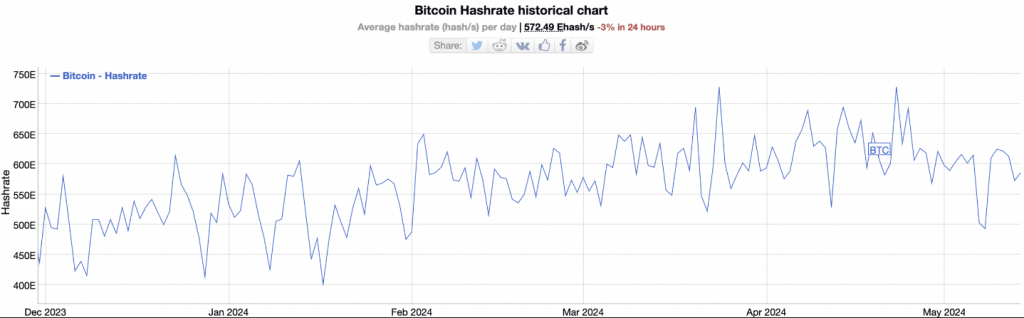

The post-halving world of Bitcoin continues to throw curveballs. After a hashrate surge to celebrate the block reward reduction in April, Bitcoin’s computational power has taken a nosedive, dropping 20% in recent weeks.

This unexpected decline has ignited a debate among analysts, with some sniffing out a fire sale and others urging caution.

Bitcoin: Hashrate Hiccup Or Miner Exodus?

Hashrate, a measure of the combined processing power dedicated to securing the Bitcoin network, typically climbs after a halving event as miners invest in more powerful rigs to compete for the reduced rewards.

However, this time around, the trend defied expectations. Experts like Maartunn, a pseudonymous analyst at CryptoQuant, believe this signals a potential “miner capitulation.”

Less efficient miners are now likely throwing in the towel. The halving, which cut block rewards in half, squeezed profit margins for miners using older equipment. As these miners shut down their operations, the hashrate dips.

Hash Ribbons Flash Warning Sign

Supporting Maartunn’s theory is a technical indicator called Hash Ribbons. This metric tracks the difference between short-term and long-term hashrate averages. When the gap widens, it suggests a decline in mining activity, potentially due to less efficient miners dropping off.

The recent hashrate plunge has triggered a spike in Hash Ribbons, historically a sign of miner capitulation that has often coincided with price lows for Bitcoin.

Bitcoin Miners Selling Off?

Further fueling the capitulation theory is a decrease in Bitcoin’s Miner Reserve. This metric tracks the amount of Bitcoin held in wallets associated with miners. A decline in the reserve suggests miners might be offloading their mined coins, potentially to cover operational costs or to exit the market altogether.

Undervaluation Signal Or Cyclical Dip?

Maartunn interprets these signs as a bullish indicator. Hash Ribbons often point to opportune moments to buy, he argues. Backing his claim is the Market Value to Realized Value (MVRV) ratio, which suggests Bitcoin might be undervalued.

This metric compares the current market price to the average price at which all Bitcoins were acquired. A negative MVRV, like the one Bitcoin currently has, suggests the asset is trading below its historical cost basis, potentially indicating a buying opportunity.

Related Reading: Buckle Up, XRP Fans: Analyst Eyes Price Explosion To $0.65 In Next 5 Days

Not Everyone On The Capitulation Train

However, not all analysts are convinced. Some argue that the hashrate decline could be temporary, perhaps due to factors like extreme weather events disrupting mining operations in certain regions.

Additionally, the post-halving period is typically one of adjustment for miners, and a short-term hashrate fluctuation might not necessarily signal a mass exodus.

The post-halving Bitcoin landscape is still unfolding. While the hashrate decline and other signs suggest a potential buying opportunity, particularly for long-term investors, the situation remains fluid.

Featured image from Shutterstock, chart from TradingView