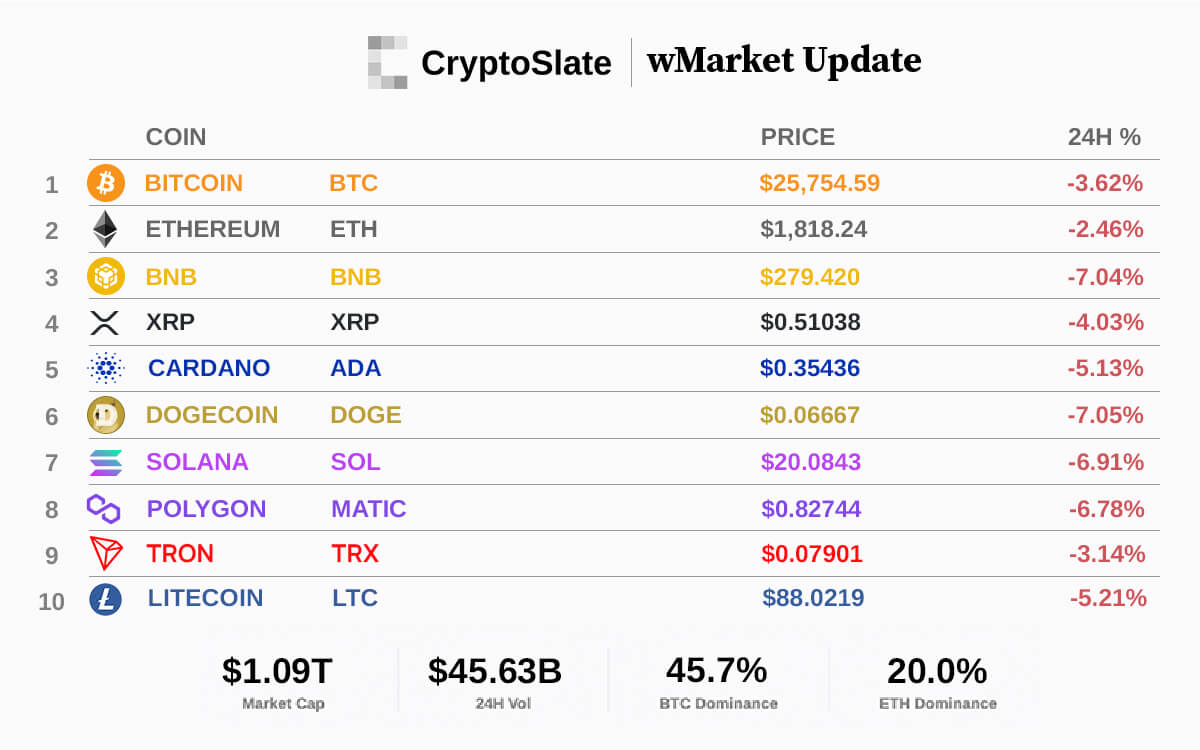

The cryptocurrency market saw net outflows of over $40 billion over the last 24 hours and currently stands at $1.09 trillion — down 3.53% from $1.13 trillion.

During the reporting period, the market caps of Bitcoin (BTC) and Ethereum (ETH) fell 3.85% and 2.65% to $498.87 billion and $218.53 billion, respectively.

Over the last 24 hours, the top 10 cryptocurrencies all posted losses. Dogecoin and BNB top the list, with over 7% decline. Others, like Ethereum, Tron, Bitcoin, Cardano, etc., recorded losses of more than 2% each.

The market cap of Tether (USDT) grew to $83.24 billion, while that of USD Coin (USDC) and Binance USD (BUSD) fell to $28.77 billion and $5.09 billion, respectively.

