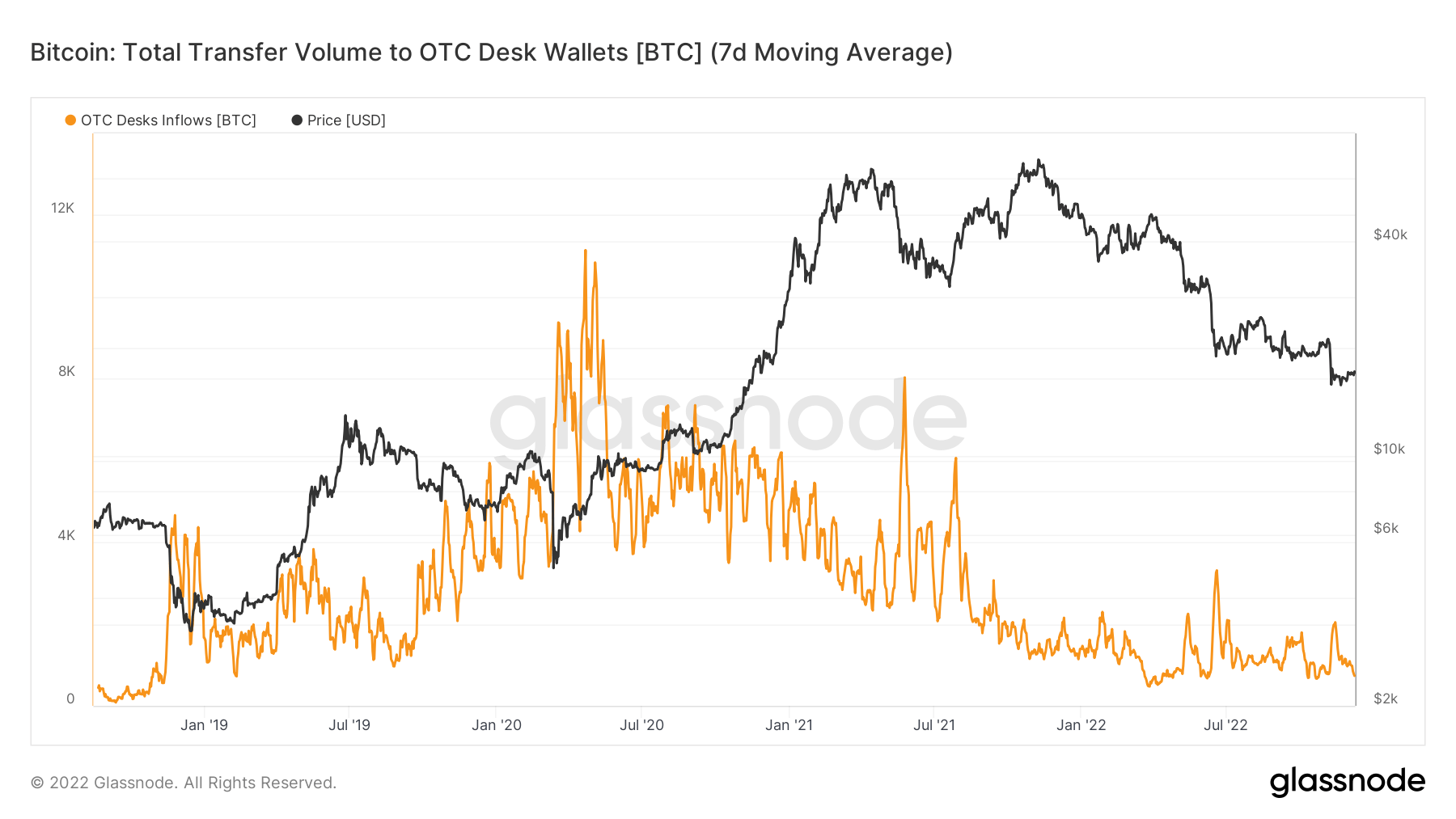

Institutional appetite for Bitcoin (BTC) has slowly evaporated due to the current bear market situation and is reflected in the significant drop in over-the-counter (OTC) trades, according to an analysis of Glassnode data by CryptoSlate.

A bull run in 2021 saw several institutional players pile into the flagship digital asset, but that interest faded as the price plunged to new lows in 2022. Data from three different OTC desks showed that the flow of funds from this group has slowly evaporated.

According to River Financial, an OTC desk acts as a dealer for traders looking to trade a given asset which could be securities, currencies, etc. They are usually used when a given trade is impossible on centralized exchanges.

