Render has shown a sharp jump of more than 23% during the last week as on-chain data shows the large hands have continued to buy.

Render Has Enjoyed Bullish Momentum Over The Past Week

The cryptocurrency sector as a whole has witnessed an uplift recently, but Render has been among the altcoins that have really stood out from the rest. Whereas Bitcoin (BTC) and Ethereum (ETH) have only seen weekly profits of around 3% and 9%, respectively, RENDER has shown an impressive 23% jump.

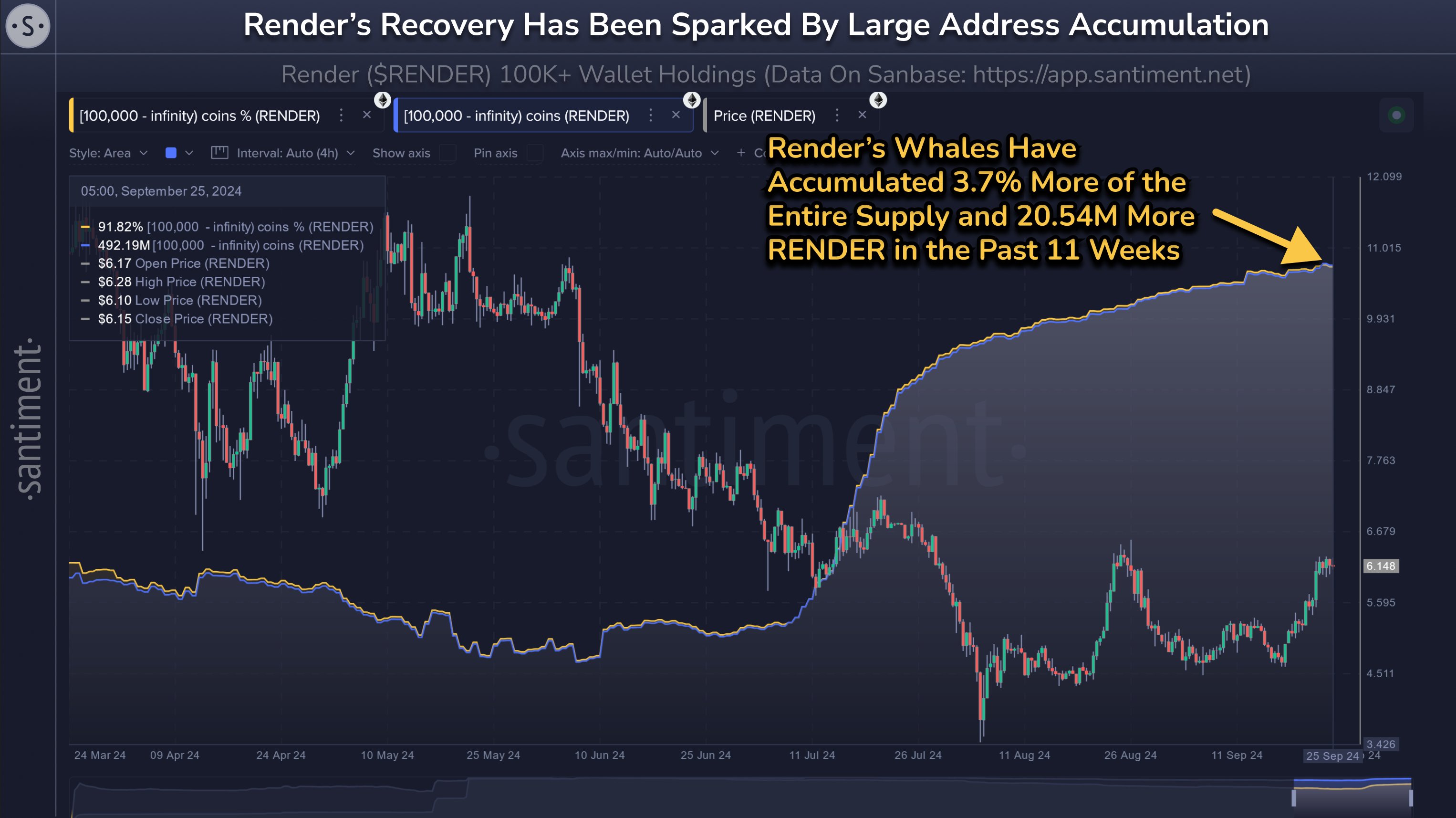

The below chart shows how the recent performance of the asset has been like.

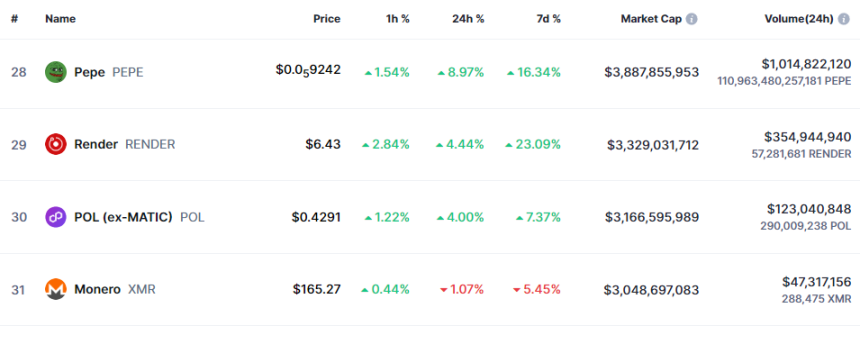

Following this sharp growth, Render’s price has now neared the $6.5 mark for the first time in four weeks. In terms of the market cap, the asset has seen its valuation touch $3.3 billion, placing it at the 29th place on the top cryptocurrencies list.

The coin is now chasing Pepe (PEPE), which is the 28th largest asset in the sector with a market cap of around $3.9 billion. Though, considering the 18% difference in their valuations, it wouldn’t be an easy task for RENDER, especially since PEPE generally shows a notable rise of its own when the market goes up.

As for what could be behind the latest growth that the cryptocurrency has enjoyed, perhaps on-chain data can provide some hints.

Sharks & Whales Have Been Busy Buying The Token Recently

According to data from the on-chain analytics firm Santiment, the Render sharks and whales have participated in some considerable accumulation during the last eleven weeks.

The indicator of relevance here is the “Supply Distribution,” which tells us about the amount of supply that a given wallet group on the network is holding right now.

In the context of the current topic, the cohort containing addresses who own at least 100,000 tokens is of interest. At the current price of the coin, this cutoff is equivalent to just under $650,000, which is a significant amount.

As such, this group corresponds to the large hands of the market, popularly known as the sharks and whales. Below is the chart shared by the analytics firm, which shows how the Supply Distribution for these investors carrying 100,000+ coins has changed over the last few months:

From the graph, it’s apparent that the supply held by the Render sharks and whales has witnessed a considerable increase over the last eleven or so weeks. More specifically, these investors have added 20.54 million tokens to their wallets, equivalent to 3.7% of the total supply.

The buying spree from this cohort has continued during the latest price surge and thus, could be at least a factor behind why it has taken place.