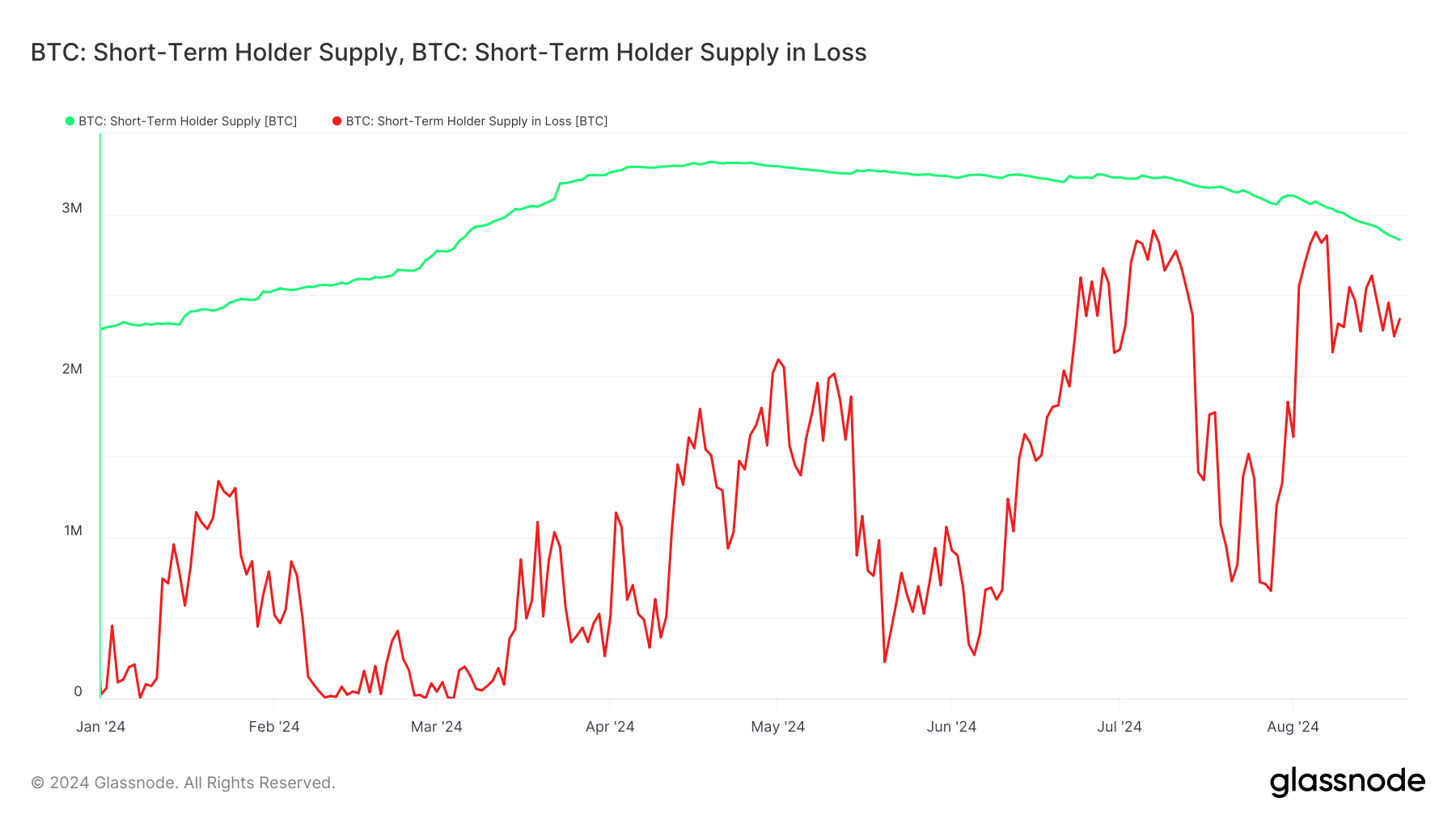

Tracking the percentage of STH supply in loss is crucial for understanding market sentiment and potential price movements. A high percentage of Bitcoin supply in loss indicates that a significant portion of recent buyers are holding positions at a loss, which can be a precursor to increased sell pressure if these holders decide to cut their losses.

It can intensify downward price movements, leading to heightened volatility. Conversely, when a low percentage of STH supply is in loss, it generally reflects a healthier market, with fewer holders incentivized to sell at a loss, thus reducing the likelihood of panic selling.

The percentage of STH supply in loss spiked from 21.74% on Jul. 28 to 94.21% by Aug. 5 before slightly decreasing to 82.72% by Aug. 20 as Bitcoin’s price recovered to around $59,000.

While this high percentage of STH supply in loss might initially seem alarming, suggesting potential for significant sell-offs and price declines, it’s important to consider the depth of these losses. When losses are relatively shallow, such as in the single-digit percentage range, they are more indicative of a flat or consolidating market rather than a market in freefall. Shallow losses may not trigger widespread selling, as holders might prefer to wait for a price recovery to liquidate a larger portion of their holdings.

