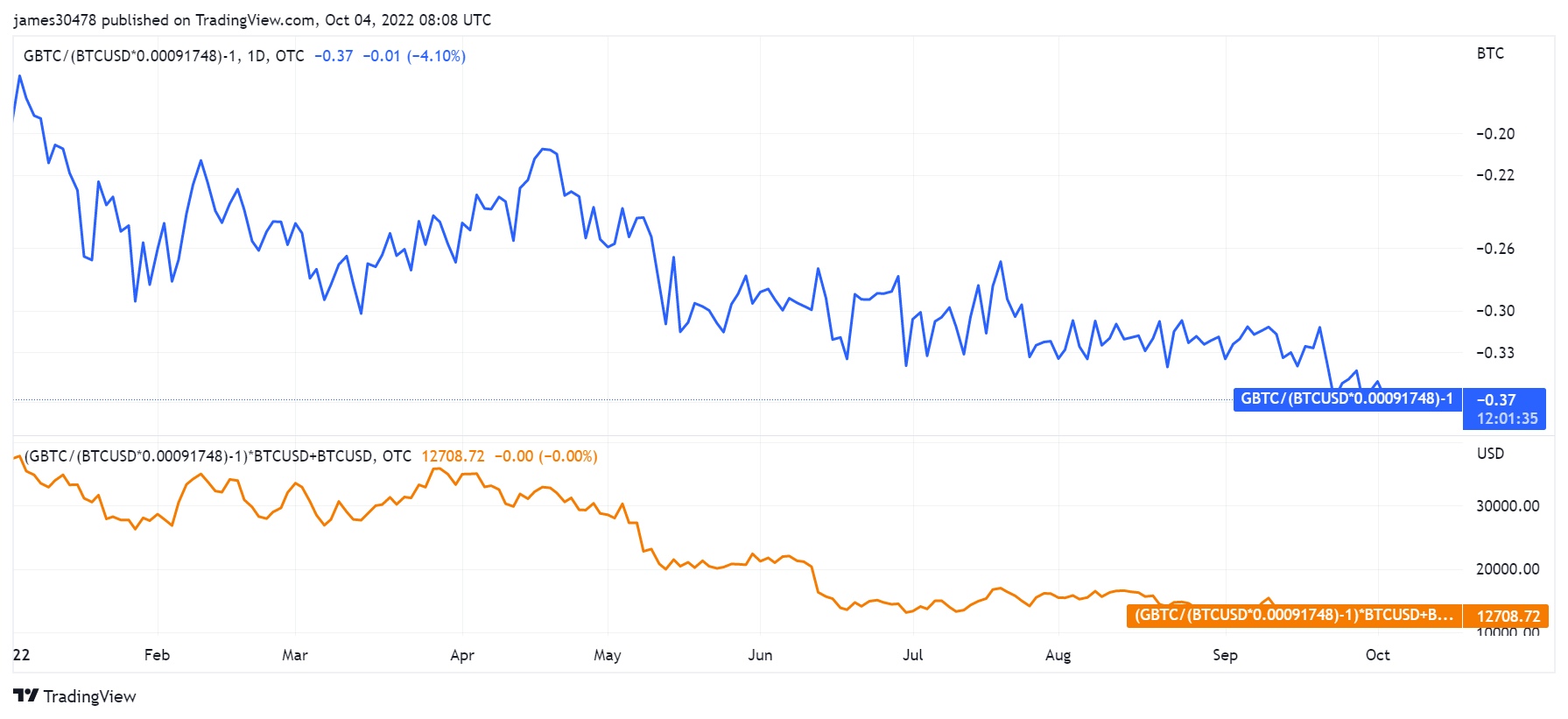

Grayscale’s bitcoin trust (GBTC) which started trading at a discount in Feb. 2021 has reached an all-time low of -36% when compared to the spot BTC price of $19,000.

Grayscale launched the first bitcoin trust in 2013, to provide institutional investors exposure to BTC through traditional instruments.

As of date, assets under management in the bitcoin trust are approximately $12.3 billion. Grayscale holds 635,240 BTC representing 3.3% of BTC’s circulating supply, with each BTC per share worth 0.00091748‡.

Prior to Feb. 2021, GBTC was trading at a premium of up to 20%. However, the share price has slipped into the discount area with its current price of $12,508 (priced with a -36.2% discount), as of Sept. 30. 2022.

At the current 36.25% discount, institutional investors’ interest in GBTC remains at an all-time low. Delphi Digital Analyst Andrew Krohn noted that the increasing GBTC discount may suggest a declining interest of institutional investors in bitcoin.

Some suggest that the increasing discount illustrates subsiding institutional interest in Bitcoin, while others point to a wider offering of ETFs or alternative vehicles for BTC investment.

The interest of institutional investors may remain low until $GBTC starts getting closer to the net asset value of $BTC.

Will a spot ETF approval trigger the next bull run?

GBTC shares accrue a 2% fee annually and are subject to a six-month lock-up. If prices fall within the lock-up period, investors can not exit their position to cut the losses.

In recent times, cheaper bitcoin ETF options have been launched across Canada, Europe, and the US. Management fees for ETFs are relatively cheaper and investors can enter and exit their position at will.

Grayscale moved to have its trust fund converted to ETF, but the SEC rejected the application. The firm has refilled its application for further consideration.

According to Krohn, the GBTC discount trend may reverse as soon as the fund is converted into an ETF.

“If the SEC approves Grayscale’s request to turn the fund into an ETF, the discount could be erased rather quickly.”

With bitcoin increasingly reclaiming its reputation as digital gold, a spot ETF approval could imitate a similar trend as the first gold ETF.

The launch of the first Gold ETF “Gold Bullion Securities” in 2003, saw the price of Gold soar significantly over the years and now trades above $1709, up by 368%, since the first Gold ETF launch.

Expectedly, a spot bitcoin ETF approval will attract more institutional and retail investors, leading to increased demand and price for BTC, which could usher the crypto market into the next bull run.

The post Research: Grayscale’s GBTC drops to all-time low of $12.5K; conversion to spot ETF could trigger rebound appeared first on CryptoSlate.