Bitcoin and other risk-on assets are under short-term pressure as the macro narrative flips from recession to sticky, entrenched inflation.

Sticky inflation

Markets are braced for an imminent recession. However, current macro analysis suggests a recession may not be coming, at least not in the short term. Instead, analysts expect a period of sticky, entrenched inflation.

On Feb. 24, the U.S. Bureau of Economic Analysis (BEA) released Personal Consumption Expenditure (PCE) data for January, showing an actual rate of 4.7%, much higher than the expected rate of 4.3%.

PCE measures the price of goods and services, similar to the Consumer Price Index (CPI), but differs by sourcing data from businesses as opposed to consumers, as is the case with CPI.

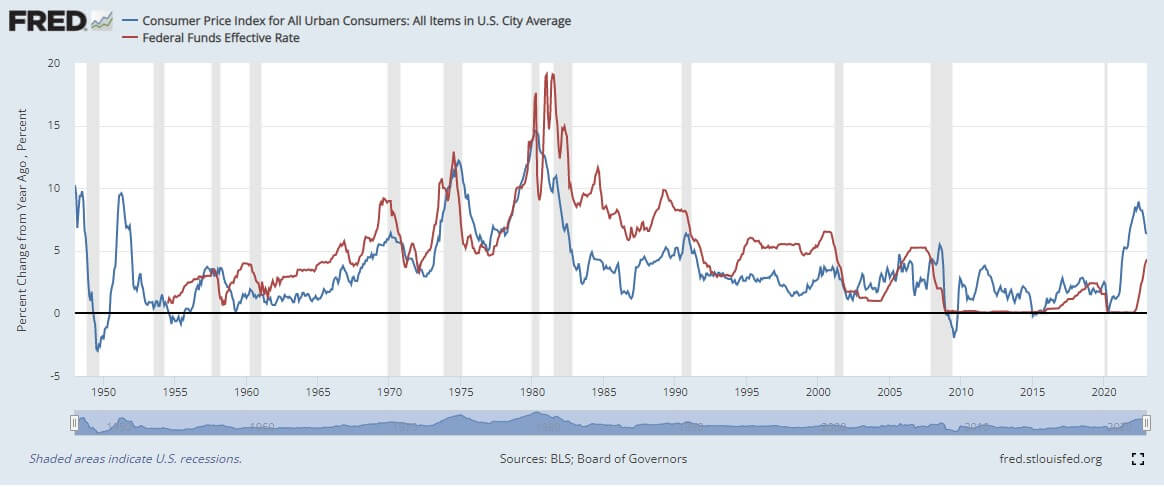

Although Year-on-Year CPI data shows inflation coming down, thus conflicting with PCE data, the U.S. labor market remains hot with a 50-year low in unemployment and spiking wage growth – suggesting inflationary pressures remain.

The upshot of this is likely further hawkishness from the Fed, which stated that its primary goal is to bring inflation down to 2%.

In turn, should higher inflation become the dominant narrative, the effect could see price pressure on Bitcoin, and other risk-on assets, as disposable income gets squeezed to keep pace with the price of essentials.

