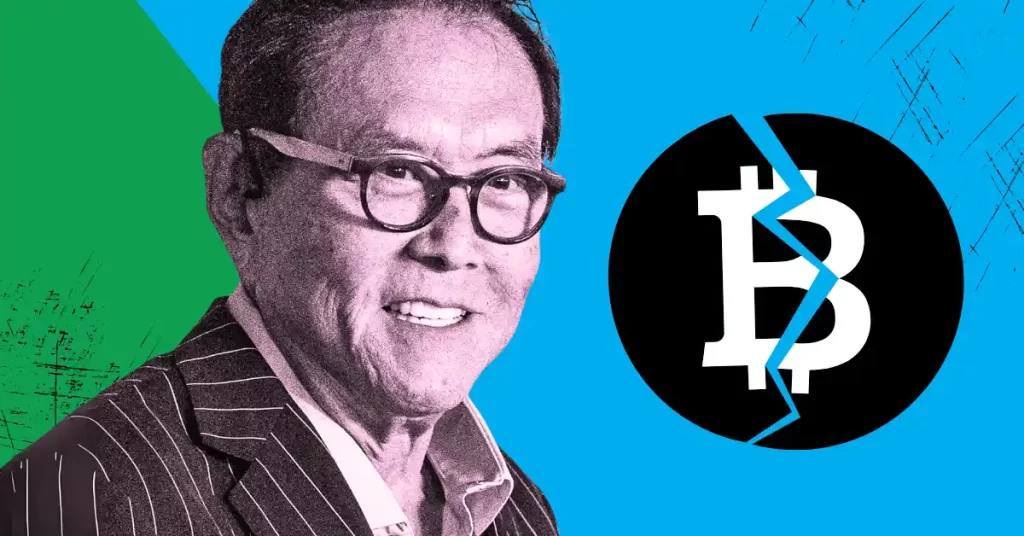

The post Robert Kiyosaki Warns of Massive Market Crash : How to Survive the 2025 Meltdown appeared first on Coinpedia Fintech News

Robert Kiyosaki, the author of Rich Dad Poor Dad, has given stark warnings since the beginning of this year, while the world is waiting for the crypto rally, Robert Kiyosaki

Robert Kiyosaki

Robert Toru Kiyosaki is an American businessman and author, known for the Rich Dad Poor Dad series of personal finance books

Content Creator / Influencer

believes this year his old warning of the global market crash will come true in 2025. He warns that this could be the biggest economic fallout in history, with massive job losses, plunging stock prices, and a struggling housing market. According to him the warning signs of an economic collapse are crystal clear now. He is sure that the 2025 crisis will be bigger than the Great Depression of the 1930s.

Kiyosaki’s Playbook and His Three Rules

To confirm this trend change, he is referring to his book published in 1997 to remind his followers of the financial lessons that got his book rejected by major publishers during that era. Despite skepticism from editors, his three money rules have stood the test of time and seem more relevant than ever in 2025.

Kiyosaki’s first rule, “The rich do not work for money,” highlights how wealthy individuals build businesses and create assets instead of relying on a paycheck. With job losses mounting in 2025, this concept is proving true as entrepreneurs continue to thrive while employees struggle.

His second rule, “Your house is not an asset,” challenges the common belief that homeownership is a guaranteed path to wealth. He defines assets as things that generate money without working, while liabilities drain finances. With home prices crashing and affordability at an all-time low, many are realizing that their homes are not the financial security they once believed.

The final rule, “Savers are losers,” addresses the impact of inflation and the dangers of relying on fiat currency. As per him, the US Dollar is “fake money” and you will lose everything if you hold this toilet paper. Kiyosaki suggests investing in gold, silver, and Bitcoin to keep money safe from inflation and losing value. He warns that saving too much cash can be risky because its worth goes down over time, especially during tough economic times. He refers to gold and silver as “God’s money” and Bitcoin as “people’s money,” urging individuals to rethink how they protect their financial future.

Crypto Dad Counters Kiyosaki

Crypto expert, Crypto Dad responded to Robert Kiyosaki’s financial advice, offering a different perspective on wealth-building. While Kiyosaki emphasizes entrepreneurship as the key to financial success, Crypto Dad argues that not everyone is meant to be an entrepreneur—and that’s perfectly fine.

He acknowledges that many people feel pressured to start their businesses, only to struggle or fail because building something from scratch is incredibly challenging. According to him, “The hardest job in the world is to create your job.” Instead, he believes individuals can still achieve financial success and wealth by working for others, as long as they make smart financial choices.

His response highlights that entrepreneurship isn’t the only path to wealth, and people should not feel forced into it. Whether through investing, career growth, or strategic money management, there are multiple ways to build financial security without starting a business.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.