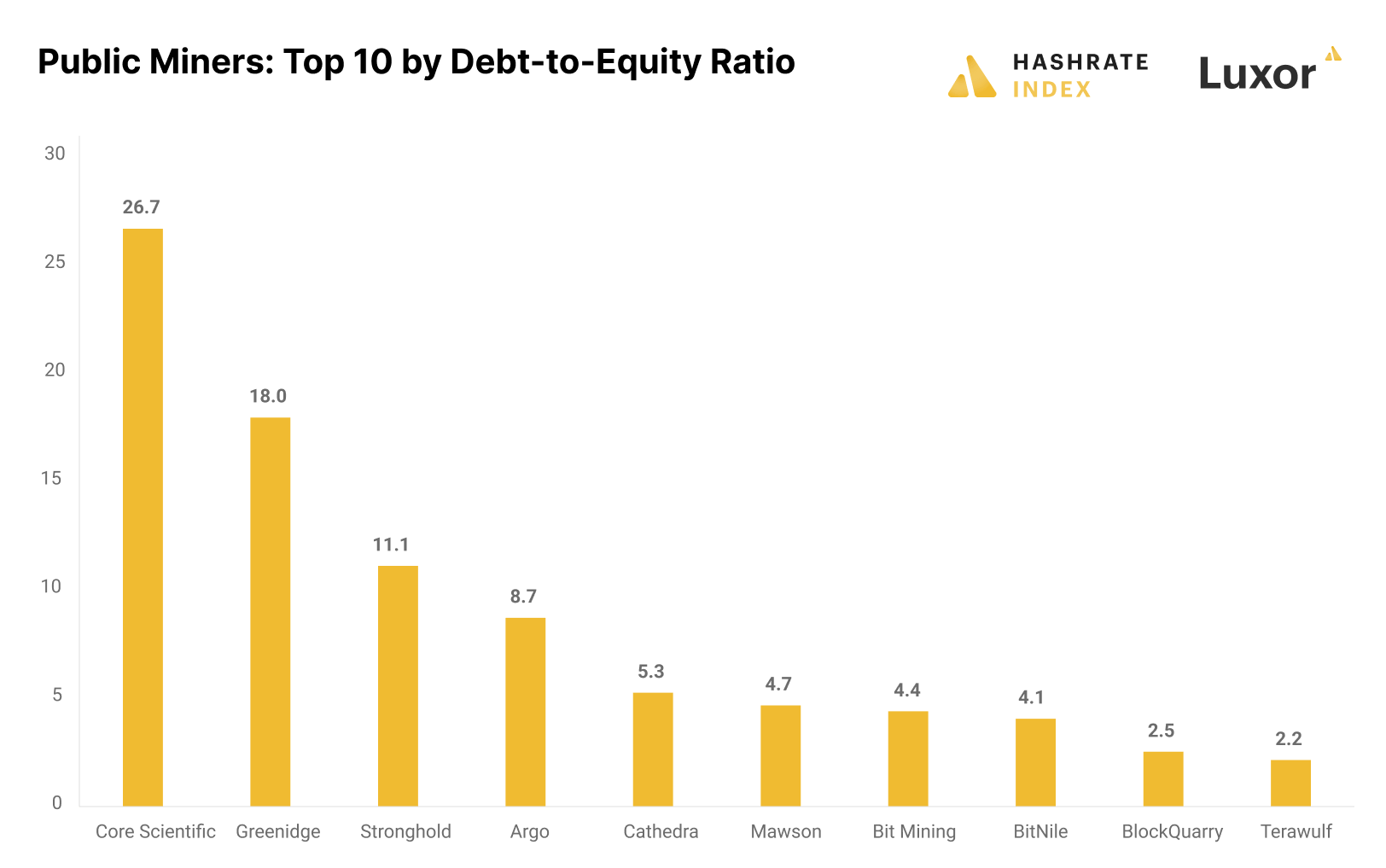

When looking at the debt-to-equity ratio, a measure of how much a company owes relative to its equity, it becomes clear that many public miners have significantly high levels of debt.

Luxor analyst, Jaran Mellerud, stated that, generally:

“A debt-to-equity ratio of 2 or higher is considered risky, but in a volatile Bitcoin mining industry, it should be substantially lower. In the chart below, we can see that there are many public miners with extremely high debt-to-equity ratios.”

Core Scientific has the highest ratio at 26.7, followed by Greenidge at 18 and Stronghold at 11.1.

Argo are In fourth position with a ratio of 5.3 — having accidentally revealed plans for bankruptcy — stated that it is “negotiating to sell some of its assets and carry out an equipment financing transaction to reduce its debt and improve liquidity,” according to Mellerud.

“Due to the unsustainably high debt levels in the industry, we will likely continue to see more restructurings and potentially some bankruptcies. We have started to enter the part of the cycle where the weak players are flushed out.”

The post Public BTC mining companies face $4B in liabilities, Core Scientific leads the pack appeared first on CryptoSlate.