Quick Take

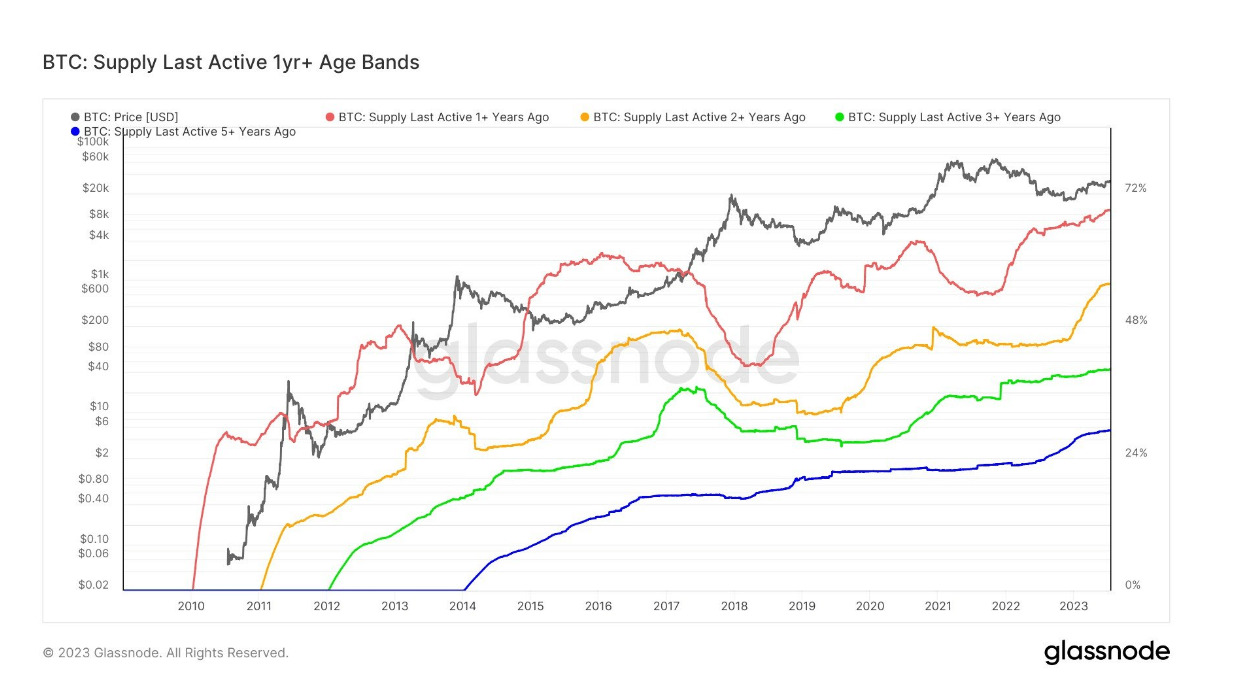

According to Glassnode, investors accumulate and store (or lose) coins for extended periods, categorized based on how long it has been since they last moved on-chain.

The chart below displays an overlay of multiple Supply Last Active variants, each shown as a percentage of Circulating Supply.

- Supply Last Active 1+ Yrs Ago

- Supply Last Active 2+ Yrs Ago

- Supply Last Active 3+ Yrs Ago

- Supply Last Active 5+ Yrs Ago

Glassnode data suggests that these metrics will rise as longer-term investors accumulate coins. Conversely, as long-term investors spend and distribute their coins, this metric will decline, with older coins becoming young again as they change hands.

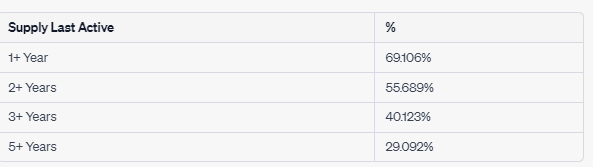

Data shows that we have hit an all-time high in every category once again for Bitcoin supply last active.

- 1+ Year = 69.106%

- 2+ Years = 55.689%

- 3+ years= 40.123%

- 5+ years= 29.092%

The post Record-breaking peaks reached in all categories of Bitcoin supply appeared first on CryptoSlate.