In an exchange on X (formerly Twitter), Ripple’s Chief Technology Officer David Schwartz, also known as “JoelKatz”, addressed criticisms about his company and the XRP Ledger.

Has Ripple Failed With Its Payments Business?

User @188ape challenged Schwartz by questioning the uniqueness of the XRPL in today’s market, stating that it seems like “most new layer 1s can do what the XRPL can do, plus more.” In response, Schwartz emphasized the XRPL’s distinctive features, highlighting that it offers functionalities like stablecoins, non-fungible tokens (NFTs), and a decentralized exchange (DEX) without exposing users to the risks associated with smart contracts.

He stated: “I don’t think there’s any other blockchain that has features like stablecoins, NFTs, a DEX, and so on that doesn’t expose you to the risks of smart contracts where your wallet has no way to know what the things you agree to are actually doing.”

The conversation intensified when another user, @dr_wonder589 (Dr. Wonder Bread), remarked that despite these features, they don’t seem to translate into market value. “Over-engineering something doesn’t mean it’s valuable to the market,” he noted.

Addressing this skepticism, Schwartz expressed surprise at the slow adoption of the payments business by Ripple. We focused very heavily on payments in the early design stages. Using cryptocurrencies or blockchains for payments hasn’t really caught on in a big way anywhere yet. I find that quite surprising,” he admitted.

When pressed further about the reasons behind this lack of widespread adoption, Schwartz cited several factors. He mentioned regulatory uncertainty and the difficulty of providing a good user experience as significant hurdles. According to him, users with access to traditional financial services prefer to use their banks, while those without such access lack the discretionary funds to experiment with new technologies.

“Users with good access to financial services would rather just use their banks. Users without good access to financial services don’t have a bunch of ‘fooling around’ money they can tolerate not having good access to and need to be able to easily pay bills with their money. Two-sided market problems and difficulty forming closed loops. One-sided flows that are inefficient because you can’t net out external flows. And so on,” Schwartz elaborated.

The dialogue took a critical turn when Dr. Wonder Bread suggested that Ripple’s challenges serve as a convenient excuse for its stagnation while it continues to fund itself through XRP sales. He insinuated that this might be a tactic to indirectly influence the price of XRP and maintain its stability.

In defense, Schwartz reiterated Ripple’s transparent strategy since 2014. “Ripple very publicly chose to focus on payments in 2014 and was completely open about our strategy and why we chose it. I don’t think anyone in the space was more successful at it than we were,” he stated.

Unsatisfied, @188ape pressed Schwartz for concrete examples of a XRP success. “Where is the success, David? Give us an example of XRP being a success story… I’ll wait,” he demanded. As of the time of writing, Schwartz has not publicly responded to this query.

Another user, @hesu_krypto, observed that Schwartz was referring to Ripple, not XRP specifically. However, @188ape countered by suggesting that the community was led to believe otherwise. Echoing this sentiment, Dr. Wonder Bread accused Ripple of manipulating the market through indirect means, implying that this could be considered securities fraud.

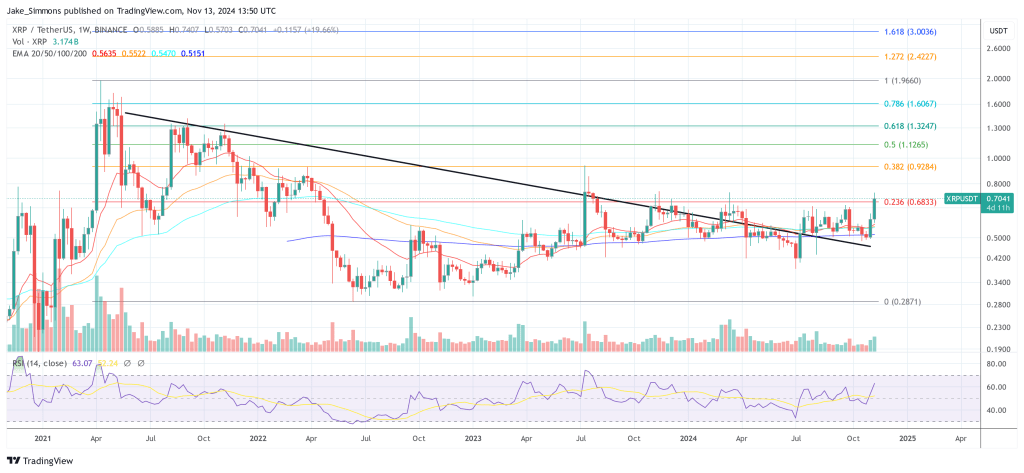

At press time, XRP traded at $0.70.