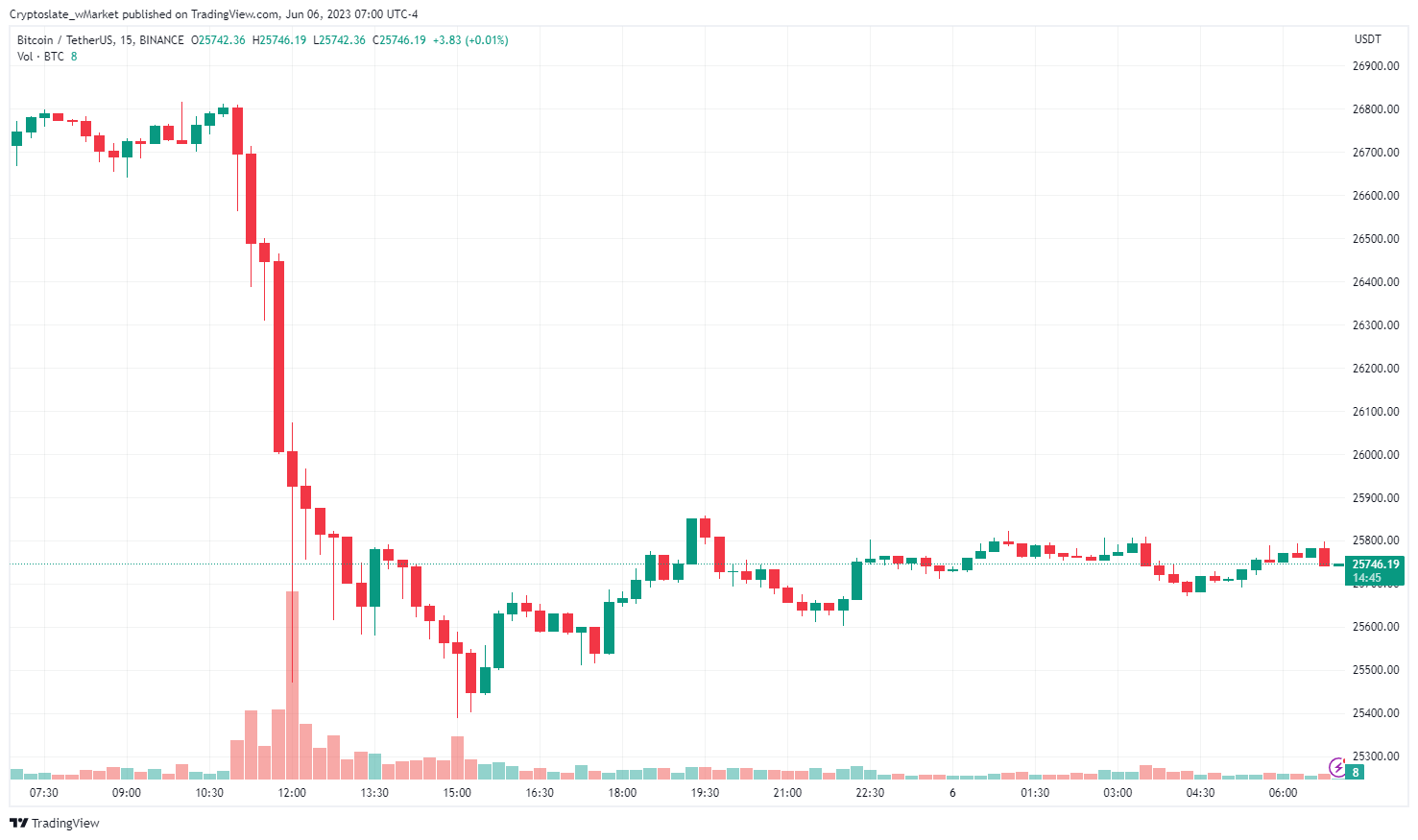

Bitcoin

Bitcoin fell by 3.62% and traded at $25,754 as of 07:00 ET. Its market dominance dropped to 45.7% from 45.8%

BTC sharply dipped below $26,000 after news of the SEC’s lawsuit against Binance emerged. The flagship digital asset liquidated over $100 million long positions held on it during the reporting period.

