Three days into the new year and Bitcoin has already been through a rather turbulent period. Bitcoin saw its largest one-day price drop since the beginning of December, marking a 4.7% decrease.

Bitcoin’s drop from a high of $45,500 to $42,800 in a single day triggered around $700 million in liquidations, with $170 million of them being Bitcoin-based derivatives.

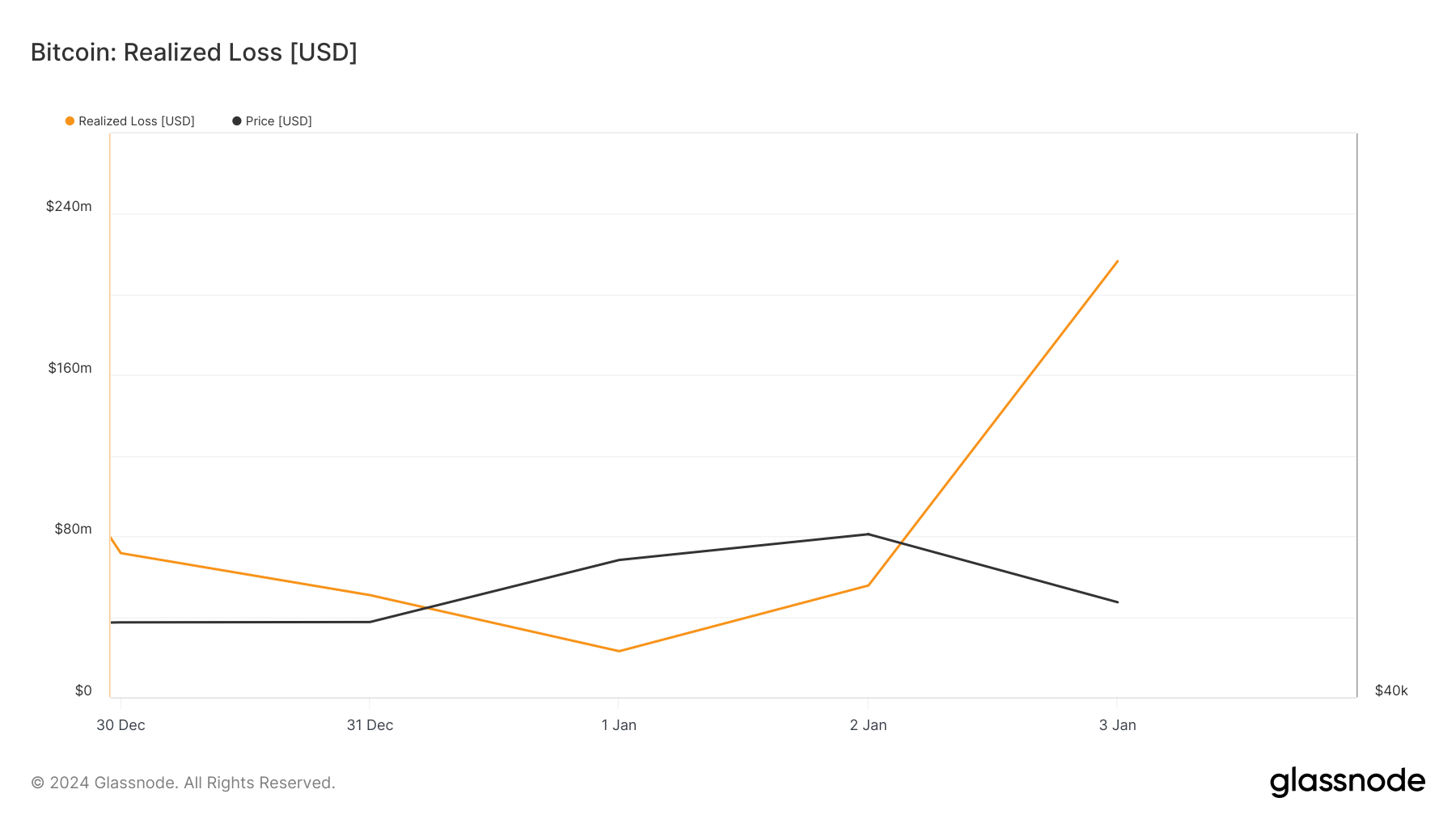

To understand the impact of this volatility, it’s crucial to analyze realized losses. Realized losses occur when investors sell their assets for a price lower than the purchase price. In the context of Bitcoin, realized loss is an extremely useful metric when analyzing the market’s response to price fluctuations.

Bitcoin’s significant price drop on Jan. 3 led to a substantial increase in realized losses, which jumped from $55.52 million on Jan. 2 to $216.55 million on Jan. 3. This 290% increase indicates a large-scale selling activity, likely driven by panic or the need to cut losses among investors.

