Realized losses spike

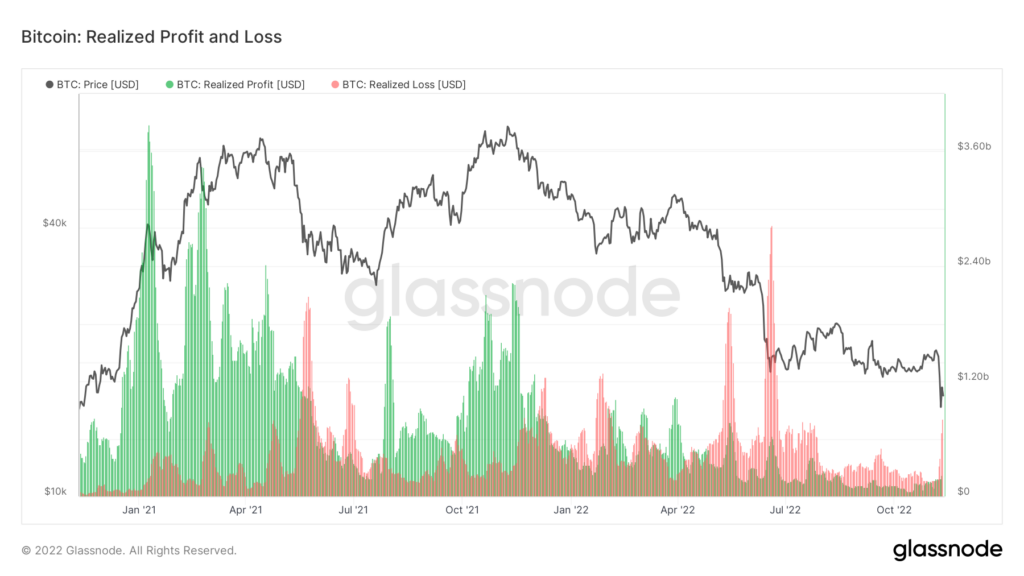

CryptoSlate analyzed on-chain data from Glassnode to identify the impact on realized profit and losses throughout the current market turmoil. The chart below highlights the volume of realized returns since the start of the 2021 bull run.

The Higher Values indicate a greater daily volume of realized profit or loss with red sections representing losses and green signifying profits. The chart focuses only on realized profit and loss meaning coins that were bought at one price and sold at another.

Grayscale Bitcoin Trust Discount Record

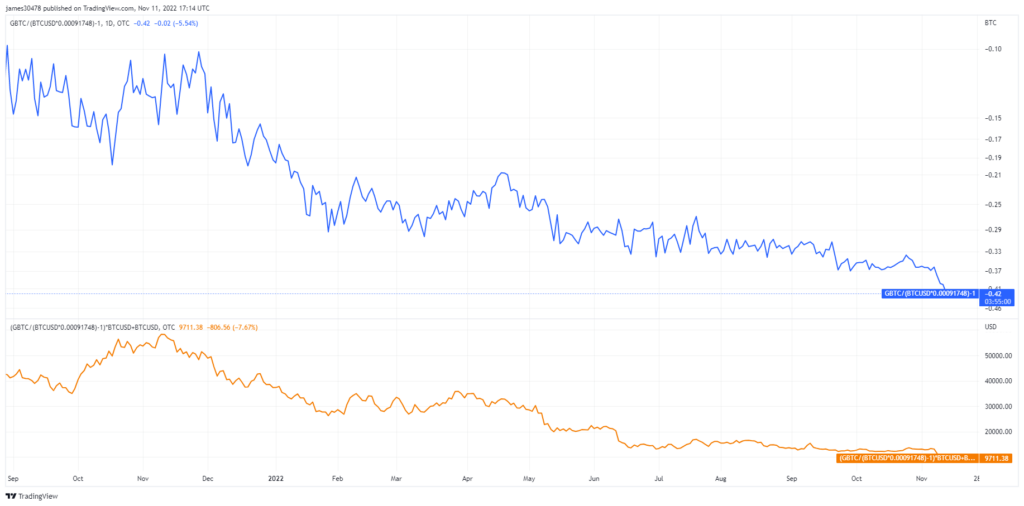

The Grayscale Bitcoin Trust was also hit hard by the downturn as GBTC currently trades at a 41% discount to its NAV (Net Asset Value). The investment vehicle started the year at just a 17% discount but has been on a downtrend throughout the entirety of 2022. Purchasing shares in GBTC as of press time is equivalent to buying Bitcoin at $9,771.

Historically, GBTC has traded at a premium as investors who were unable to buy Bitcoin directly flocked to the investment vehicle to gain exposure to the world’s largest cryptocurrency by market cap. The premium went over 100% in December 2017 and finally moved negative for the first time in February 2021. The current price is at an all-time low for the Trust as interest in the product dwindles amid price capitulation.

The post Realized Bitcoin losses spike as Grayscale GBTC trades at less than $10k BTC equivalent appeared first on CryptoSlate.