The FTX debtors filed a bankruptcy court document detailing lavish cash transfers and purchases by former CEO Sam Bankman-Fried and other company insiders. The section titled “Statement of Financial Affairs for Non-Individuals Filing for Bankruptcy” shows that Bankman-Fried reportedly received more than $1 billion in cash transfers in the year before FTX’s collapse.

FTX Bankruptcy Filing Details Lavish Cash Transfers and Purchases for Former CEO Bankman-Fried

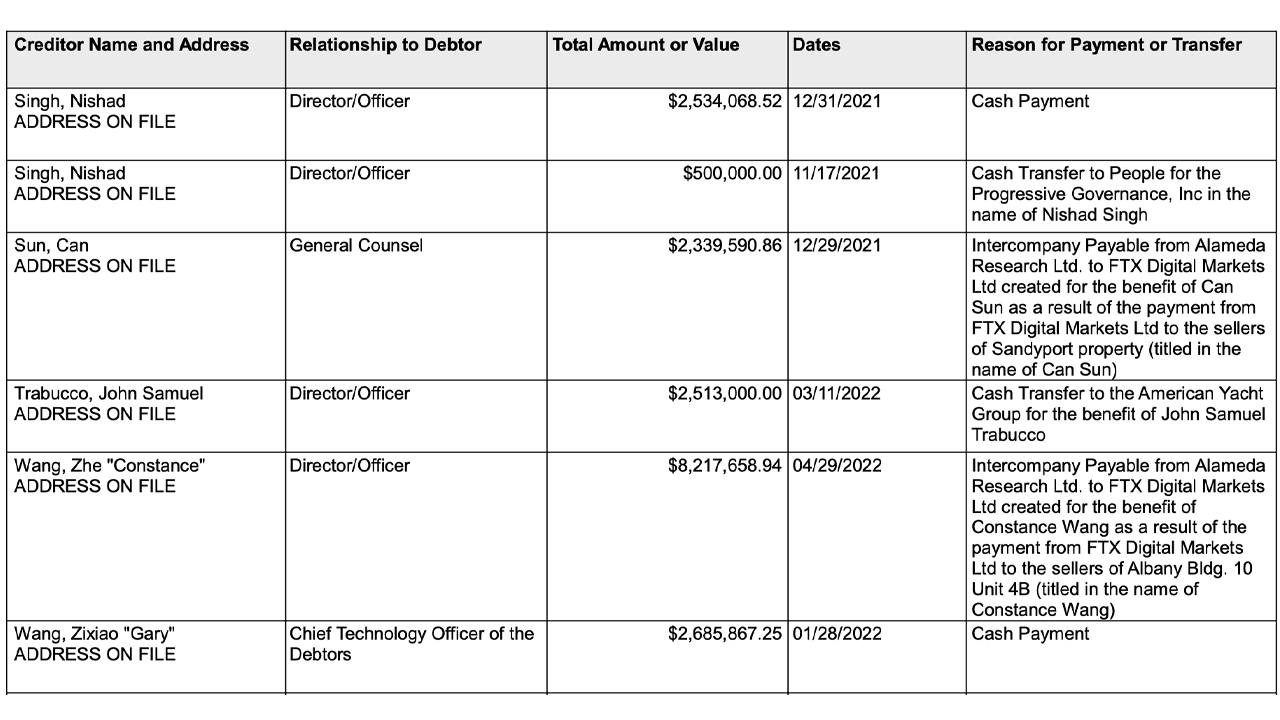

Recent court documents indicate Sam Bankman-Fried allegedly received cash payments of $68.3 million on Aug. 8, 2022, and $200 million on May 26, 2022. The document lists other payments to Bankman-Fried, including $100 million on June 7, 2022, and $10 million on several other dates. The filings also suggest FTX funds were used to purchase a yacht for former Alameda Research co-CEO Samuel Trabucco, valued at more than $2.5 million.

The document details other lavish purchases, including multimillion-dollar real estate in the names of insiders like former Alameda CEO Caroline Ellison. Transfers to political groups on behalf of insiders are also listed, such as a $500,000 donation in the name of FTX co-founder Nishad Singh to the People for the Progressive Governance.

Bankman-Fried has pleaded not guilty to criminal fraud charges related to the alleged misuse of FTX customer deposits. Former FTX senior members Gary Wang, Ellison, and Singh reportedly have agreed to plea deals with U.S. law enforcement. Former FTX co-CEO Ryan Salame intends to invoke his Fifth Amendment rights and has reportedly declared himself “unavailable as a witness.”

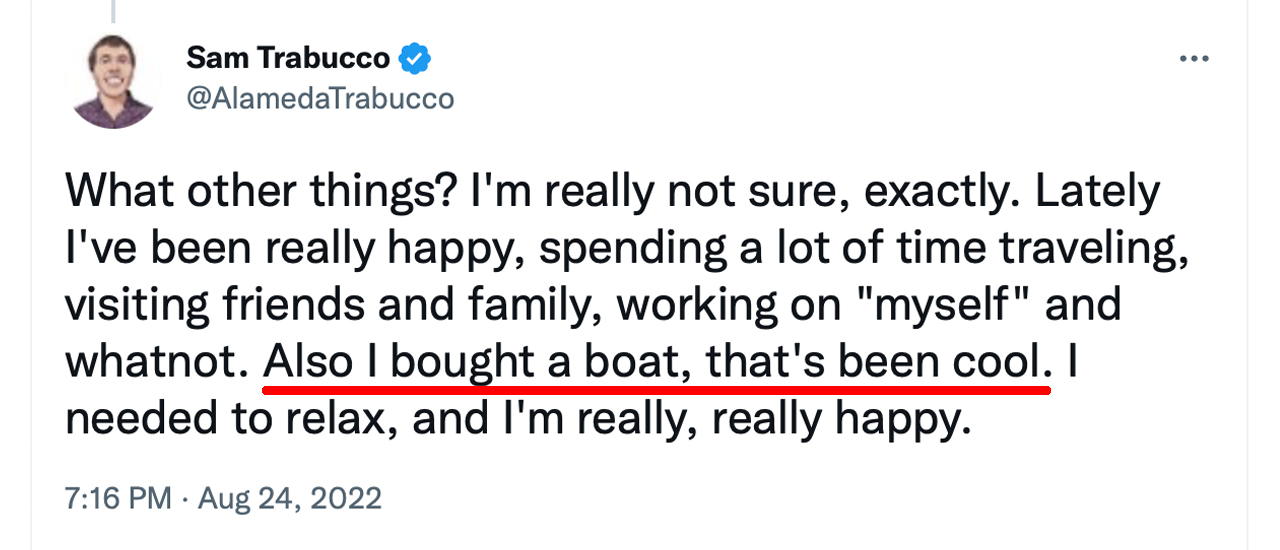

Reports say Samuel Trabucco was last seen in the Bahamas in the spring of 2022, visited by former MIT classmates. He also traveled to Las Vegas in July of that year for MIT’s Mega-Pi reunion. These are the last known public sightings of Trabucco, and his current location is unknown. The crypto community has been speculating about Trabucco’s activities since FTX’s collapse. Trabucco’s 52-foot yacht called “Soak my Deck,” was first reported back in December 2022 in an editorial published by the Financial Times.

What do you think about the recent court filing that details Bankman-Fried’s alleged cash transfers and Trabucco’s reported yacht purchase? Share your thoughts and opinions about this subject in the comments section below.