On Friday, Michael Barr, the vice chair for supervision at the U.S. Federal Reserve, published a report on the vulnerabilities that led to the ultimate failure of Silicon Valley Bank (SVB). In addition, Marshall Gentry, the chief risk officer of the Federal Deposit Insurance Corporation (FDIC), released a similar report on Signature Bank’s collapse and its overreliance on uninsured deposits.

Fed Is Confident Supervisory Recommendations ‘Will Lead to a Stronger and More Resilient Banking System’

The Federal Reserve and the FDIC published reports on Friday concerning the fall of the second and third-largest U.S. bank failures in history. The first report, published by the Fed’s vice chair for supervision Michael Barr, claims the central bank’s supervisors failed to recognize the extent of vulnerabilities at Silicon Valley Bank (SVB) as it grew in size and complexity. Barr wrote that SVB had 31 open supervisory findings while other banks had much fewer in comparison.

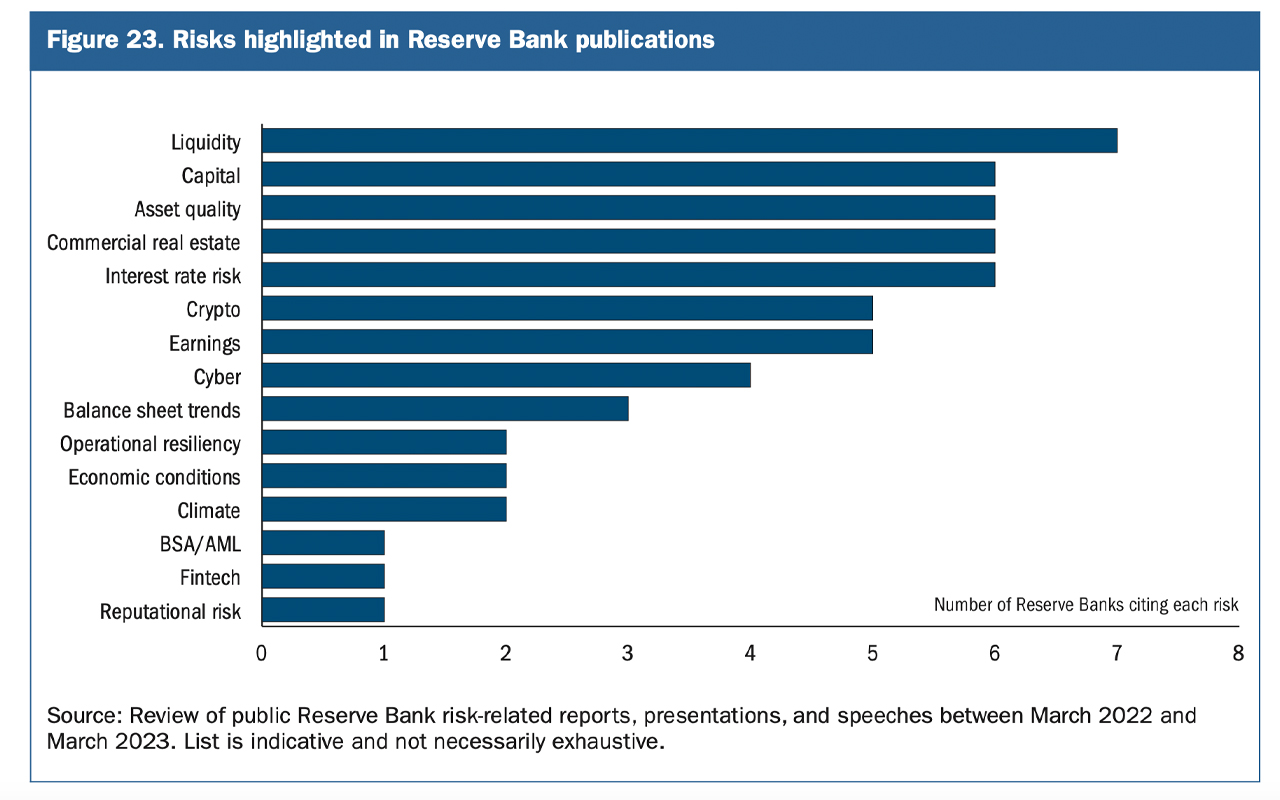

The report offers a comprehensive perspective, noting that the Federal Reserve’s supervisory approach failed to fully contemplate the ramifications of rising interest rates. Then a slowing activity in the technology sector, ultimately paved the way for the demise of SVB. “The supervision of SVB did not work with sufficient force and urgency, and contagion from the firm’s failure posed systemic consequences not contemplated by the Federal Reserve’s tailoring framework,” Barr said. Barr’s report mentions crypto three times and one instance is located on a bar chart describing risks.