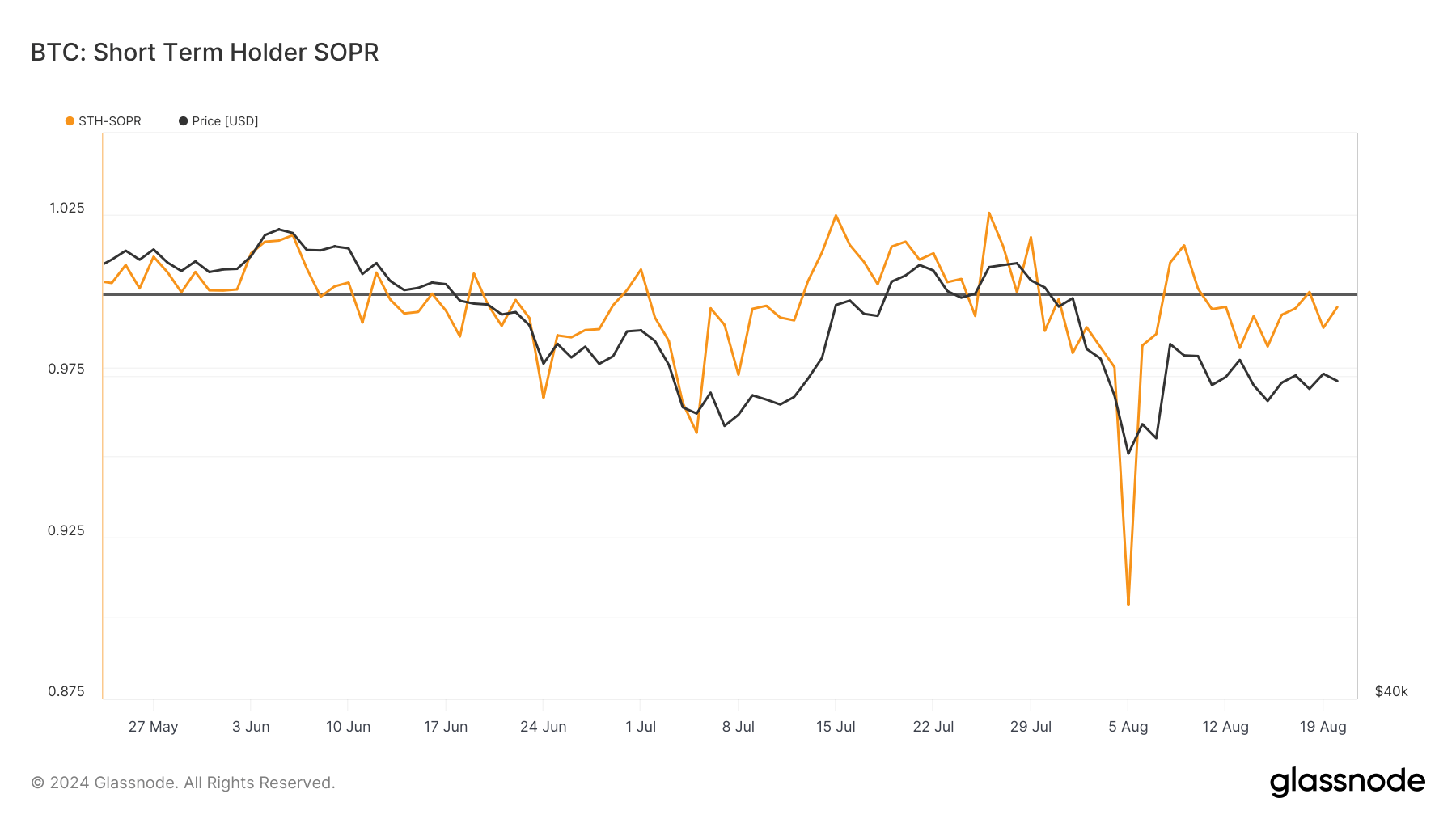

The spent output profit ratio (SOPR) measures the profitability of coins spent on the blockchain. It’s calculated by dividing the price at which the coins were sold by the price at which they were acquired. Therefore, a SOPR value greater than 1 indicates that coins are being sold at a profit, while a value less than 1 means they’re being sold at a loss.

On Jul. 28, the STH SOPR was slightly above 1, showing that, on average, short-term holders were selling their coins at a marginal profit. This indicates a significant amount of confidence among holders, as almost 80% of them were profitable at the time.

However, by Aug. 5, the STH SOPR dropped to 0.9040 as Bitcoin’s price touched below $54,000. While the price drop caused widespread panic in the market, SOPR shows that STH were selling their coins for about 9.6% less than their purchase price. By Aug. 20, the STH SOPR had recovered to 0.9962. This shows that while STHs are still selling at a slight loss, the difference between the current Bitcoin price and the STH purchase price has narrowed significantly.

This progression from a SOPR of 1.0007 to 0.9040, then to 0.9962, illustrates the changing sentiment among short-term holders. Initially, they were willing to sell at a minor profit, but as the market declined, they began realizing larger losses. However, the near-recovery of SOPR to 1 by Aug. 20 suggests that the depth of loss had lessened, and short-term holders were no longer panic selling but capitulating at minimal losses.

This slight difference between the current and STH purchase prices implies that the market might find a short-term bottom, with reduced downward pressure from short-term sellers.

The post Realized losses minimal despite 80% of STH supply being underwater appeared first on CryptoSlate.