CryptoSlate’s analysis showed that the seven-day moving average for total transfers to OTC desk wallets is now close to 2018 lows. OTC trades peaked during covid 19 pandemic when BTC was trading at around $3000.

Since then, the market witnessed considerable spikes throughout 2021 but slowed as the year ended. OTC trades in 2022 saw a significant spike in July when investors were still reeling from the Terra ecosystem collapse.

Since then, the 7-Day moving average for OTC desk inflows has fallen and is now approaching a year-to-date (YTD) low.

Purpose ETF has seen no activity since early August

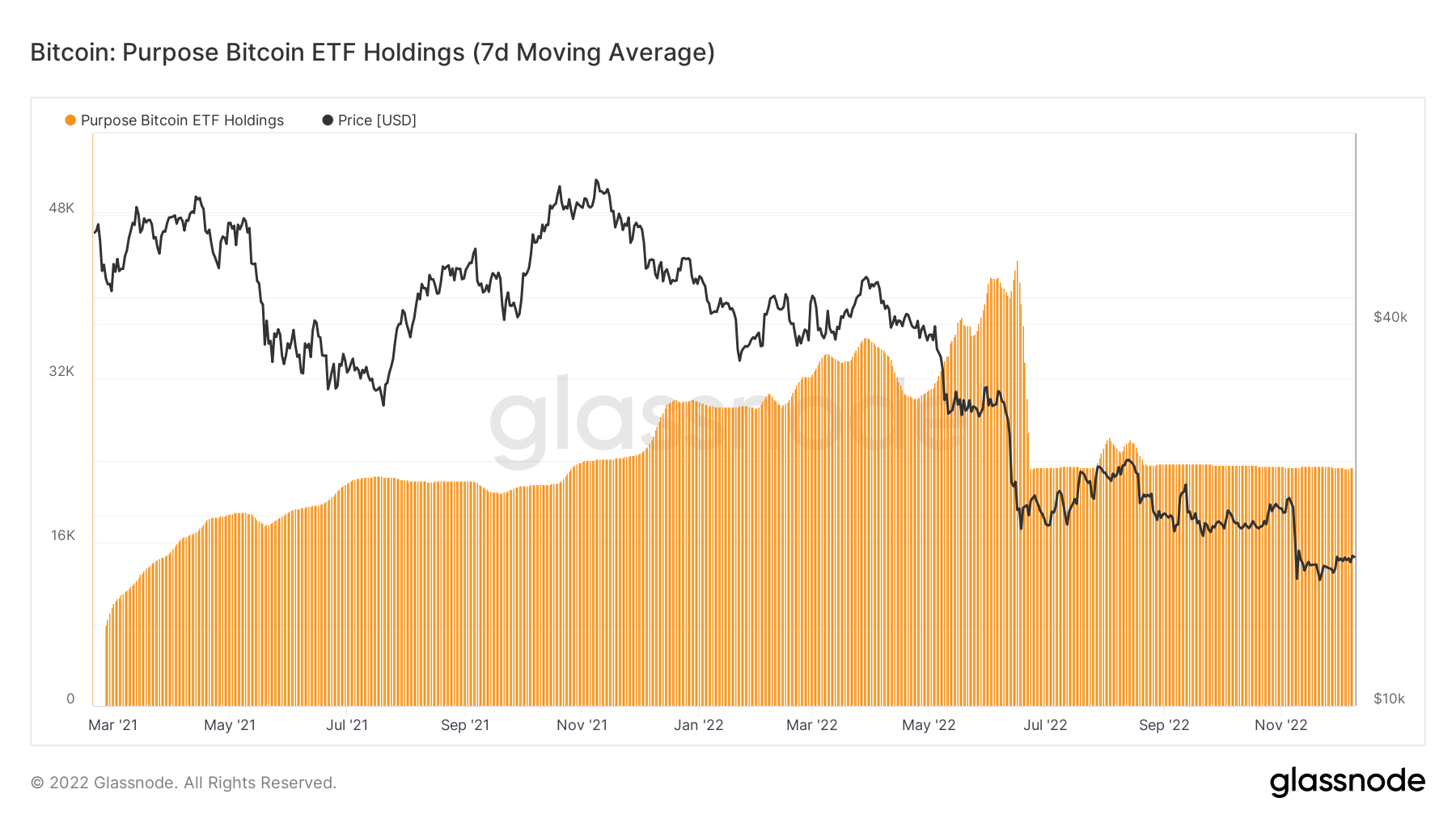

The world’s first Bitcoin ETF, Purpose Spot Bitcoin ETF, has had a pretty quiet year.

CryptoSlate analysis revealed that the ETF had not seen any major activity since late July and early August. According to Glassnode data on its 7-Day moving average, Purpose ETF BTC holdings peaked between June and July 2022.