“As I have previously announced, the Federal Reserve has begun to build a dedicated novel activity supervisory group to focus on the risks of novel activities (such as fintech or crypto activities) as a complement to existing supervisory teams,” Barr stated.

FDIC Report Discusses Crypto Risks and SBNY’s ‘Flurry of Negative Press’

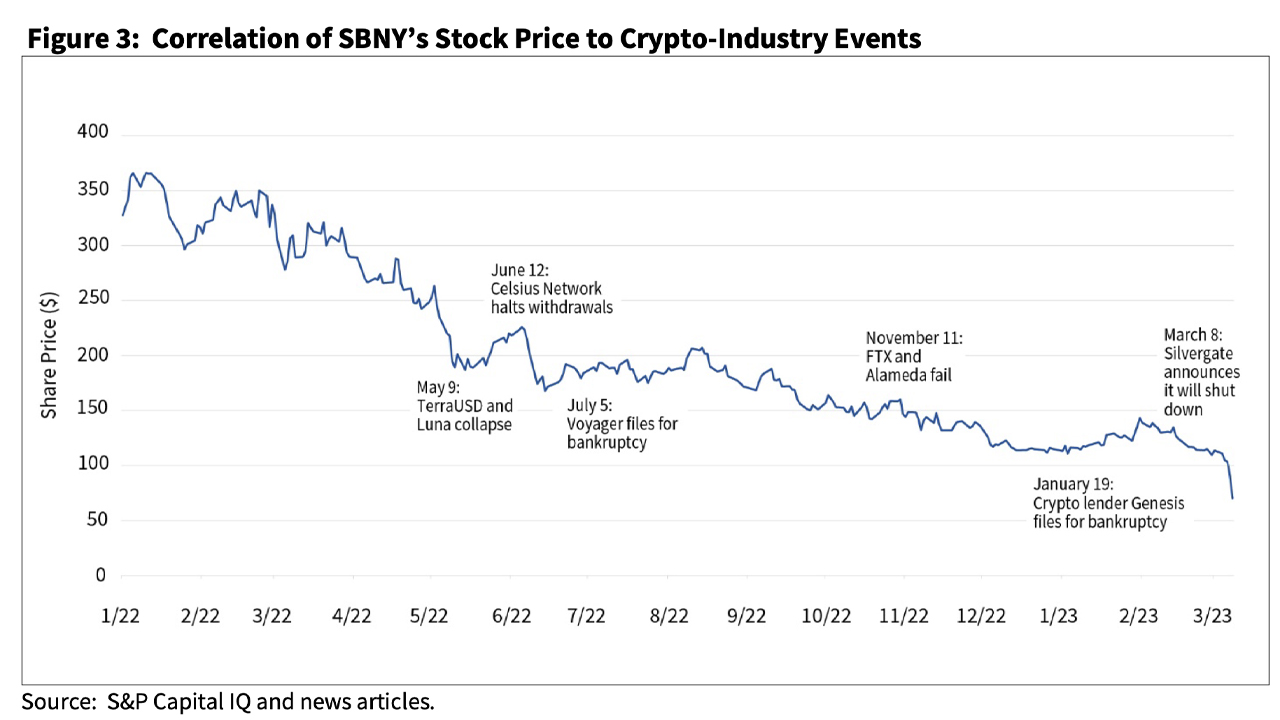

The FDIC published its report on Signature Bank’s (SBNY) collapse and the report authored by Marshall Gentry talks a lot more about crypto assets and the FTX failure. Throughout the report, Gentry discusses how liquidity risk management witnessed withdrawals of uninsured deposits rise to critical levels. On page 13, the FDIC report goes into great detail about the crypto industry turmoil that bolstered SBNY’s failure. ”The strategy exposed SBNY to greater susceptibility to liquidity, reputation, and regulatory risk due to the uncertainty and volatility of the digital asset space,” Gentry explained.

The report describes how two cryptocurrencies collapsed in May 2022 (terrausd and luna), leading to additional turbulence in the industry and further discusses the collapse of FTX. It noted that SBNY’s shares were correlated with the crypto industry. “Due to its reputation as a banker to many in the crypto industry, SBNY’s stock price closely tracked these tumultuous events in the crypto industry space and dropped significantly during 2022,” the report notes. Both reports were approved by the Fed’s chair Jerome Powell and the FDIC’s chair Martin Gruenberg.

What’s your take on the reports published by the Federal Reserve and the FDIC on the fall of Silicon Valley Bank and Signature Bank? Let us know your thoughts in the comments section below.