The on-chain analytics firm Santiment has explained how Tether (USD) and USD Coin (USDC) exchange inflows preceded the recent Bitcoin rally.

Bitcoin Rally May Restart If Stablecoins See Further Exchange Deposits

In a new post on X, Santiment discussed the trend in the supply of exchanges of various assets in the cryptocurrency sector. The “supply on exchanges” is an indicator that keeps track of the percentage of the total circulating supply of the given coin currently sitting in the wallets of all centralized exchanges.

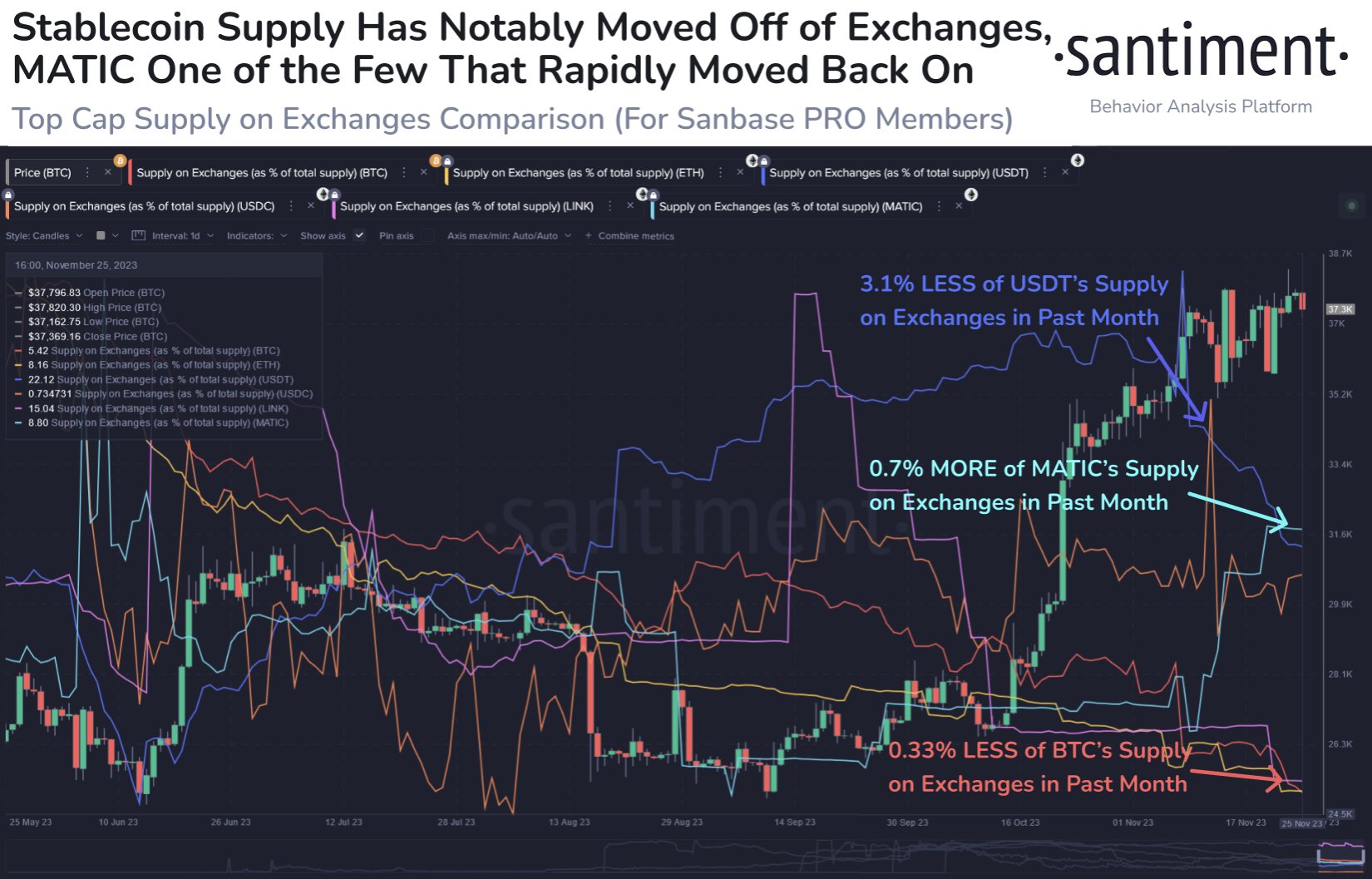

The below chart shows the trend in this indicator for Bitcoin (BTC), Ethereum (ETH), Chainlink (LINK), Polygon (MATIC), Tether (USDT), and USD Coin (USDC) over the past few months.

Depending on what type of asset it is, the significance of the supply on exchanges can differ. In the case of volatile assets like Bitcoin, the supply being stored on these platforms may be considered the available selling supply of the asset, as one of the main reasons investors may deposit their coins to the exchanges is for selling.

Thus, when this indicator trends up for these cryptocurrencies, it’s a potential sign that selling pressure in the sector is going up. The graph shows that Polygon has seen 0.7% of its supply move to exchanges in the past month, which could be a bearish sign for its price.

On the other hand, Bitcoin has observed withdrawals equivalent to 0.33% of its supply during the same period. Such a decline in the indicator can suggest that investors may participate in accumulation, as they are taking their coins off towards self-custodial wallets.

As for the stablecoins, an increase in the supply on exchanges also suggests that investors wish to swap these tokens. This selling of stables, though, actually provides a buying boost to the volatile side of the market, as the investors may use these assets to shift into Bitcoin and others.

As the chart shows, both Tether and USD Coin saw the exchange supply rise between August and October. More specifically, USDT and USDC observed 3.54% and 0.72% of their supplies moving into these platforms, respectively. “These transfers were the predecessor to the crypto-wide rally from late October to mid-November,” explains Santiment.

In the past month, however, 3.1% of the Tether supply has left these platforms, while the USD Coin has observed the metric move sideways. This would suggest that buying pressure has stopped rising, and the opposite may occur.

“After a cooldown, USDT & USDC returning to exchanges will be crucial to seeing market caps continuing to increase for a big final 5 weeks of 2023,” notes the analytics firm.

BTC Price

Bitcoin has registered some drawdown today as the asset’s price has now slipped under the $36,800 mark.