Quick Take

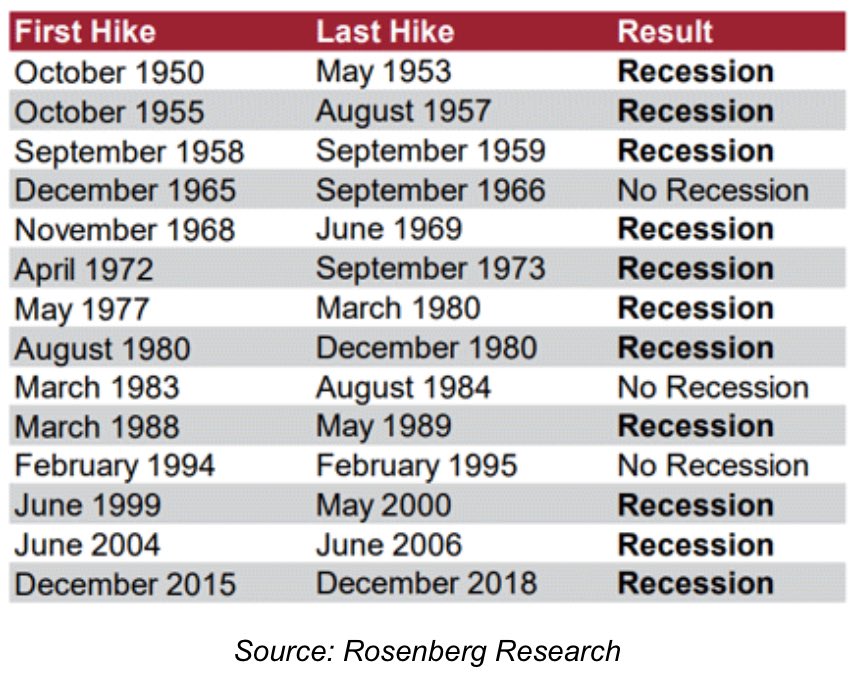

The Federal Reserve and other central banks worldwide are approaching the end of a rate-hiking cycle, raising concerns about a potential recession. Historical data from Rosenberg Research, shared by QE infinity, reveals a concerning trend: out of the past 14 rate-hiking cycles since 1950, the United States has experienced a recession 11 times. Recessions were successfully averted in 1966, 1984, and 1995.

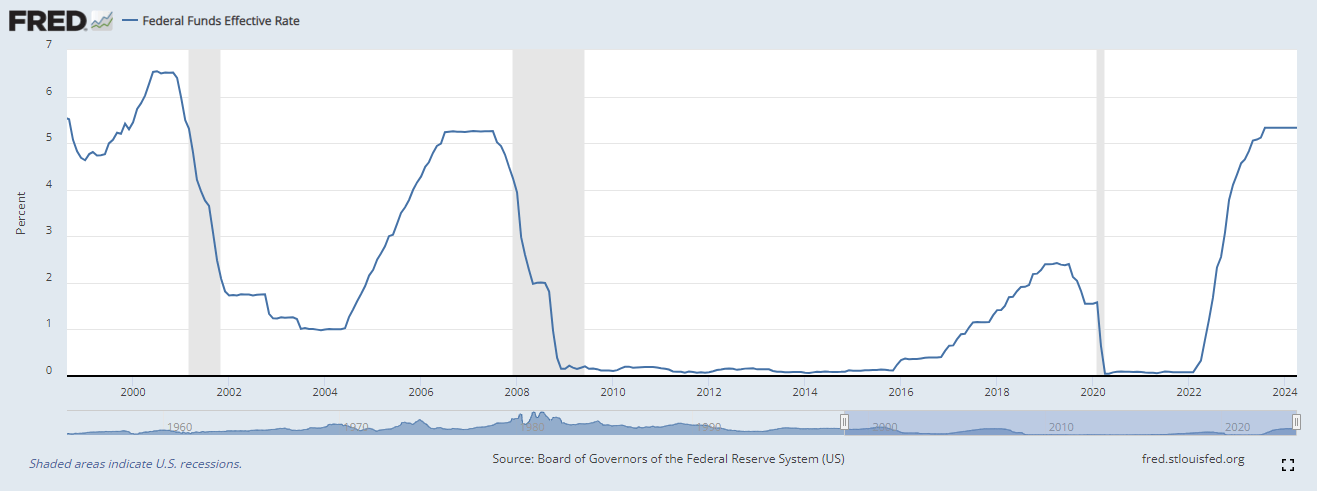

The current rate-hiking cycle has seen the Federal Reserve raise the federal funds rate to 5.33% in August 2023, and it has maintained this rate since then, pausing for nine consecutive meetings. Comparing this to the 2008 recession, the Fed last hiked rates in June 2006 to 5.25% and held for 12 months before the recession hit.

As the Fed and other central banks continue to navigate the delicate balance between controlling inflation, unemployment, and sustaining economic growth, the CME FedWatch tool is currently pricing in two rate cuts in 2024, potentially lowering the federal funds rate to the range of 4.75% – 5.00% by the end of 2024.

While rate hikes are a standard tool central banks use to combat inflation, the data suggests that such measures often come at the cost of economic contraction.

The post Rate hikes linked to 11 out of 14 past U.S. recessions, historical analysis shows appeared first on CryptoSlate.