A whirlwind of speculation is currently surrounding the crypto asset JasmyCoin (JASMY), colloquially termed the “Bitcoin of Japan,” following a recent announcement from the Prime Minister’s Office of Japan. Yesterday, it was disclosed that a video conference between Prime Minister Kishida and Apple CEO Tim Cook had confirmed the integration of Japan’s My Number Card function into iPhones by next spring.

Crypto Investors Speculate On Apple Collaboration

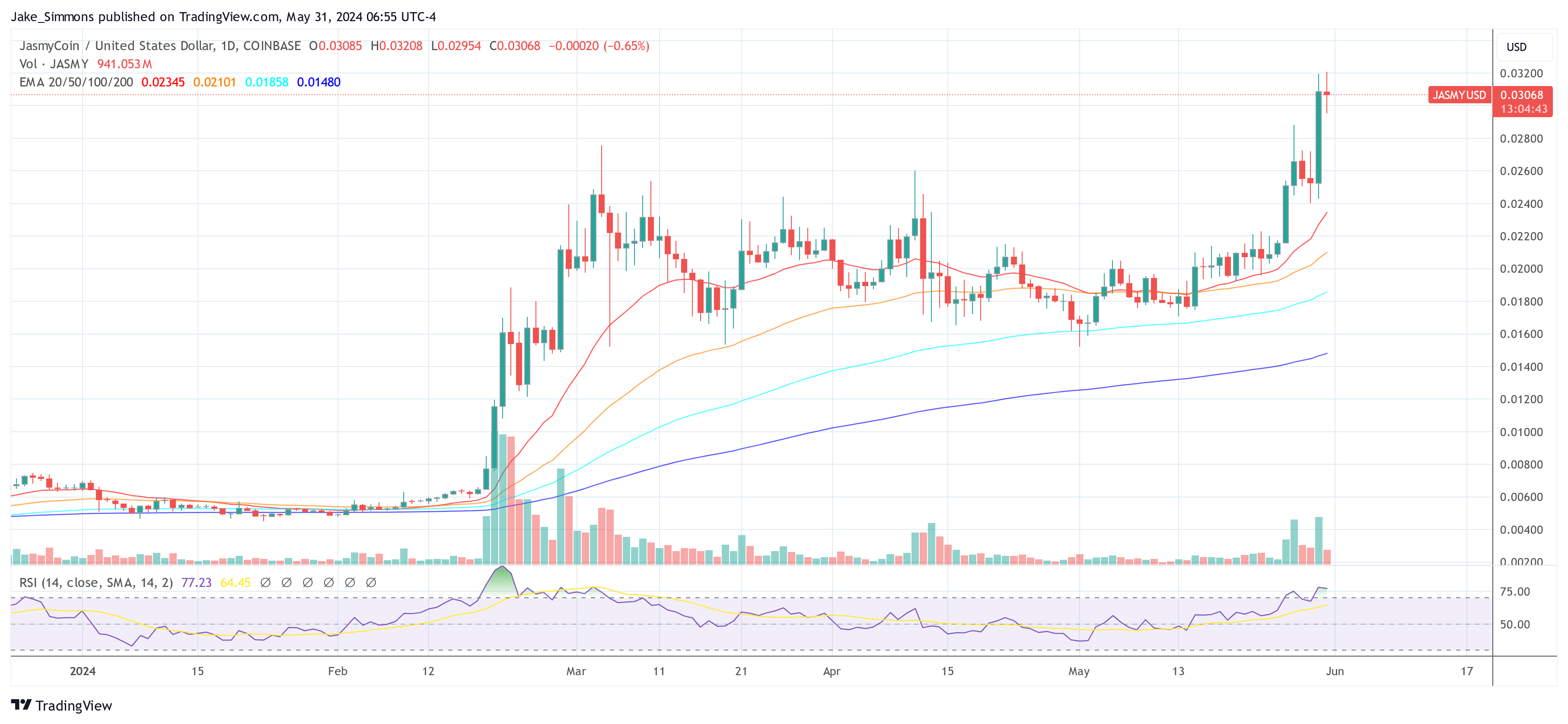

The news has sparked a significant rally for JASMY, leading to a 20% increase in its market value within the last 24 hours, pushing its market capitalization to $1.4 billion and ranking it the 67th largest cryptocurrency by market cap. The altcoins’ 24-hour trading volume has also surged by 400% to $570 million.

While the My Number Card system—a personal identification framework by the Japanese government—is not officially related to JasmyCoin, rumors have circulated regarding a potential linkage for a few months. Despite no formal confirmation, investors are seemingly speculating on a linkage, influenced by the broader interpretation of Japan’s digital strategy, which includes fostering Web3 technologies like blockchain and IoT, domains where JasmyCoin is a significant player.

JasmyCoin, established in 2016 by former Sony executive Kazumasa Sato, aims to provide secure data transactions and storage for IoT devices. The cryptocurrency is rumored to be part of Japan’s broader approach to integrate advanced technologies into everyday life, including the Metaverse and NFTs. “Jasmy’s mission is to facilitate the democratization of data through secure management and storage solutions, allowing individuals to retain control over their personal information.

Speculation about JasmyCoin’s involvement with the My Number Card system seems further fueled by an erroneous report shared on Binance Square, suggesting a direct integration of JASMY with the card’s functionality on iPhones. However, this claim has not been substantiated by any official sources.

The Japanese government has been a proponent of adopting Web3 innovations as a strategy for economic growth, with the Prime Minister himself emphasizing the importance of digital transformations in recent public addresses. The optimistic outlook for blockchain technology in Japan has been a boon for JasmyCoin, with the government’s digital policy indirectly benefiting the cryptocurrency.

The recent surge in JASMY’s market activity demonstrates the volatile nature of cryptocurrency markets, where rumors and expectations can drive significant price movements. As it stands, while JasmyCoin is indirectly aligned with Japan’s digital ambitions, direct partnerships or integrations with governmental projects like the My Number Card have not been officially confirmed.

Since February 19, JASMY has rallied by approximately 380%. However, the altcoin is still down more than 91% from its all-time high of $0.35 in October 2021. At press time, JASMY traded at $0.03068.