Fed funds rate on the rise

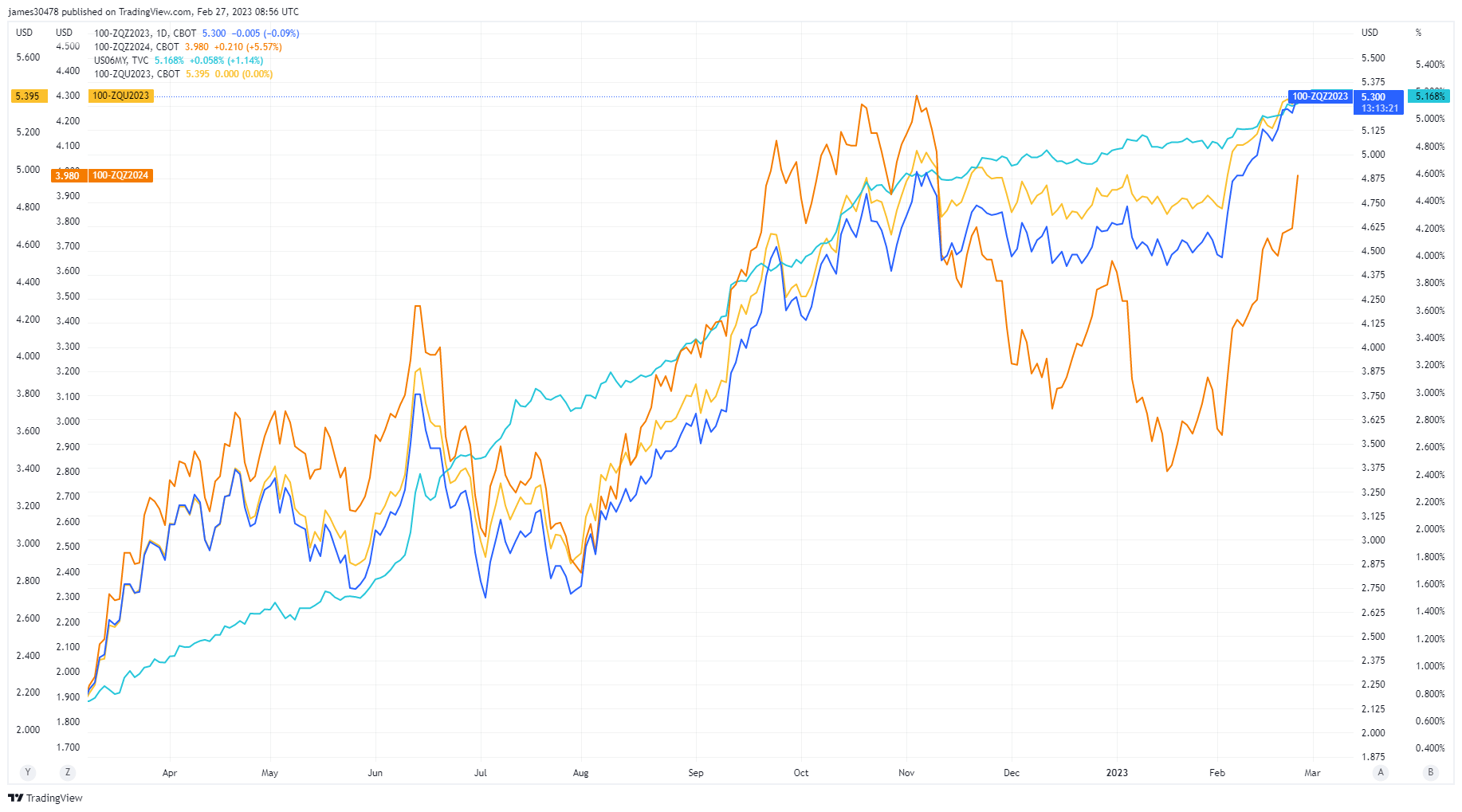

Fed funds futures data previously pointed to growing confidence within the interbank lending market. However, recent movements show this narrative has flipped.

Fed funds futures refer to derivatives based on the federal funds rate – the lending rate charged by banks (to other banks) for overnight lending.

The chart below shows Fed funds futures for September 2023, December 2023, and December 2024 have adjusted higher. A higher rate across the board suggests banks lack confidence in lending to other banks – meaning interbank borrowing becomes more expensive.

Like persistent inflation, a higher Fed funds rate will create downward pressure on risk-on assets as banks clamp down on borrowing to limit their exposure.

