The post Ripple News: Will Ripple’s $100 Billion XRP Holdings Impact its Future IPO? appeared first on Coinpedia Fintech News

Ripple is considered one of the most promising cryptocurrency companies. Even though it has faced numerous challenges recently, it has sustained them all, becoming an undeniable force in the crypto sector. Lately, triggering discussions about its true valuation, Ripple CEO brad garlinghouse

brad garlinghouse

Brad Garlinghouse is the CEO of the financial technology company Ripple Labs, he is an extremely popular name across the global crypto landscape. He has previously served as the CEO of Hightail, a file-sharing service, and is also an active angel investor. He joined Ripple as COO in April 2015, answering to the CEO and prime supporter, Chris Larsen. He was elevated to CEO in December 2016. Initially, he worked at AOL and Yahoo! From 2003 to 2008, he filled in as Senior Vice President at Yahoo!, where he ran its Homepage, Flickr, Yahoo! Mail, and Yahoo! Courier divisions. While at Yahoo!, he wrote an inner update known as the "Peanut Butter Manifesto," requiring the organization to zero in on its core business instead of extending itself excessively far, much like peanut butter.

Details:

Organization: Ripple

Location: United States

Education: MBA from Harvard Business School and BA from The University of Kansas

Skills: Venture capital and Startups

Experience:

CEO at Ripplefrom from Jan 2017 – Present ·

President and COO at Ripple logo from Apr 2015 – Dec 2016

Board Member at Animoto from 2012 – Dec 2017

Tonic Health, an R1 company logo

Board Member at Tonic Health from 2011-2016

Board Member at Ancestry from 2013 – 2016

CEO at Hightail from May 2012 – Sep 2014

EntrepreneurInvestorChief Executive OfficerBoard Member

stated that his company holds no less than $100 billion in XRP. Curious to know more? Read on!

Ripple’s $100 Billion XRP Ownership & its Actual Valuation

Dismissing the $11 billion valuation of Ripple from early 2024 as outdated, Garlinghouse highlighted the importance of considering the value of his company’s XRP holdings when determining its actual valuation.

He pointed out that the private market valuation of his company remains hugely discounted compared with its Net Asset Value.

Ripple’s IPO Plans & SEC Challenges

Garlinghouse noted the challenges the company has faced from the SEC during the regime of crypto-skeptic chairman gary gensler

gary gensler

Gary Gensler is a pioneer and the current chair of the U.S. Securities and Exchange Commission. He has extensive experience that spans Wall Street, government regulation, and an angel teaching about cryptocurrencies and blockchain at MIT. Gary S. Gensler was on born October 18, 1957, in Baltimore, Maryland.He graduated from Pikesville High School in 1975, where he was later given a Distinguished Alumnus award. He also earned a degree in economics.Gensler served in the United States Department of the Treasury as Assistant Secretary for Financial Markets from 1997 to 1999, then as Undersecretary for Domestic Finance from 1999 to 2001He has expressed his desire to present crypto-related approach changes later on that include token commitments, decentralized finance, stablecoins, guardianship, exchange-traded resources, and advancing stages.

Chairman

as a reason why it has not yet considered the possibility of an IPO.

As Gensler is set to be replaced by pro-crypto executive Paul Atkins on the day of Trump’s inauguration, many believe that there is a possibility for Ripple to reconsider its stance on its IPO release.

Ripple USD Excitement Explained

Garlinghouse emphasised the growing demand for Ripple’s custody solutions and blockchain products. RLUSD has created extreme excitement in the cryptocurrency market.

Many experts think that Ripple could emerge as one of the leading blockchain infrastructure providers for financial institutions.

- Also Read :

- XRP Price Prediction for January 7

- ,

XRP Market Analysis: A General Overview

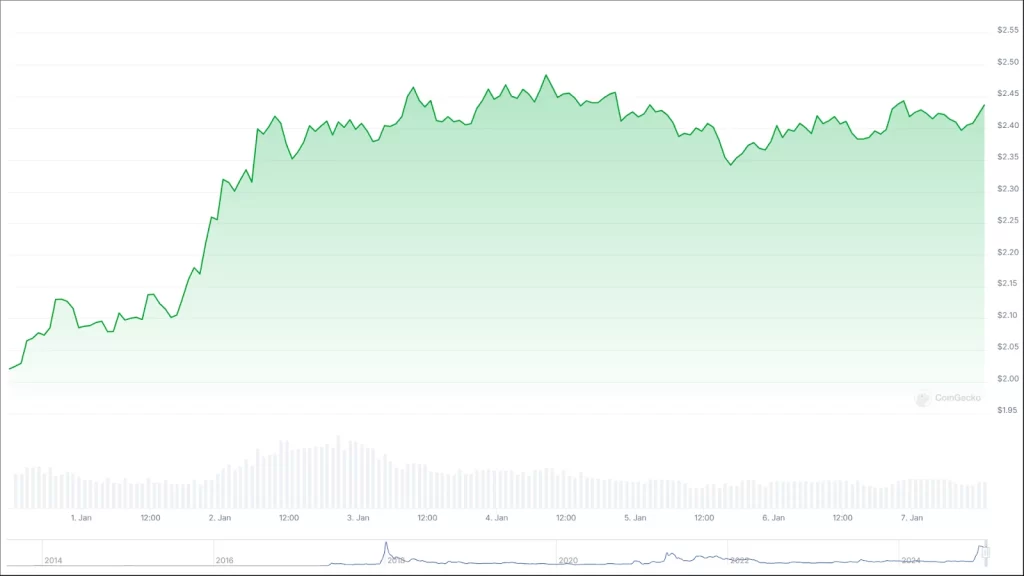

In the last seven days, XRP has seen an impressive growth of 19.8%. In the last six months, the market has grown by over 457.6% – the highest among the top ten cryptos by market cap. In the last 24 hours alone, the market has climbed by at least 0.85%.

In conclusion, with $100 billion in XRP, and growing demand for RLUSD, Ripple is well-positioned to strengthen its leadership in blockchain solutions for financial institutions.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.