The post Shiba Inu Faces On-Chain Challenges: Can SHIB Price Avoid Declining Whale Interest and Volatility? appeared first on Coinpedia Fintech News

Following an impressive weekly surge in the meme coin market, Shiba Inu is now aiming for a massive comeback in the price chart. Over the last few days, SHIB price has been declining due to a market-wide selling pressure. This has resulted in a sharp drop in Shiba Inu’s on-chain metrics. However, as the meme coin prepares for a solid rebound, analysts expect a breakout above resistance level soon.

SHIB Struggles Amid Rising Bearish Threat

In the past 24 hours, the price of SHIB has repeatedly been rejected, leading to a spike in liquidations. Data from Coinglass indicates that total SHIB liquidations are approaching $1.2 million, with long liquidations accounting for about $1 million of that total. This trend highlights a strong bearish presence in the SHIB price chart.

On-chain data has shown that there is a major support level for Shiba Inu, involving about 55 trillion tokens. This data points to a large number of purchases made in the price range of $0.000024 to $0.000025, held by roughly 40,000 to 56,000 addresses.

Also read: Shiba Inu Climbs 2.9%—Could a Breakout Be Coming?

This support level is key for the stability and potential rebound of Shiba Inu’s price. Currently, the price of SHIB is hovering around this critical support zone, showing its ability to withstand market fluctuations. In technical term, this cluster of 55 trillion SHIB acts as a protective barrier.

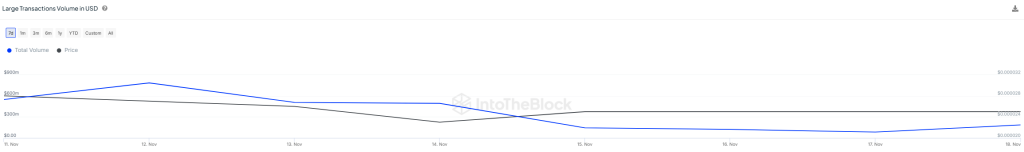

However, data from IntoTheBlock raises concerns due to a decrease in whale activity for SHIB. The volume of large transactions has dropped significantly from a weekly high of $784 million to $188 million, indicating a sharp reduction in interest from major investors. Consequently, this has led to reduced volatility in the SHIB price chart.

It’s important to note that if the price remains above the $0.000024 level, which would otherwise pressure the 115.25K addresses that are currently out of the money to sell, it could boost investor confidence. Additionally, if SHIB breaks above the current resistance at $0.000026, it would open up immediate upward potential for the cryptocurrency.

What’s Next for SHIB Price?

Shiba Inu has managed to stay above the 200-day EMA ($0.000022), although the bulls are finding it challenging to initiate a strong recovery. The price continues to struggle in holding above the $0.00026 mark, resulting in a consolidation below that level. As of writing, SHIB price trades at $0.0000256, surging over 0.3% in the last 24 hours.

The first indication of strength will be a closing price above $0.000026. If this occurs, the SHIB/USDT pair could rise to $0.000030. At this level, sellers will likely provide a tough resistance, but if the bulls can overcome this, the pair might complete a bullish inverted head-and-shoulders pattern, potentially pushing the price to $0.000038 and then $0.000046.

Conversely, if the price falls and breaks below the 200-day EMA, it suggests that the bulls are losing control. This could lead the pair to drop to $0.000016.