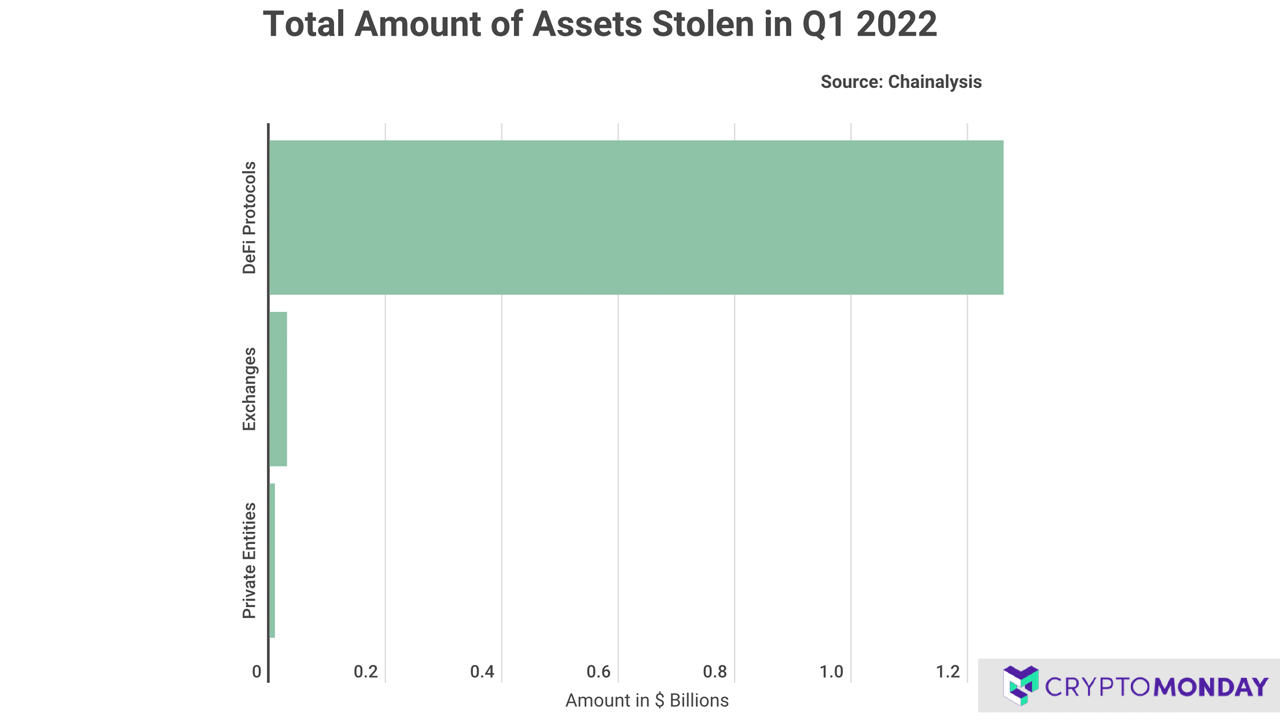

According to a research report, $1.3 billion in digital currencies have been stolen during the first quarter of 2022. The study, published by cryptomonday.de researchers, further highlights that 97% of the stolen funds derived from decentralized finance (defi) protocol exploits.

Defi Exploits Account for Lion’s Share of Stolen Crypto This Year

2022 is already breaking records in terms of stolen cryptocurrencies from hacks and exploits. Last year, $3.2 billion in digital currencies were stolen and so far, 2022 has recorded over 40% of 2021’s aggregate during the first quarter alone. The recorded stolen crypto data stems from a report published by cryptomonday.de and the study’s author, Elizabeth Kerr. The report’s author says “the numbers signify a major spike.”

For instance, out of the $1.3 billion in digital currencies stolen this year, 97% of the funds were taken from defi protocols. In Q1 2021, only 72% of the stolen funds derived from defi and in 2020, the number was as low as 30%. Moreover, most of the theft in 2022 came from faulty code exploits where smart contract errors have been used to siphon stolen money from defi protocols. The author says that because the defi environment is open source, anyone can search for vulnerabilities and errors within a defi project’s codebase.

Centralized Exchange Hacks Drop Significantly

The research further details that in previous years, centralized exchanges were popular honeypots, but attacks on centralized trading platforms has declined. “[Centralized exchange attacks] now only account for less than 15% of the [stolen] cryptos,” Kerr writes. The report also notes that common defi protocol hacks came in the form of flash loan attacks and security breaches. The report’s author further mentions the Ronin bridge attack, which saw a loss of over $600 million.

“Hackers and cyber criminals made away with more than $3.2 billion last year and we just might have a higher amount being stolen this year, if the first quarter is anything to go by. The need for tighter security measures grows by the day, especially since more people are coming aboard,” Jonathan Merry, CEO at Cryptomonday explained in a statement.

What do you think about the study that shows most of 2022’s stolen crypto assets stemmed from defi protocol exploits? Let us know what you think about this subject in the comments section below.