On-chain data suggests the Bitcoin retail investors are losing interest in the asset as their volume has seen a sharp plunge during the last month.

Bitcoin Retail Investor Volume Has Seen A Significant Drop Recently

As explained by CryptoQuant community analyst Maartunn in a new post on X, the Retail Investor Demand has seen a significant flip recently. The “Retail Investor Demand” here refers to an indicator that keeps track of the demand for using the network that’s present among the retail cohort.

Retail investors are the smallest of entities on the network, so their transactions generally tend to be quite small in size. Thus, the transaction volume pertaining to transfers valued at less than $10,000 could be attributed to the activity from these investors.

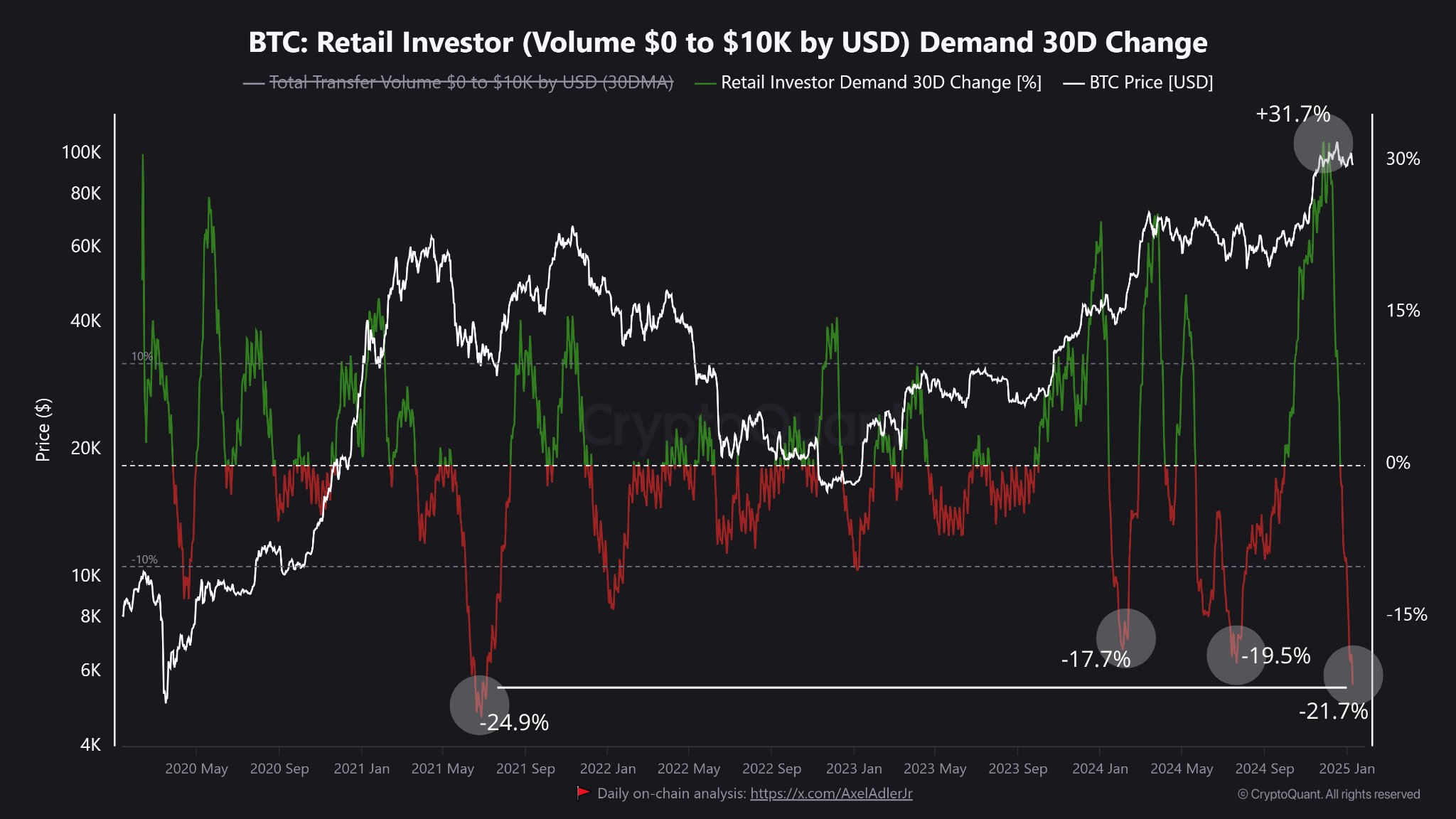

The Retail Investor Demand uses the 30-day change in this volume to calculate its value. Below is the chart for the metric shared by the analyst that shows its trend over the past few years.

As displayed in the above graph, the Bitcoin Retail Investor Demand shot up to high positive levels during the bull rally that occurred in the last couple of months of 2024. This suggests the rally attracted the attention of the masses, which led them to making a large amount of moves on the network.

This isn’t a particularly unexpected pattern, as investors tend to find sharp price action exciting, so they become more active than usual. The scale of the spike was quite notable this time, however, as the metric reached a peak value of 31.7%.

Following this high, the retail investor volume slowed down its rise and as the downtrend in the cryptocurrency kicked in, the 30-change in it straight up dipped into the red territory.

The decline in the volume of these shrimps has only strengthened in this new year of 2025, as the Retail Investor Demand is now sitting at a low of negative 21.7%.

This value implies that the transaction activity of the group has seen a decrease of 21.7% during the last 30 days. The drop is the largest that the metric has witnessed since mid-2021.

The cooldown in interest from the retail investors may not be entirely bad for Bitcoin, though, as the aforementioned negative spike in 2021 occurred around a bottom in the price.

In some other news, Ethereum, the second largest cryptocurrency by market cap, has seen a high amount of exchange outflows during the past week, according to data from the market intelligence platform IntoTheBlock.

In total, the centralized exchanges have seen a net amount of $1.42 billion in Ethereum leave their wallets during the past week, a sign that the investors could be in a phase of accumulation.

BTC Price

Bitcoin slipped towards the $91,000 mark yesterday, but the asset appears to have made some recovery today as its price is now trading around $93,800.