Ethereum developers said the upcoming Shanghai upgrade, slated for March, would add functionality to withdraw staked ETH, according to Bloomberg News.

The confirmation brings welcome relief for stakers and vested parties, who, following ongoing speculation over indefinite token lock-in, now see the light at the end of the tunnel.

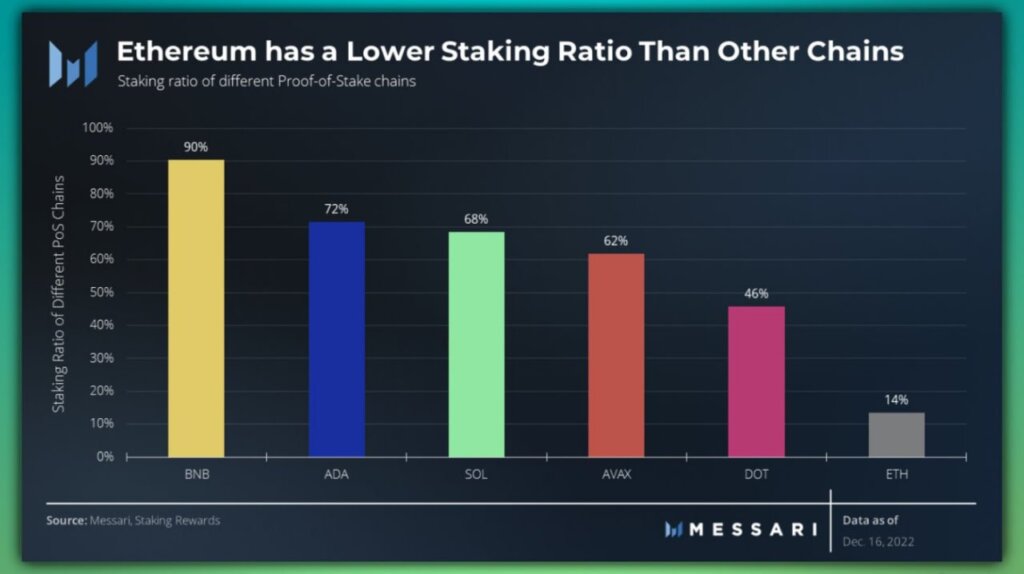

Since the Beacon Chain went live in November 2020, Ethereum deposited into the staking contract has amassed at a steady rate. Currently, 15.9 million ETH, valued at approximately $19.8 billion, have been deposited, representing 13.2% of the supply.

What now for Ethereum?

Data from Messari showed Ethereum has the lowest staking ratio of any major Proof-of-Stake (PoS) chain. The staking ratio of other significant PoS chains ranged between 46%, going as high as 90% for BNB.

Twitter user @MStiive expects as March approaches “a radical increase” in staked Ethereum will occur, pushing the staking ratio higher and more in line with other chains.

However, others speculate that enabling withdrawals would trigger an ETH exodus en masse, adding to sell pressure in an already fragile market still reeling from the scandals of last year.

What to expect from Shanghai

Shanghai is the next major upgrade for the Ethereum network, following the Merge in September 2022. Key highlights of what to expect include:

- Gas fee reduction for layers 2 solutions, which could make Ethereum potentially faster and cheaper to use post-Shanghai.

- Efficiencies in data storage and access, such as the removal of historical block hash data in contracts.

- Withdrawal of staked ETH, contract lock on staked tokens to be removed enabling unstaking.

Despite the bearish narrative surrounding Shanghai from some quarters, @TheEliteCrypto thinks the upgrade will be a bullish driver for the second-largest cryptocurrency. Perhaps even sparking a return to pre-FTX price levels.

“Exciting thoughts on the potential for an upgrade in Shanghai to boost the bullish trend for #ETH. Who knows, maybe we’ll even see it reach 1.6K! Good morning, fam!“

The post Shanghai upgrade to include Ethereum unstaking appeared first on CryptoSlate.