Keeping rates higher for longer

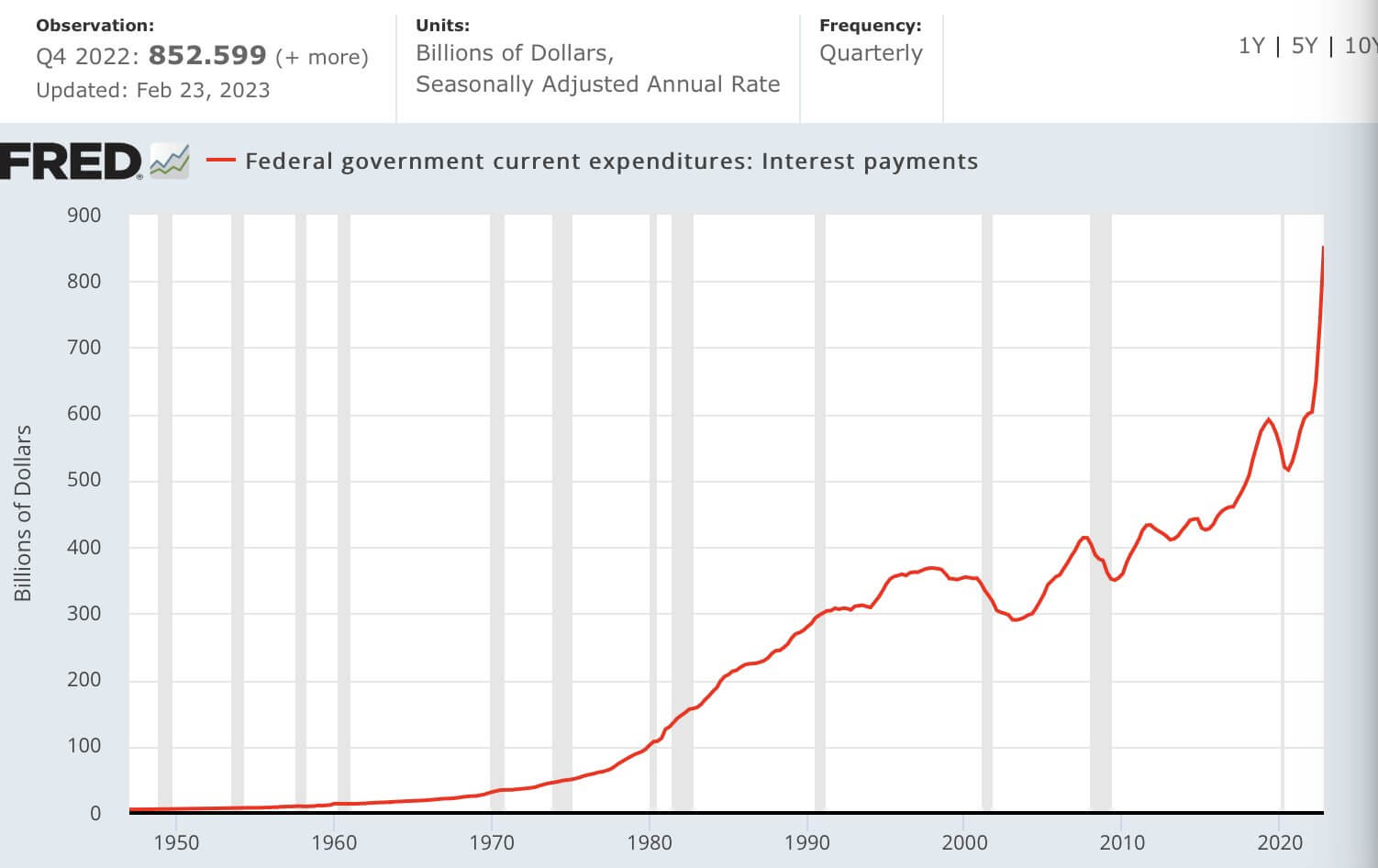

The interest paid on federal government debt is approaching $1 trillion. The chart below shows interest payments almost doubling since 2020.

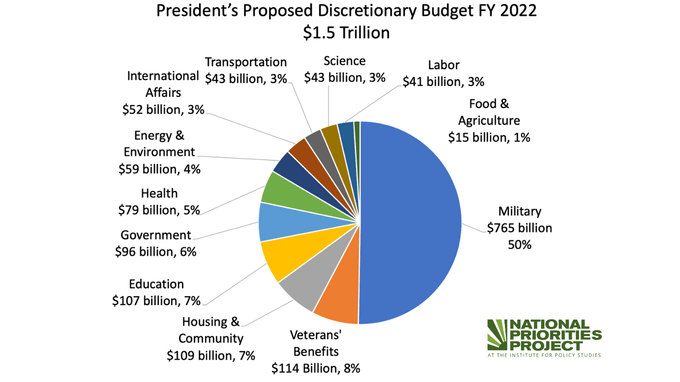

50% of 2022’s $1.5 trillion discretionary budget was spent on the military, with the next most significant slice, at 8%, allocated to Veterans’ Benefits totaling $115 billion.

Keeping interest rates higher for longer would make it more difficult to service existing debts – this puts the Fed in a tough spot regarding seeing things through to a 2% inflation rate.

The updated predicted terminal interest rate now comes in at 5.25% -5.50%, giving leeway of 75 basis points from the current rate.

The next FOMC meeting is scheduled to conclude on March 22. Presently, economists are 70% in favor of a 25 basis point hike, with the remaining 30% expecting a 50 basis point hike.

Meanwhile, risk-on assets, including Bitcoin, now face short-term downward pressure as inflation and dwindling risk appetite among banks provide headwinds against price appreciation.

The post Research: Bitcoin, risk-on assets under short-term pressure as macro narrative flips appeared first on CryptoSlate.