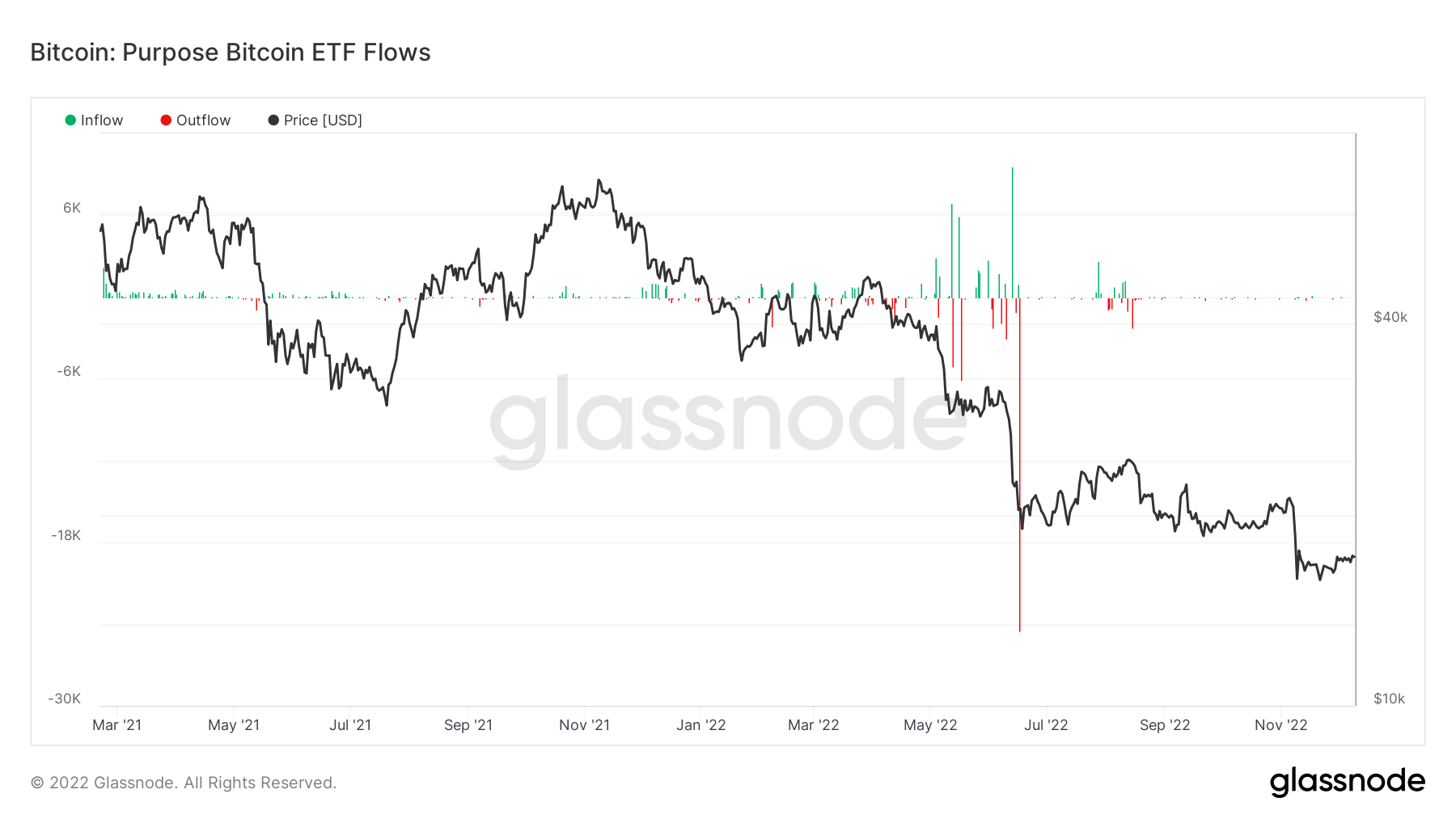

The Glassnode chart on its inflows and outflows showed that the ETF had experienced heavy outflows between May and July 2022, coinciding with when BTC’s value dipped by 40%. In July mainly, Purpose ETF saw its largest wick of outflow.

It experienced some inflows and outflows in early August and has seen little to no activity since then.

Despite the months of inactivity, the ETF holdings are still significantly above the levels in March 2021 when it launched. According to Purpose Invest, the ETF’s asset under management sits at $396.7 million (23,240 BTC).

The post Research: Institutional appetite for Bitcoin has evaporated as OTC trades approach YTD low appeared first on CryptoSlate.