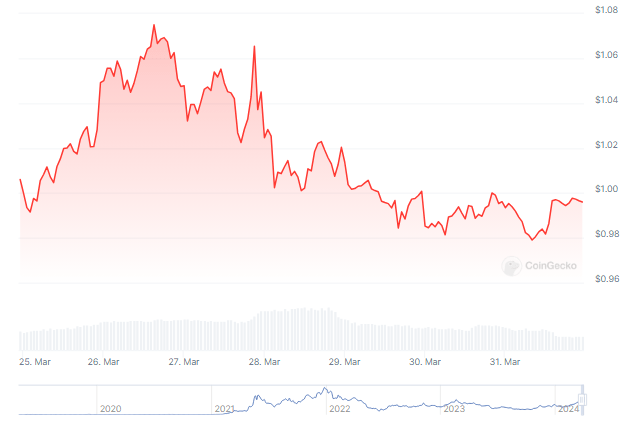

Polygon’s native token, MATIC, finds itself at a crossroads as it grapples with price volatility amidst an impending network upgrade and challenges surrounding Total Value Locked (TVL). In the past week, MATIC has witnessed a notable downturn in price, slipping by 4.44% according to data from CoinMarketCap. Despite earlier optimism that drove MATIC close to the $2 mark, the token has encountered resistance at the $1 level, with bullish momentum struggling to gain traction amidst prevailing market conditions.

MATIC Investors Feel The Pinch

Data analysis from IntoTheBlock paints a mixed picture for MATIC holders, revealing that 51% are currently facing losses, while 43% are enjoying profits, leaving a mere 5% at the break-even point. This volatility serves as a stark reminder of the inherent risks associated with investments in the cryptocurrency market.

However, amidst the market turbulence, a ray of hope emerges for MATIC holders in the form of Polygon’s recently announced “Napoli upgrade.” This upgrade, designed to bolster the network’s consensus mechanisms, is set to introduce enhancements in parallel execution and incorporate novel operational codes for the Ethereum Virtual Machine (EVM). Analysts speculate that the Napoli upgrade could inject renewed buying pressure into the market, with projections hinting at a potential price rise towards $1.30 if bullish sentiment prevails.

Despite the anticipation surrounding the Napoli upgrade, Polygon faces challenges on other fronts, notably concerning its Total Value Locked (TVL). In a remarkable turnaround from its peak in 2021, TVL has plummeted to $1 billion, according to data from DeFiLlama. This decline reflects a waning participation in liquidity provision, raising concerns about the protocol’s health and resilience.

The Road Ahead For Polygon

Polygon’s leadership remains optimistic about the project’s future, emphasizing its resilience amidst market fluctuations. They believe that the Napoli upgrade, coupled with strategic initiatives aimed at addressing challenges such as TVL, will fortify Polygon’s position for sustained success in the dynamic cryptocurrency landscape.

As investors and industry observers closely monitor developments within the Polygon ecosystem, navigating the delicate balance between the potential catalyst of the Napoli upgrade and the headwinds posed by declining TVL, the road ahead for MATIC remains uncertain. The cryptocurrency’s ability to weather market volatility and regain momentum in the face of recent setbacks will be pivotal in shaping its trajectory in the coming weeks and months.

MATIC’s recent price gyrations, punctuated by the announcement of the Napoli upgrade and challenges surrounding TVL, underscore the complexities inherent in navigating the cryptocurrency market. As Polygon continues to chart its course, adaptation and innovation will be key drivers in determining its long-term viability amidst an ever-evolving landscape.

Featured image from Andrea Piacquadio/Pexels, chart from TradingView