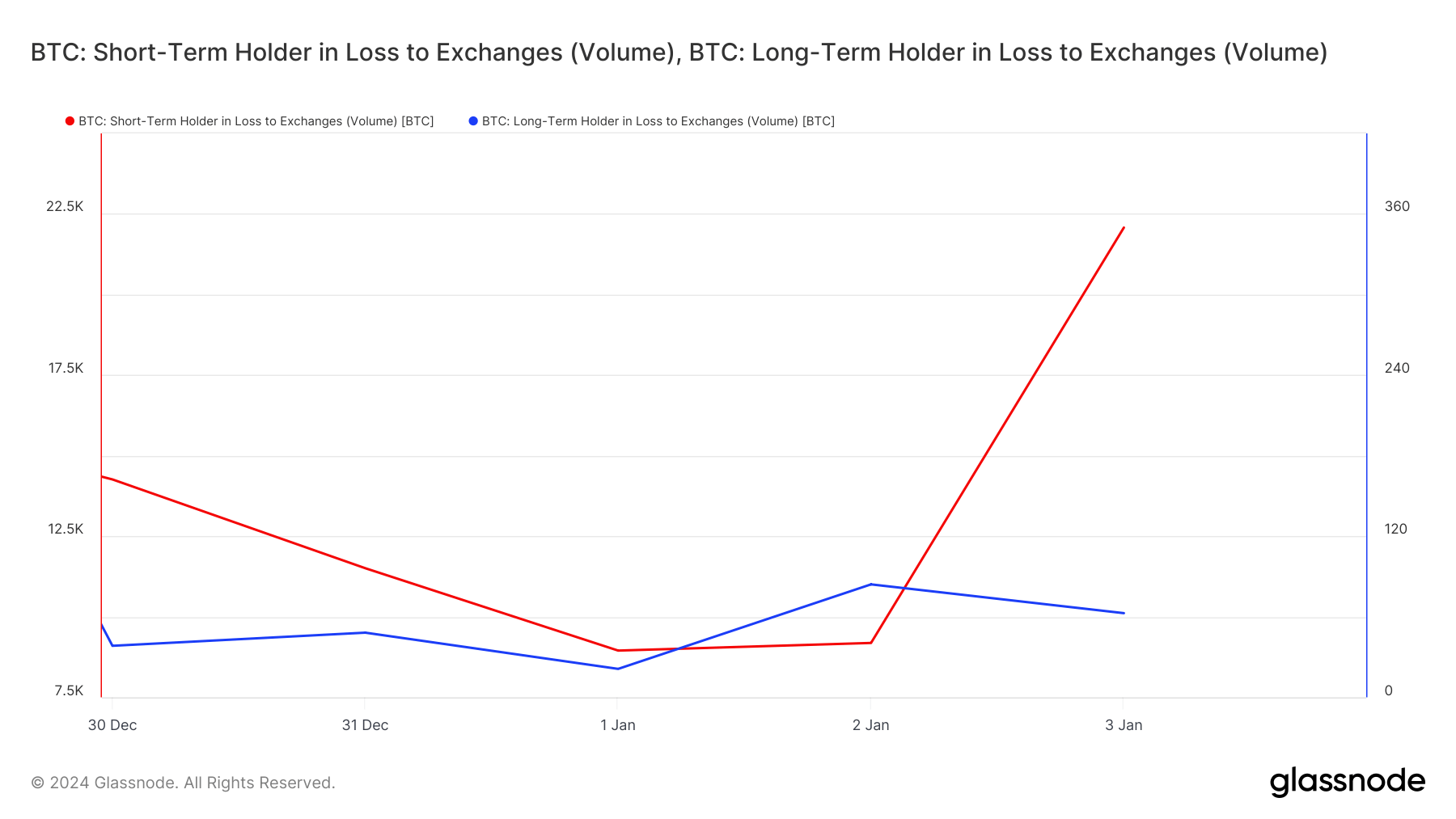

Delving into the data on long-term and short-term holders provides further insight into who was selling. The volume of long-term holders in loss to exchanges remained relatively stable since the beginning of the year, with a slight decrease on Jan. 3. This stability implies that long-term holders were less reactive to the price drop, maintaining their investment strategy despite the market downturn.

In stark contrast, short-term holders reacted significantly to the price drop. The volume of short-term holders in loss to exchanges more than doubled, increasing from 9,187 BTC on Jan. 2 to 22,077 BTC on Jan. 3. This data indicates that short-term holders were the primary sellers in response to the price fluctuation.

