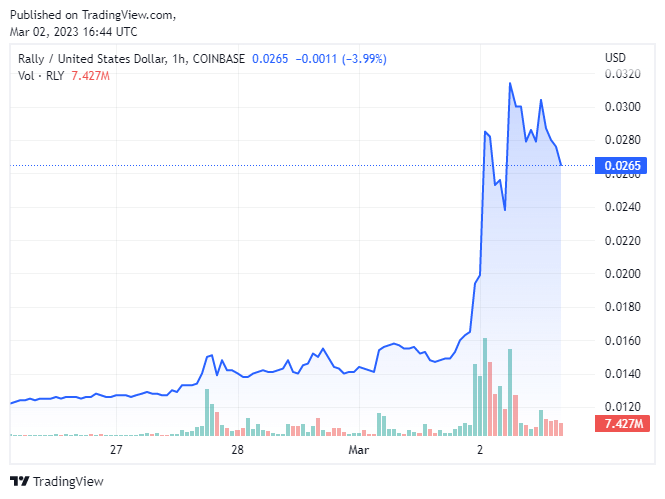

The Rally Token (RLY) has recorded an 83.73% increase in the last 24 hours, according to CryptoSlate data.

RLY token increased from as low as $0.0149 to as high as $0.0313 in the last 24 hours. At the time of writing, the RLY price lingers around $0.0265.

CryptoSlate data also shows that the token recorded a 108.96% and 121.61% surge in the last seven and 30 days, respectively. The 30-day metric is unexpectedly strong, given that the Rally sidechain, RallyIO, shut down on Jan.31, causing the RLY price to tank by 10%.

Rally’s future

The token’s daily surge was recorded after the project team published a thread on its official Twitter account to disclose the treasury holdings and future plans on March 1.

The Rally team said they felt the need to ensure the community regarding the protocol’s future after the side chain shut down. The team noted that RallyIO was one of the many customers of the RLY Token Bonding Curve Protocol, which remains an essential technical offering of the RLY protocol. Given the number of applications built on this protocol, the team said, RallyIO’s suspension doesn’t affect the strength of the RLY ecosystem.

The team added:

“As we look to the future, the RLY Network Association will soon be announcing new additions to the RLY open-source software to support and grow the RLY ecosystem and community,”

According to the thread, the RLY blockchain will continue to grow with Polygon (MATIC), Solana (SOL), Flow (FLOW), and other protocols.

RLY Treasury

The shutdown of RallyIO sparked insolvency concerns about the project. The Rally team acknowledged this by stating:

“RallyIO was one application of many being built on the RLY protocol, and their shutdown doesn’t affect or change the viability of the overall ecosystem. Financially, the community treasury has significant funds to continue to innovate and support the ecosystem.”

According to the project team, over 20 million USD Coin (USDC) and more than seven billion RLY tokens are currently held in the treasury. Treasury’s two primary wallets contain most of these tokens, and they can be found at 0xe75ed5295c13d224036feb6439db7539fe6d7ce8 and 0x75f4BD3A503f23450Ed9e8dABDAFDE6288af2c9b.

The post RLY surges over 80% in a day as project team shares treasury holdings, future plans appeared first on CryptoSlate.