The post Ripple’s CEO Pushes for a U.S. Crypto Reserve To Includes More Than Just Bitcoin appeared first on Coinpedia Fintech News

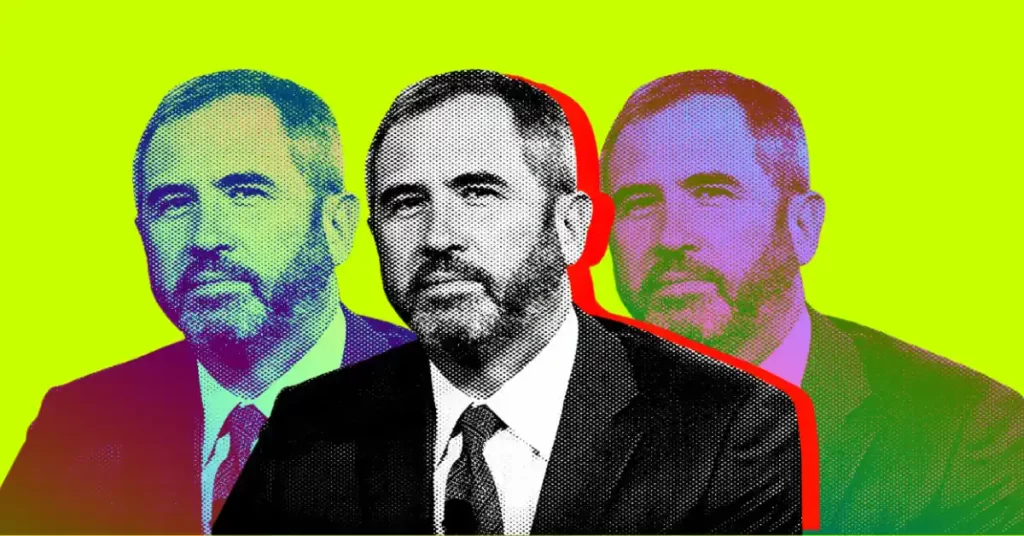

Brad Garlinghouse, the CEO of Ripple, recently shared his thoughts on the U.S. government’s plan to create a national digital asset reserve. He believes the reserve should include Bitcoin and other cryptocurrencies like Ripple’s XRP. This idea goes against the opinion of Bitcoin supporters who think Bitcoin should be the only coin in the reserve.

US Reserve To Add Other Crypto Too

In a recent tweet post, Garlinghouse pointed out that the cryptocurrency industry could do much more if multiple cryptocurrencies worked together instead of fighting each other. He believes that if the crypto industry wants to succeed, it must stop focusing on one cryptocurrency over others and instead collaborate.

He noted that the cryptocurrency space should not be a “zero-sum game,” where one coin’s success equals another’s failure. Garlinghouse, who holds several cryptocurrencies, including XRP, Bitcoin, and Ethereum, advocates for a fairer playing field.

He believes that the future of crypto should be about collaboration, not competition. His message is clear: the industry can grow stronger if different digital assets are allowed to thrive together.

Call for a Diversified Reserve

Garlinghouse wants any government-backed digital asset reserve to include a variety of cryptocurrencies. According to him “If a government digital asset reserve is created, I believe it should be diversified. It should include more than just one token, whether it’s BTC, XRP, or any other.”

Ripple has been working with U.S. regulators to ensure that XRP is considered in the discussions about digital asset reserves. Garlinghouse believes that a balanced and fair reserve will help support the growth of the entire cryptocurrency industry, not just one specific coin.

Criticism from Bitcoin Supporters

Garlinghouse’s idea hasn’t been welcomed by everyone. Some Bitcoin supporters argue that only Bitcoin should be in the reserve. Pierre Rochard, Vice President of Riot Platforms, thinks Bitcoin’s decentralized nature makes it the only suitable choice. He also believes that Ripple is pushing for XRP’s inclusion through lobbying efforts.

Ryan Selkis from Messari also believes that Bitcoin has special features that make it better for the reserve compared to other cryptocurrencies.

As the U.S. considers creating a national digital asset reserve, the question remains whether it will represent only Bitcoin or include a wider range of cryptocurrencies, as Garlinghouse suggests.