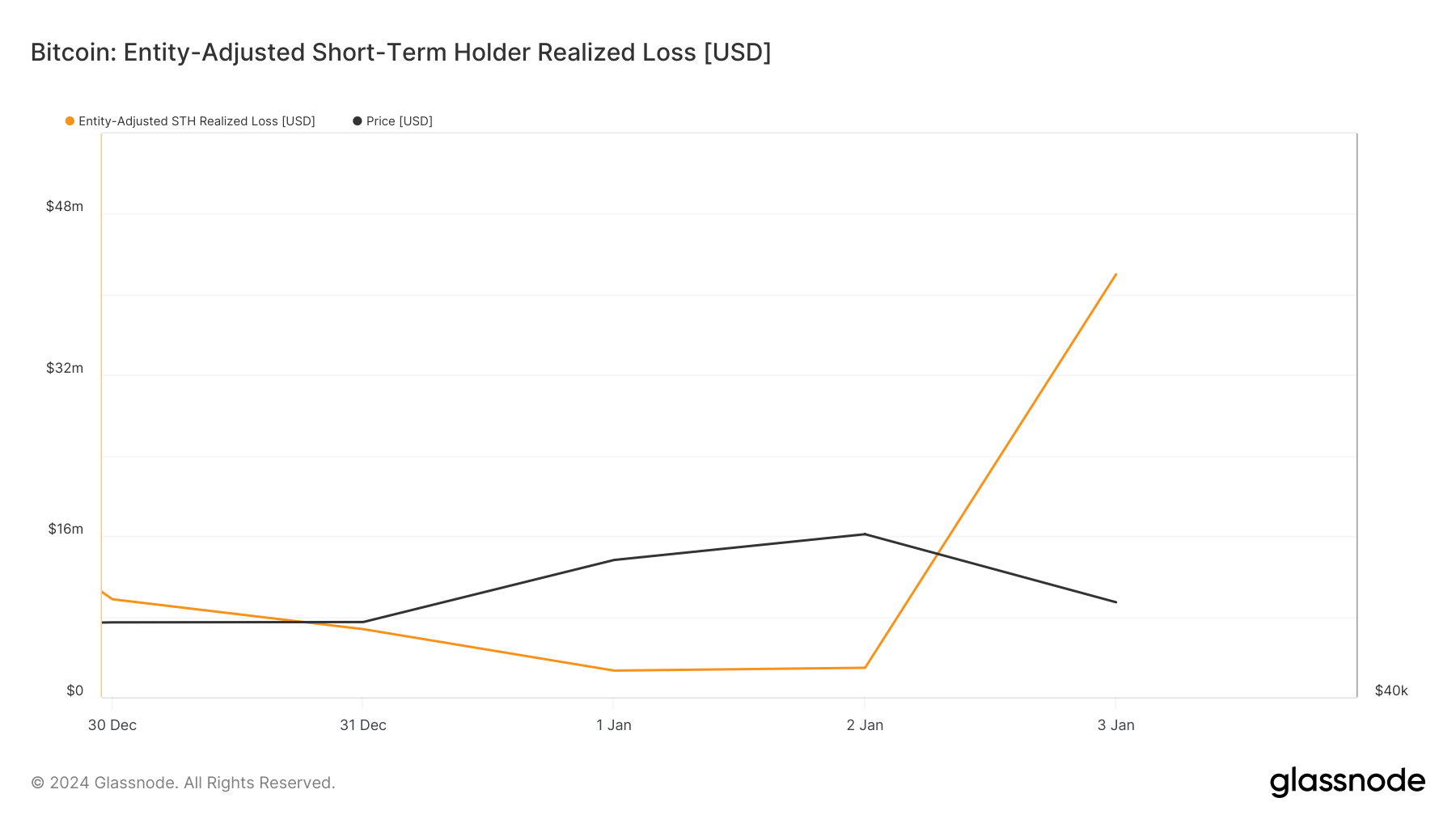

The entity-adjusted realized losses for both long-term and short-term holders further support this. Glassnode defines entities as clusters of addresses controlled by the same network and excludes the volume transferred between these addresses from this calculation. This helps determine the actual realized losses incurred by a particular cohort, as it excludes transactions such as internal exchange transfers.

The loss for long-term holders was relatively consistent, remaining at around $5 million on both Jan. 2 and Jan. 3. In contrast, short-term holders experienced a dramatic increase in realized losses. Entity-adjusted short-term holders’ realized loss increased from $2.93 million on Jan. 2 to $42 million on Jan. 3.

Overall, the data indicates that the market has been highly reactive to short-term price movements, particularly among short-term Bitcoin holders.

The sharp increase in realized losses and the volume of short-term holders selling at a loss indicate a market sentiment skewed towards panic selling and short-term strategies. In contrast, long-term holders showed more resilience in the face of this volatility.

The post Realized losses spiked as Bitcoin saw turbulent start to the year appeared first on CryptoSlate.