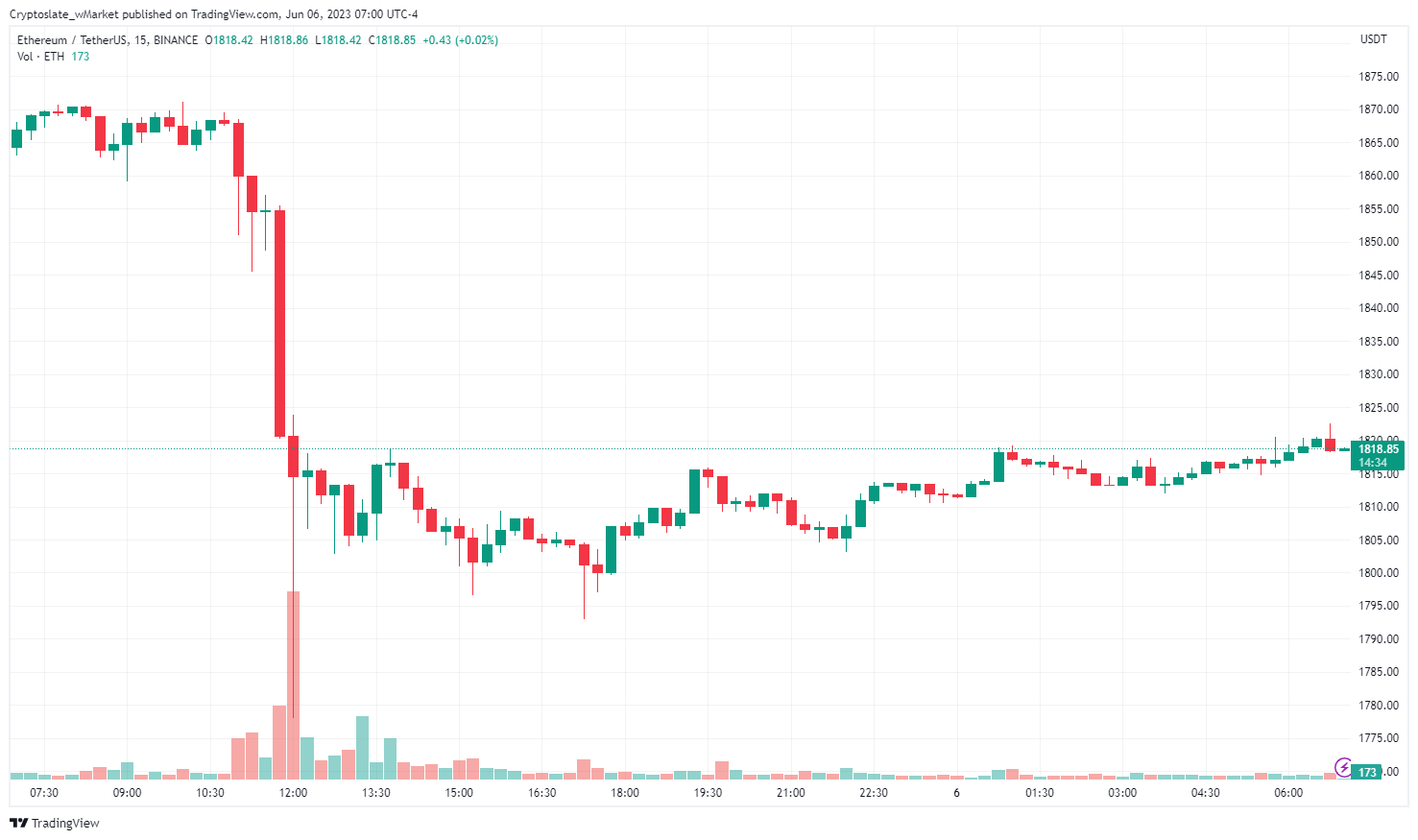

Ethereum

Over the last 24 hours, Ethereum shed 2.46% to trade at $1,818 as of 07:00 ET. Its market dominance rose to 20% from 19.8%.

ETH mirrored BTC’s price performance, bottoming at $1,780 during the reporting period.

Top 5 Gainers

Metal

MTL is the day’s biggest gainer, growing 11.62% over the last 24 hours to $1.51 as of press time. The project has gained over 40% in the previous seven days. Its market cap stood at $101.16 million.

Pendle

PENDLE soared 10.05% to $0.47 over the last 24 hours. The Ethereum-based DeFi protocol’s liquidity pool touched $6 million in under a week. Its market cap stood at $98.54 million.

Synapse

SYN grew 9.11% over the last 24 hours to $0.73263 as of press time. The cross-chain layer protocol runs a whitelist program to incentivize its community. It has a market cap of $102.4 million.

Nano

XNO gained 8.32% to trade at $0.77 at the time of writing. Despite today’s upside, the token is down 35% over the past month. Its market cap stood at $103.34 million.

Kava

KAVA rose 8.85% to $1.11 as of press time. Its market cap stood at $621.9 million.

Top 5 Losers

Wilder World

WILD is the day’s biggest loser, falling 24.38% to $1.11 at the time of press. Despite today’s drawdown, the token is up 77% over the past month. Its market cap stood at $111.39 million.

Space ID

ID fell 16.63% to $0.37922 over the reporting period. RewardsBunny recently integrated the project’s Web3 name SDK. Its market cap stood at $122.48 million.

BinaryX

BNX sunk 16.12% to $0.43 as of press time. The play-to-earn game wants to host an AMA session on June 7 to discuss the project features. Its market cap stood at $124.03 million.

The Sandbox

SAND fell 14.43% to trade at $0.51 at the time of writing. The metaverse-related token is one of the several digital assets the SEC labeled as security. Its market cap stood at $957.92 million.

Pepe

PEPE is on the top losers list for the second consecutive day. The meme coin lost 8.2% to trade at $0.0000010229. Its market cap stood at $397.46 million.

The post SEC’s Binance lawsuit triggers market-wide selloff: CryptoSlate wMarket Update appeared first on CryptoSlate.